Bank of England interest rate cut joy for mortgage holders as Reeves blames mini-Budget for inflation - live

The Bank of England has decided to cut interest rates for the first time in more than four years

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Bank of England has cut interest rates for the first time since 2020 as inflation continues to remain steady, holding at their two percent target for two consecutive months.

Bank Rate is currently 5.25per cent, a 16-year high where it has been pegged for the last year to fight inflation, but it has now been set at five percent, a drop of 0.25 percentage points.

Governor Andrew Bailey said the move comes after inflation pressures “eased enough that we’ve been able to cut interest rates today”.

The decision will come as joy for homeowners who have been struggling with rising mortgage payments as major banks have confirmed rates could go down as low as three per cent.

Chancellor Rachel Reeves has welcomed the move but warned “millions of families are still facing higher mortgage rates after the mini-budget”.

Is the door open for future rate cuts?

Bank of England governor Andrew Bailey has been asked whether there could be more rate cuts in the future.

During the press conference, a journalist asked: “Is the door open for future rate cuts, or does today’s move mean the Bank of England is ‘one and done’?”

Mr Bailey cautioned the committee is still on “high alert” to the risks of inflation despite the decision to reduce rates to five per cent.

Refusing to give a firm answer he said: “We will go from meeting from meeting, as we always do. It’s this judgement about resilience.”

Streeting promises to ‘work with GPs’ to rebuild NHS amid strikes

Wes Streeting has vowed to “work with GPs to rebuild the NHS together” following the announcement that family doctors will strike.

The health secretary tweeted:

Bailey: We have truly come a long way

Andrew Bailey has declared “we have truly come a long way” to hit inflation targets.

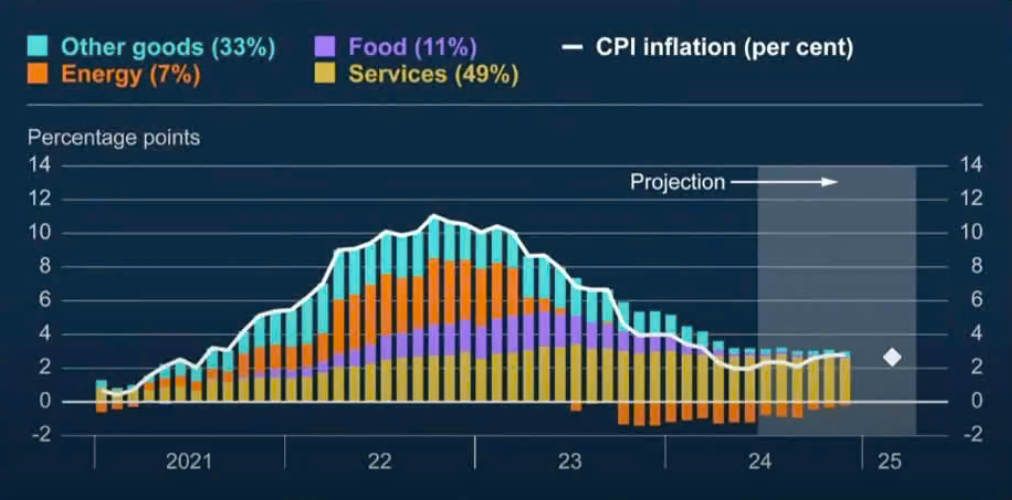

Talking to the press, he showed a chart showing how inflation has fallen from a 11 per cent peak in 2022 to two per cent in June.

But the government warned inflation is expected to rise later this year to around 2.75 per cent before going back to the two per cent target again.

Pictured: Healey and Lammy meet Lebanese prime minister in Beirut amid conflict

Unions: ‘Working people paid the price for Tories’ economic failures'

TUC has claimed working people paid the price for the “Tories’ economic failures”.

In response to the BoE announcement, the general secretary Paul Nowak said: “This rate cut will give relief to millions of families and businesses – and needs to be the first of many.

“Working people didn’t cause the huge spike in inflation. But they have paid the price for the Conservatives’ economic failures with sky-high bills and mortgage payments.

“Labour’s plans to invest in industry and deliver a new deal for workers can help create a new period of economic stability, with prices kept under control and living standards recovering.”

Bailey: Economy has been stronger in recent months

Bank of England governor Andrew Bailey is holding a press conference in response to the announcement interest rates are now down to five per cent.

Mr Bailey said inflation pressures have eased and remained on the two per cent target for two months in a row.

He added the “UK economy has been stronger in recent months”. But he warned: “We need to make sure that inflation stays low. We need to put the period of high inflation firmly behind us.”

Hunt chalks up interest rate cut

Jeremy Hunt has claimed the latest interest rate cut is part of the Tories’ legacy.

The Tory MP said Labour inherited a “stronger economy” thanks to the “difficult decisions” he took while in No 11.

The shadow chancellor said:“Today’s cut will be welcome news for millions of homeowners and shows that Labour inherited a stronger economy which was on the right track.

“In government, we took difficult decisions that cut inflation from 11.1 per cent to the Bank’s target of 2.0 per cent, paving the way for lower rates.

“Our concern is that further substantive cuts may now take longer because of inflation-busting public sector pay rises rushed through by the Chancellor ahead of the summer.”

Lib Dems hail ‘light at the end of tunnel’ after interest rates announcement

The Liberal Democrats have said “there is light at the end of the tunnel” after the reduction of interest rates.

Treasury spokesperson, Sarah Olney MP said: “There is finally light at the end of the tunnel for homeowners but sadly for millions the damage has already been done. Families across the country are already paying off sky high mortgage bills.

“The country is still reeling from Liz Truss’ disastrous mini-budget and years of economic failure under the Conservatives.”

She added: “Today must serve as a reminder that governments should never treat Budgets as an economic experiment for wild policies. We need a return to sound economics and stability after years of Conservative chaos and mismanagement.”

Tory MPs were quick out the gates to claim credit for the cut

Tory MPs took just minutes to try to claim credit for the Bank of England’s decision, Archie Mitchell writes.

“Our plan was working,” declared Central Suffolk and North Ipswich MP Patrick Spencer, moments after the announcement was published.

Rachel Reeves will be rebelling at the fortuitous timing of the central bank’s decision, right after Rishi Sunak’s snap general election, with Labour able to bank any bounce felt by consumers.

Unite slams interest rates cut is 'too little, too late’

Unite has branded the Bank of England’s move to cut interest rate from 5.25 per cent to 5 per cent “too little, too late”.

General secretary Sharon Graham said: “This is too little, too late from the Bank of England. Interest rates still stand at historic highs and this small cut will offer little help to workers struggling with the cost-of-living crisis and record housing costs.

“Decisive action from both the Bank of England and government is urgently needed. Including, a clear roadmap for future rate cuts and a programme of serious investment in our public services and industry to get us out of this crisis.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments