George Osborne is now in the business of buying votes

I had always assumed the Chancellor of the Exchequer cared about politics above economics. And so it has turned out

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Hang out the flags. The British economy is probably growing at last – not a lot but a bit. Well at least that seems the consensus based on lots of survey evidence, including the purchasing managers’ indices (PMIs) as well as the European Union business and consumer-confidence indexes.

Indeed, there has been an unexplained pick-up in confidence across the EU, although the extent of it is greater in the UK than elsewhere. The International Monetary Fund (IMF) even went as far as to raise its forecast of UK growth in 2013 more than for any other country. But let’s get real folks: even then the growth it is projecting is pretty hopeless: 1.4 per cent in 2013 and 1.9 per cent in 2014.

This compares with 1.6 per cent and 2.6 per cent for the United States and 0.5 per cent and 1.4 per cent for Germany. An economy growing at under 2 per cent – still well below the starting level of output – is unlikely to be the vote winner at the 2015 election that Chancellor George Osborne had hoped for.

But the devil really was in the detail. In fact Appendix Table B1 in the IMF’s latest World Economic Outlook contained the real nitty gritty, in particular the collapse in real GDP per capita, especially in the UK. The IMF projects that by 2014 living standards in the UK will still be 4.8 per cent below starting levels, well behind France (-1.9 per cent), Germany (+6.6 per cent), the United States (+1.9 per cent), Japan (+3.5 per cent) and Canada (+2.1 per cent).

That isn’t very good. Measuring the drop in output based on the number of people is especially appropriate in the UK’s case given the rise in population; since the beginning of 2008 the size of the working population aged 16 and over has increased 4.1 per cent. Once you adjust for changes in population the IMF forecasts real GDP growth of only 0.6 per cent and 1.1 per cent in 2013 and 2014 in the UK below the 0.8 per cent and 1.7 per cent for the US and 0.7 per cent and 1.6 per cent for Germany.

The Office for National Statistics published data this week which suggested the burst of growth that is likely to have occurred in the third quarter, consistent with IMF projections, may not be here for the long haul. Industrial production decreased by 1.1 per cent compared with July 2013 while manufacturing output fell 1.2 per cent on the year.

This picture is consistent with the number of workforce jobs in manufacturing which fell 15,000 on the year. Seasonally adjusted, the UK’s deficit on trade was estimated to have been £3.3bn in August, compared with £3.4bn in July. Exports to countries within the EU fell by £400m while overall imports of goods on a three month basis now stand at a record high. So much for rebalancing.

It turns out that we now have a pretty good idea over which of the four components of growth – investment, consumption, net trade or government – have been responsible for the recent pick-up in activity. I will give you a clue: it isn’t the private sector or exports.

Of particular interest this week was the Office of Budget Responsibility’s (OBR) mea culpa on its abysmal forecasting performance. From the very start it had been optimistic that the economy would grow nicely, driven by investment and trade even though government was going to be a much smaller part of the economy.

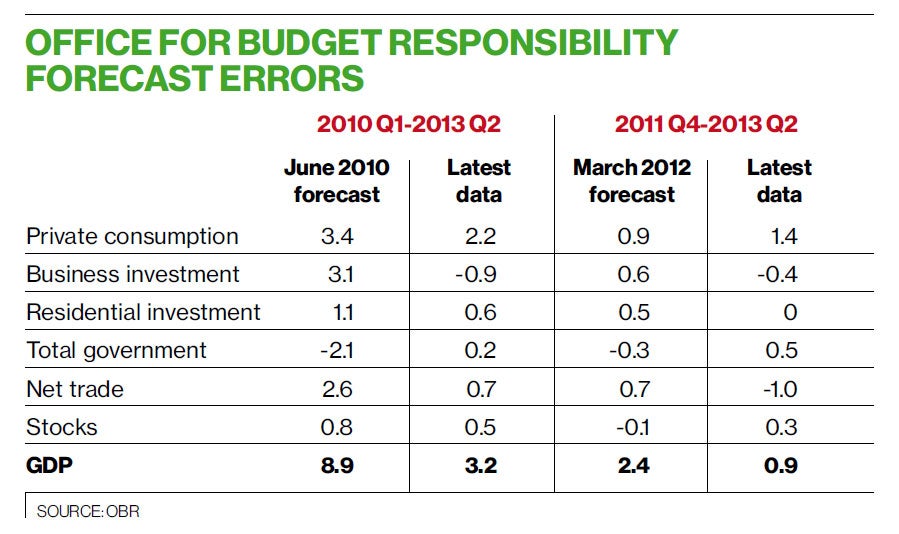

There would be an expansionary fiscal contraction. Of course it didn’t work out that way. The left-hand side of the table above presents the data for the first quarter of 2010 through to the second quarter of 2013 and compares the June 2010 forecast with the actual outcomes to date. They, of course, are subject to further revision. In addition, similar results are reported on the right-hand side for the fourth quarter of 2011 to the second quarter of 2013 with the March 2012 forecast and the latest outcomes.

A number of factors stand out. First, the OBR was overly optimistic expecting growth of 8.9 per cent by now and we actually got 3.2 per cent, or just over a third of that. Its forecasts were nearly three times too big in the second period where the OBR predicted growth of 2.4 per cent and we got 0.9 per cent. The OBR is a hopeless growth forecaster. Incidentally, in its latest March forecast, it predicts growth of 0.6 per cent in 2013 and 1.8 per cent in 2014, 2.3 per cent in 2015, 2.7 per cent in 2016 and 2.8 per cent in 2018. It doesn’t learn quickly.

Second, the OBR expected major contributions from investment, trade and consumption with Government spending being a net detractor from growth. Oh how wrong they were. Consumption was a positive contributor, although less than predicted as was net trade. Investment though was a big detractor from growth. I owe Mr Osborne an apology for calling him “Slasher” – he really didn’t slash government spending, he actually raised it. So government spending supported growth!

The picture was broadly similar in the later period, where business investment detracted from growth while government spending supported it. Net trade continues to lower GDP. So he has actually followed my admonitions to turn to Plan B, which likely explains most of the burst in growth we have seen. I admit I should have noticed.

Mr Osborne has now realised his detractors like me, Robert Skidelsky and Paul Krugman were right and he has become a Keynesian. Cutting government spending lowers growth and raising government spending increases growth. Sad to say it took him a while, but that was almost inevitable if the Tories were to have any hope of winning the next election. I had always assumed he was a pragmatist who cared about the politics above the economics, and so it has turned out. We had a clue to his thinking this week when his comments at a Cabinet meeting on Help to Buy were leaked when he said “hopefully we will get a little housing boom and everyone will be happy as property values go up”. Simple as that; Osborne is now vote buying.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments