Bitcoin price news – BTC price sends crypto market into ‘extreme fear’

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Bitcoin has managed to bounce back after crashing to an 18-month price low over the weekend.

The cryptocurrency is trading at just below $30,000 on Thursday, marking a 56 per cent drop from its all-time high last November, while other leading cryptocurrencies are also way down from their record highs.

The downturn has seen more than $1.5 trillion wiped from the market and led to warnings from analysts that another “crypto winter” similar to 2018 may be underway.

Bitcoin’s precarious price comes as El Salvador President Nayib Bukele hosts 44 countries on Monday to discuss the merits of the cryptocurrency and the benefits of adoption.

Eight months after El Salvador made bitcoin legal tender, several other countries appear close to adopting the cryptocurrency despite warnings from the IMF and some figures within the industry.

You can follow all the latest news, analysis and expert price predictions for bitcoin (BTC), Ethereum (ETH), Cardano (ADA), Solana (SOL) and other leading cryptocurrencies in our live coverage below.

Bitcoin, altcoins slightly recover

Bitcoin has surged by about 5 per cent in the last day and is currently valued at over $30,000 – up by more than 1 per cent compared to its value last week.

Ethereum has also grown by over 5 per cent in the last 24 hours, but it is still down by about 2 per cent compared to its price 7 days earlier.

Other top cryptocurrencies, including cardano, solana, and polkadot have gained by about 7 to 8 per cent in the last day.

Dogecoin and its spinoff shiba inu have also grown by about 5 per cent during the period.

The overall crypto market is up by 5 per cent in the last 24 hours, and is valued close to $1.28 trillion.

Billionaire’s tattoo mocked after crypto crashes to $0

Billionaire crypto investor Mike Novogratz has spoken up for the first time since Terra’s LUNA crashed to $0.

The Galaxy Digital CEO was one of the most ouspoken advocates of the project, even going as far as to get a LUNA tattoo on his left arm when its price hit $100.

That piece of body art has since been described as the “worst tattoo in history”, though Novogratz claims he won’t be getting rid of it.

“With hindsight things always look clearer,” he wrote in an open letter. “My tattoo will be a constant reminder that venture investing requires humility.”

You can read the full story here:

Billionaire’s tattoo mocked after crypto crashes to $0

Mike Novogratz says howling wolf tattoo will serve as ‘constant reminder’ after net worth crumbles

Bitcoin and Ethereum dip below key levels

Both bitcoin (BTC) and Ethereum (ETH) have dropped below the levels they have managed to hold so well over the last few days. BTC fell below $30k, while ETH is currently trading below $2k, which analysts have blamed on the knock-on effect of a downturn with the US stock market.

Here’s what market analysts at the crypto exchange Bitfinex had to say to us:

Bitcoin is trading lower today after yesterday’s steep drop in US stock prices. Spiraling levels of inflation has left global financial markets staring into the abyss as the prospect of a global recession looms large. This is leaving all assets that have benefited from more than a decade of accommodative monetary policy from central banks vulnerable to a correction as interest rates rise.

Crypto features in latest episode of Decomplicated

What are cryptocurrencies? If you’re reading this you probably already know, but just in case I thought I’d share the latest video in The Independent’s Decomplicated series.

The first episode was on non-fungible tokens (NFTs), while this one looks more broadly at bitcoin and the rest of the crypto space. Even if you just want a brush up on how it all works, it’s worth a watch.

What are cryptocurrencies? | Decomplicated

Cryptocurrency has grown from a fringe technology popular only with cryptographers, to become one of the world’s most valuable assets by market cap within a decade of the first system going live.An estimated 2.3 million people in the UK owned cryptocurrency by 2021, according a report by the Financial Conduct Authority. However, only 71 per cent of UK adults who are aware of crypto understand what it is.So what exactly is cryptocurrency, and how does it work?Independent TV‘s Decomplicated series explains cryptocurrency.Click here to sign up to our newsletters.

Coinbase hits back at ‘crypto is dead’ comments

Popukar crypto exchange Coinbase has published a blog post this morning in response to the recent market turmoil.

The post, titled ‘Long Live Crypto’, explains why such downturns should not be seen as disheartening if focus remains on “the long term view”.

Volatility is painful, and can be scary. Nobody likes to lose money in the short term — whether in crypto, or the stock market more broadly. That said, volatility is also natural for emerging technological breakthroughs like crypto. At Coinbase, we’re inspired by the long term view and the spirit of those who continue to keep innovating no matter the external environment.

The publicly traded firm, whose share price has halved since the start of the month, also shared a video to its social media channels criticising all the times crypto has been declared dead.

“It’s easy to write an obituary,” the blog post concluded. “It’s hard to bring something new to life.”

Bitcoin price crash doesn’t deter MicroStrategy

MicroStrategy is not going to sell any of its vast bitcoin holdings or even adjust its crypto acquisition strategy, despite the recent market downturn.

The software firm is the biggest corporate investor in bitcoin, driven by CEO and co-founder Michael Saylor’s seemingly unwavering belief that it is the world’s greatest store of value.

The company’s new chief financial officer told the Wall Street Journal: “There are no scenarios that I’m aware [in which] we would sell.”

He added: “Some of the more recent volatility was certainly around some of the activity outside of bitcoin. For us, we monitor that from a market perspective, but there [isn’t] anything fundamental to bitcoin that we believe presents any issues against our strategy.”

Bitcoin, altcoin prices plummet

Bitcoin is down by over 4 per cent in the last 24 hours and is currently valued at about $29,000.

Ethereum has also dropped in value by over 6 per cent in the last day and by nearly 7 per cent compared to its price last week.

Other top cryptocurrencies including solana, cardano, and polkadot are also down by over 10 to 13 per cent in the last day.

Meme coins dogecoin and its spinoff shiba inu are also down by 8 to 10 per cent in the last 24 hours.

The overall crypto market is down by about 6 per cent in the last day and is valued at $1.22 trillion.

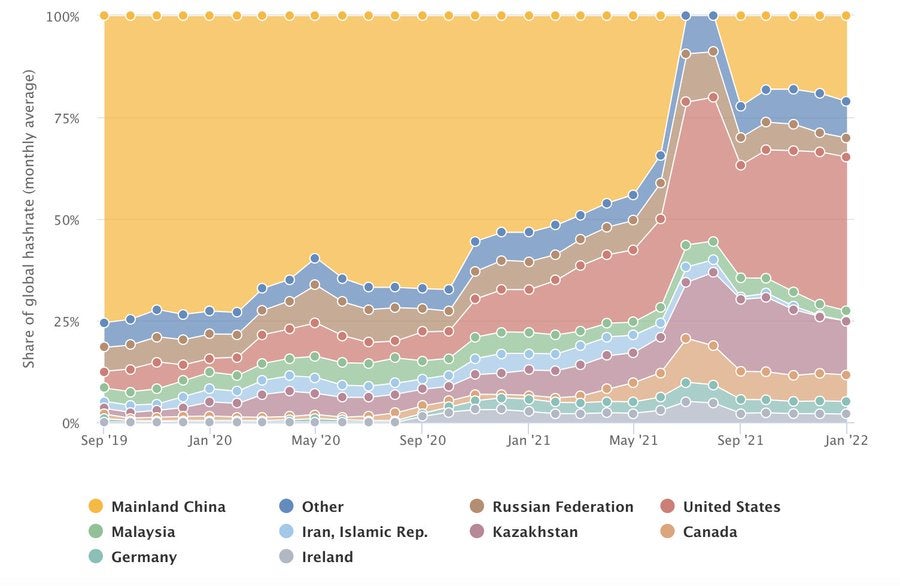

Bitcoin mining in China thrives despite ban

After a complete crackdown from authorities in China, underground operations in the country appear to be thriving, according to new data from the Cambridge Centre for Alternative Finance (CCAF).

China’s bitcoin mining share fell from around 75 per cent to effectively zero last year, however the latest figures show that it has since rebounded to become the world’s second biggest crypto mining hub.

“This strongly suggests that significant underground mining activity has formed in the country, which empirically confirms what industry insiders have long been assuming,” CCAF wrote in a blog post detailing its findings.

“Access to off-grid electricity and geographically scattered, small-scale operations are among the major means used by underground miners to hide their operations from authorities and circumvent the ban.”

What actually happened to Terra LUNA and UST?

With bitcoin (BTC) and Ethereum (ETH) still languishing near 18-month lows, one of the causes of the crypto crash is still yet to be resolved.

Close to $60 billion has been wiped from the combined market caps of Terra’s LUNA and UST, with their downfall sparking a mass sell-off across the entire crypto space. Now, developers claim to have now come up with a revival plan.

Here’s a full rundown of how the catastrophe unfolded, and what might come next:

Biggest ever crypto collapse attracts conspiracy theories

Biggest ever crypto collapse attracts conspiracy theories

Bitcoin price sends crypto market into ‘extreme fear'

The Bitcoin Fear & Greed Index has just hit a 2.5-year low, falling to into single digits to register “extreme fear”.

Measuring sentiment using data from cryptocurrency exchanges, social media posts and market momentum, the index acts as a rough indicator as to how investors and traders are behaving.

The last time it was this low was during the market downturn in 2019, with some investors taking the index as a measure of whether to buy, sell or hold.

As its developers explain:

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When investors are getting too greedy, that means the market is due for a correction.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments