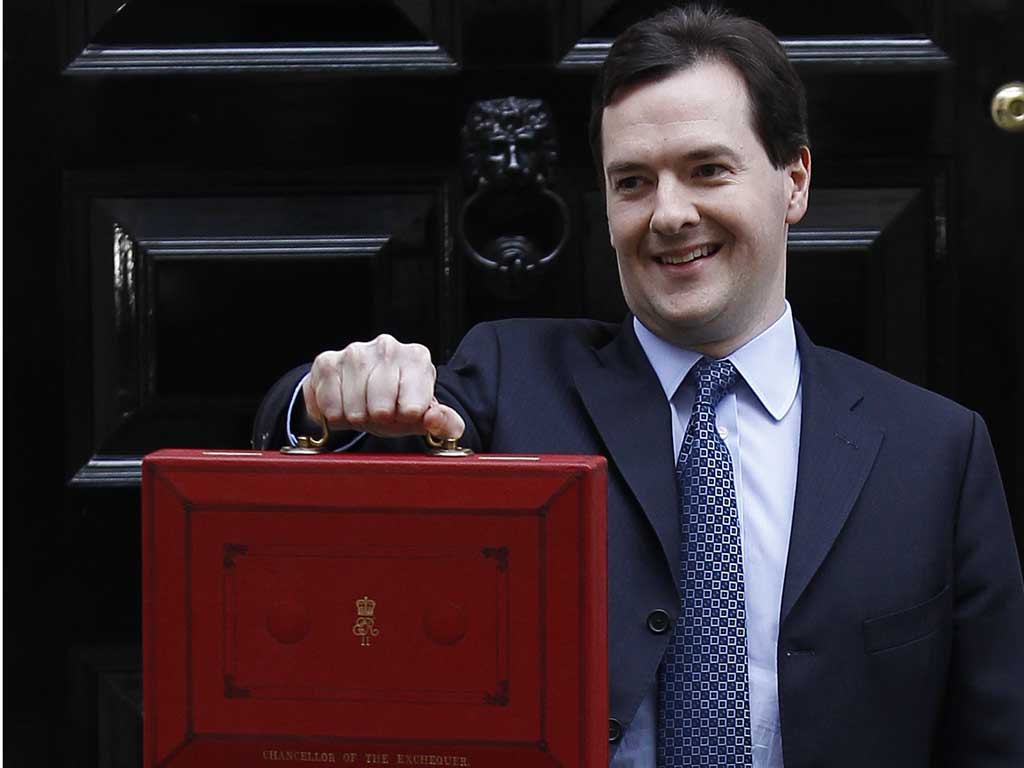

George Osborne slashes 50% top tax rate

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Chancellor George Osborne was today accused of imposing a £1 billion “granny tax” on pensioners as he used his Budget to cut the 50p top rate for Britain's wealthiest earners and lift thousands of low-paid workers out of taxation altogether.

The Treasury acknowledged that 4.5 million pensioners will lose out as a result of the decision to phase out their age-related allowances.

Age UK said it was "disappointed" with the move, warning it could leave some pensioners up to £259 a year worse off.

And economist Ros Altmann, director-general of the Saga Group, denounced it as an "absolutely outrageous assault" on all pensioners with incomes between £10,500 and £24,000.

Mr Osborne presented his statement as a "Budget that rewards work", announcing that a £1,100 rise to £9,205 in the income tax threshold will take another 840,000 of the low paid out of taxation and save 24 million people £220 a year.

But around 300,000 people will be drawn into paying income tax at 40% from 2013/14 by a reduction in the higher rate threshold to £41,450.

The 50p top rate on earnings over £150,000 introduced by Labour will be cut to 45p from April next year, after a study by HM Revenue and Customs (HMRC) found it raised "next to nothing", said Mr Osborne.

The widely expected cut was offset by a hike in stamp duty on properties worth more than £2 million and a commitment to clamp down on "aggressive" tax avoidance.

Labour leader Ed Miliband said the Budget meant millions would pay more while millionaires paid less.

"It is a millionaires' Budget that squeezes the middle," he said.

But Deputy Prime Minister Nick Clegg hailed it as "a Budget every liberal can be proud of", pointing to the lift in the income tax threshold and increases in taxes on wealth which Liberal Democrats had demanded in negotiations with Conservative coalition partners.

Mr Osborne told MPs that "Britain is going to earn its way in the world" as a result of the Budget. "Together, the British people will share in the effort and share the rewards," he said.

"This country borrowed its way into trouble. Now we're going to earn our way out."

However, the heavily trailed tax changes threatened to be overshadowed by the row over the phasing out of pensioners' allowances.

Under the Chancellor's plans, age-related allowances will be withdrawn for new pensioners from April next year while existing pensioners will have their allowances frozen at £10,500 for the over-65s and £10,660 for the over-75s until overall tax thresholds catch up with them.

According to the Budget red book, the measure will raise an additional £1.01 billion for the Exchequer by 2015/16.

Although Mr Osborne insisted there would be no cash loss to pensioners, Treasury sources said existing pensioners would be, on average, £63 a year worse off while new pensioners would lose out to the tune of £197 a year.

But the Chancellor pointed to a report which claimed many pensioners did not understand the allowances and found claiming them "burdensome".

"These allowances require around 150,000 pensioners to fill in self-assessment forms, and as we have real increases in the personal allowances, their value is being eroded all the time," he said.

TUC general secretary Brendan Barber said the decision would "come back to haunt" the Chancellor.

"It's already being dubbed 'the granny tax'," said Mr Barber.

"Pretending that pensioners will be grateful because it will simplify their tax is a vain hope. Instead they will see that they are being asked to pay more while the super-rich have kept all the pensions tax relief - a heavy burden for ordinary taxpayers."

Mr Osborne also signalled that millions of existing workers will have to wait longer for their pensions, with automatic reviews of the state pension age "to ensure it keeps pace with increases in longevity".

And he also warned of new cuts to welfare payments - with the need to find additional savings of £10 billion by 2016.

However, there was action to ease the effects of his decision to end child benefit for the better off, with a phased withdrawal of payments for those on incomes between £50,000 and £60,000.

Overall, the Chancellor said his measures would raise five times more from the wealthy than the top rate introduced by Labour.

He said a study by HMRC found that the 50p rate had raised just a third of the £3 billion predicted and that cutting it to 45p would cost the Exchequer just £100 million a year - a loss which could be cancelled out by other tax revenues.

But shadow chancellor Ed Balls challenged the claim, pointing to an Office for Budget Responsibility (OBR) assessment of the HMRC evaluation as "highly uncertain".

Mr Osborne's figures relied on the "heroic" assumption that people who had previously been avoiding tax would decide to pay an extra £3 billion, he said.

Tories challenged Mr Balls to say whether he would restore the 50p rate, but Labour sources said decisions on taxation would not be made until the the next election.

Labour Treasury spokeswoman Rachel Reeves said the party would reverse the cut "if there was an election tomorrow".

A further cut to 40p, which had been predicted in some quarters, looked unlikely after the OBR calculated it would cost the Treasury a further £600 million.

Asked whether the Chancellor regarded the 45p rate - like the 50p rate - as "temporary", Treasury sources would say only: "We keep all tax rates under review."

Treasury sources said it was a fiscally "neutral" Budget with the net £2 billion in tax cuts paid for by a £2.4 billion reduction in the cost of operations in Afghanistan - funded from the Treasury reserve - as the troops return home by the end of 2014.

Mr Osborne rejected calls to relieve the pressure on motorists struggling with record petrol prices to cut fuel duty.

He also dealt a blow to smokers, saying that duty on all tobacco products would rise by 5% above inflation - slapping 37p on a packet of cigarettes from 6pm tonight.

However, drinkers escaped relatively unscathed, with no additional increases in alcohol duty - though the previously announced 5% hike in duties will go ahead, adding 5p to 10p to the price of a pint of beer in the pub.

The Chancellor predicted slightly better-than-expected economic growth, with the OBR expecting the UK to avoid a technical recession with positive growth in the first quarter of this year.

He said the OBR had reported that the economy has "carried a little more momentum into the new year than previously anticipated", slightly revising upwards its growth forecast for the UK this year to 0.8%.

The OBR is now predicting growth of 2% next year, 2.7% in 2014 and 3% in both 2015 and 2016.

Mr Osborne said public sector borrowing was now set to come in at £126 billion this year, falling to £120 billion next year and then dropping back to £21 billion by 2016-17.

There was good news for business as the Chancellor announced another 1% cut in the rate of corporation tax from next month to 24%.

He said that by 2014, the rate would be 22%, which is "dramatically lower" than competitors'.

PA

Government accused of 'stealth tax' on pensioners

Corporation tax cut to 24% in April

Unions criticise regional pay rates plan

Thousands escape child benefit axe

TV tax credit 'could end exodus' of big-budget shows

Smokers slam tobacco duty rise

Job fears over increase in beer tax increase

Plane passengers hit by air passenger duty hike

Anger over George Osborne's North Sea bid

Videogame industry celebrates tax relief in Budget

University research gets £100m boost

Ed Miliband condemns top rate tax cut

Estate agents warn that stamp duty raid could hit all homeowners

Government accused of producing a Budget 'for the rich'

George Osborne slashes 50% top tax rate

Osborne dashes fuel price hopes

Oliver Wright on the Budget: Now we have to look at what was NOT said

James Moore: Budget snap judgements

The Budget at a glance

Full text of the Budget speech

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments