Inflation - live: Boris Johnson accused of being on ‘shore leave’ as UK faces recession

Inflation rate of 10.1 per cent puts further strain on households across UK

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The UK rate of inflation has hit 10.1 per cent, the highest level in 40 years.

The increase was largely down to food prices and staples including toilet rolls and toothbrushes, the Office for National Statistics said.

It is the biggest jump in the cost of living since 1982, when Consumer Prices Index reached 10.4 per cent, according to ONS estimates.

It is also a massive jump from the 9.4 per cent inflation in June.

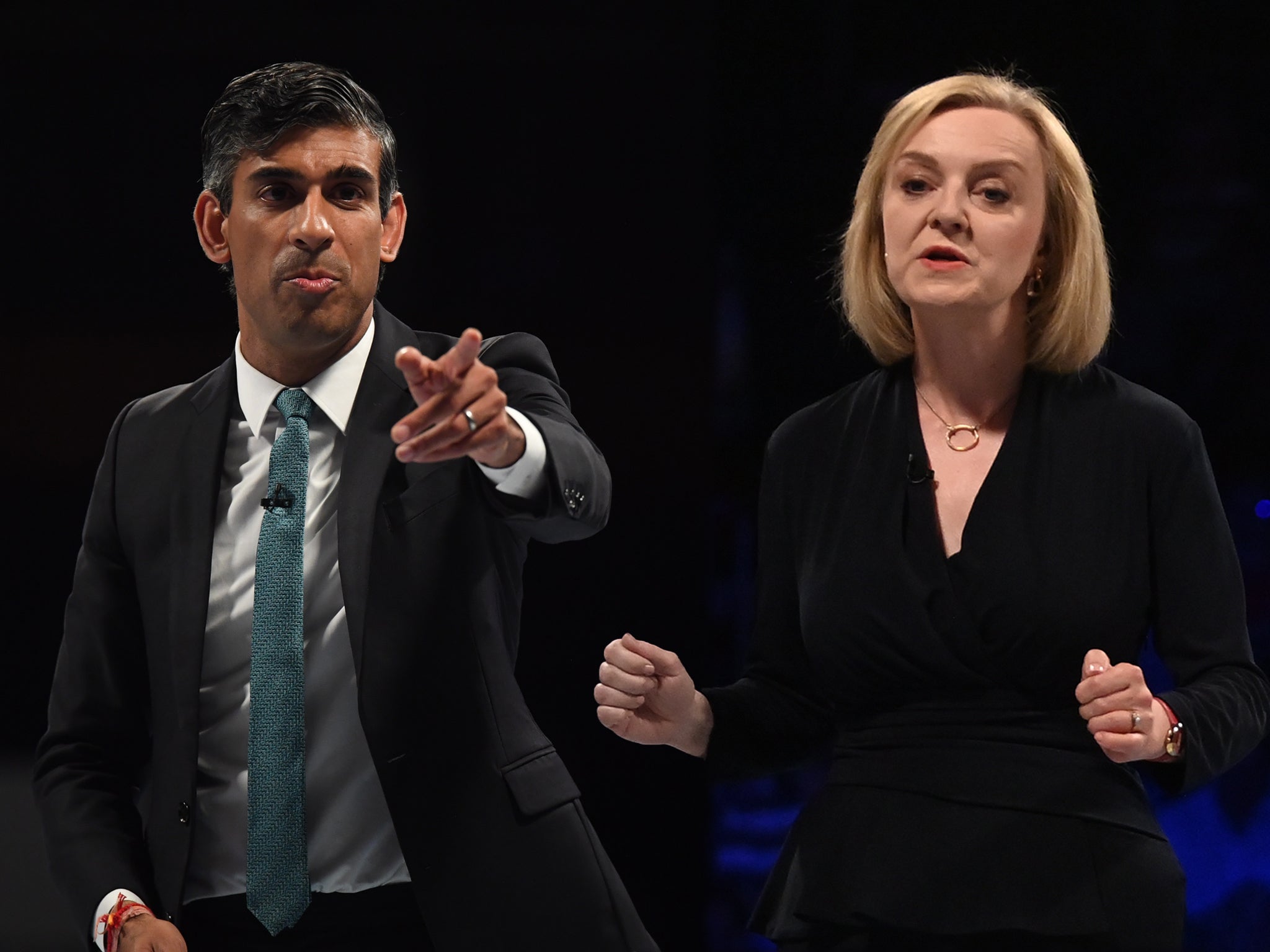

Tory leadership rivals Liz Truss and Rishi Sunak have faced calls to take urgent action to help tackle the cost-of-living crisis, even as No 10 ruled out any co-ordination between Boris Johnson and his two would-be successors for immediate solutions.

Mr Sunak’s campaign hit out at his rival on Tuesday, urging her to “come clean” on her cost-of-living plan. Meanwhile, Ms Truss has reiterated her plan to cut taxes for households and said she will reject “sticking plaster” approaches.

What was life like the last time inflation was this high?

Consumer Prices Index (CPI) inflation reached 10.1% last month. It is the biggest jump in the cost of living since February 1982, when CPI reached 10.4%, according to estimates.

Here is what was happening in the country in 1982:

– Economy

The unemployment rate stood at 10.4%, the highest it had been for 50 years, with three million (one in eight) people out of work.

The basic rate of income tax was 30%, while the standard rate of VAT was 15%.

– Politics

Margaret Thatcher’s priorities in the early 1980s included tackling inflation, aiming to reduce the amount of money in circulation by cutting spending and raising indirect taxes.

Inflation did start to come down, but not before the UK economy spent the whole of 1980 and early 1981 in recession – hindering support for the Conservative Party.

Mrs Thatcher had been almost three years into her first term as prime minister, but her party was averaging around 31% in the opinion polls, putting it behind Labour (32%) and the Alliance (34%) – a recently formed pact between the Liberal and Social Democratic (SDP) parties.

– Business

Large shops had to be closed on Sundays by law, with many shutting for half a day on Wednesdays.

The UK’s gas, electricity, coal and water industries were all public-owned, along with Royal Mail, British Rail, British Airways, British Steel, BP, Rolls-Royce and British Leyland (later known as the Rover Group).

The entire telephone system was also run by British Telecom, which was in public hands, though a licence would later be granted to Mercury Communications to operate the country’s first ever privately run network.

– Strikes

NHS staff went on a three-day strike over pay in September, with nurses campaigning for a 12% pay rise.

In June, miners in South Wales downed tools in support of health service workers.

– War

In April, the Argentine invasion of the Falkland Islands took place, overpowering 80 Royal Marines and local volunteers.

Over a few months, the British forces would fight back and regain control of the territory.

The conflict cost 255 British lives, while about 650 Argentines died.

‘Poorer families will continue to be hardest hit by rising inflation'

Poorer families will continue to be hardest hit by rising inflation as they spend more of their income on increasingly expensive food, analysis of new official data shows.

The Resolution Foundation said that while inflation hit 10.1% in July, the poorest tenth of households faced an inflation rate of 10.9%.

Meanwhile the richest tenth also saw their cost of living rise significantly, but only 9.4%.

James Smith, research director at the foundation, said: “Inflation has hit double digits earlier than expected off the back of the highest food price inflation in over two decades, and is set to continue climbing as energy bills soar this winter.”

Real pay is dropping at its fastest rate since 1997, he said, and low-income households face having to cut back non-essential spending by a quarter to cope with soaring energy bills.

“It will take many months, and much more living standards pain, before inflation starts to ease,” Mr Smith said.

“So, the number one priority for the next prime minister will be to offer significant support to help millions of families through a brutal winter and beyond.”

Zahawi says Truss won’t write budget on campaign trail

Nadhim Zahawi said it is his “responsibility” to prepare options for tackling the cost-of-living crisis for Liz Truss if she becomes prime minister.

The Chancellor, who is backing Ms Truss in the Tory leadership contest, was asked by broadcasters what extra help she would give to struggling households, and replied: “Liz has said a couple of things: one is that she will have a moratorium on the energy levies which will help with energy costs. She will also reverse the national insurance increase, which again will help those families that really need help.

“But what she has also said is she won’t be writing a budget on the leadership campaign, she will do it once she walks into Number 10.

“My task, my responsibility, is to give her the options to be able to make that decision of how she targets the help for those families that we know are going to need it as we get through winter, and as we know that Putin will continue to use energy as a tool to get back at us for the help we are putting into Ukraine.

“We must remain united in the face of this threat on our continent. It is not right, I think, that we begin to divide and turn it into a domestic issue.”

Mr Zahawi had earlier said he was preparing options for the incoming prime minister to “hit the ground running” on September 5.

Citizens Advice warns of “winter of despair”

Millions of people in the UK face a “winter of despair”, with one in four unable to afford their energy bills in October based on current forecasts, Citizens Advice has warned.

The 24% of people who will not be able to afford to pay for their energy is double the number already in the red ahead of the price cap rise, according to figures released by the advisory service.

And it said the figure could jump to one in three (34%) in January when prices are predicted to soar above £4,200.

The charity said its projections take account of the energy rebate and cost-of-living payments offered by the Government, showing that spiralling costs are rapidly outstripping the support on offer.

Of those who will not be able to pay in October, the majority (68%) have a household income of less than £30,000, the research found.

They also include 3.2 million disabled people and 4.4 million families with children.

On average, those who cannot afford autumn’s predicted rise will end up almost £100 a month in debt.

Citizens Advice said future support must target those who need it the most.

Ofgem ‘should suspend forced installations of prepayment meters'

Alongside further interventions from the Government to help households with bills, Citizens Advice is calling for industry regulator Ofgem to ensure that people are protected from the most serious consequences of falling into arrears, including a suspension of forced installations of prepayment meters.

The charity also warned that rising prices will drag more people into “dire circumstances”, with many of its frontline advisers already sharing reports of people who had never previously contacted Citizens Advice needing crisis support such as food bank referrals and fuel vouchers.

Its analysis suggests that more than half of those who will be in debt in October (53%) will not receive the additional cost-of-living payments targeted at those on benefits, disabled people and low-income pensioners.

With future price rises rapidly outpacing the value of the energy rebate, it warned that further action will be needed to stop more people falling into debt.

In July, the charity saw record numbers of people who were unable to top up their prepayment meter – the fifth time the record has been broken this year – while its web page on help with rising living costs was viewed more than 70,000 times – an increase of 40% on its previous record in March 2020 when the country went into the first national coronavirus lockdown.

Citizens Advice chief executive Dame Clare Moriarty said: “Every single day at Citizens Advice we’re already helping people in the most heart-breaking circumstances, trying to scrape together enough to feed their kids and keep the lights on. This will get far, far worse unless the Government acts.

“It’s becoming increasingly clear that skyrocketing prices will swallow up all of the help that has been announced so far.

“Every day that goes by without a plan is another day without reassurance for people who desperately need it. We urgently need further support, otherwise we risk a winter of despair for millions.”

Sunak outspends Truss on Facebook

Rishi Sunak’s campaign has poured almost £24,000 into Facebook advertising since the middle of July, heavily outspending his Tory leadership rival Liz Truss.

The former chancellor has spent £23,810 on 208 adverts since July 16, according to data from Facebook’s advert library.

The money has been used to promote posts from both Mr Sunak’s personal Facebook page and one for his campaign named Ready4Rishi, and has made him one of the top 20 UK spenders on Facebook advertising in the past month.

Ms Truss has spent far less, paying £6,590 to promote 20 adverts over the same period.

On August 14, the most recent day for which data is available, Ms Truss’s campaign recorded no spending on Facebook advertising while Mr Sunak’s campaign spent £1,635.

A spokesperson for Mr Sunak’s campaign said: “There all kinds of ways to communicate Rishi’s message and online advertising is an effective one that has the potential to reach millions of people every week.

“It’s vital people understand what Rishi has to offer the country, particularly in what is going to be challenging times for the country.”

Credit card spending has shot up by a third

Credit card spending has shot up by a third as more people turn to borrowing cash amid the cost-of-living crunch.

UK credit card holders spent just under £20 billion in May, a 33% jump in the total spend compared to the same month last year, according to official figures from trade body UK Finance.

Debt was also on the up, with outstanding balances on credit card accounts growing nearly 10% in the year to May.

The number of credit card transactions also rose by more than a quarter year-on-year, with around 357 million payments in May by UK cardholders both in the country and oversees.

Consumer Prices Index inflation had reached 7.9% in the year to May and has since risen further.

Credit card spending has been increasing steadily since the start of the year, coinciding with the rising cost of bills and double-digit food and drink inflation.

Meanwhile, total debit card spending edged up by just 1% compared to the same period last year, UK Finance said.

The data comes as inflation spilled over into double figures in July, hitting 10.1%, driven by big price rises across food and staple items, the Office for National Statistics said on Wednesday.

Real wages have declined, with UK workers seeing their pay lag behind inflation at record levels over the three months to June.

Inflation is expected to get even worse later this year, peaking at 13.3% in October, according to the Bank of England.

This is likely to push the UK into a recession, starting in the fourth quarter of this year and continuing until the final three months of 2023, the Bank said earlier this month.

Inflation is largely being driven by spiking energy bills, with another energy price cap rise of around 85% forecast for October. Bills are then likely to spike even further in January and April next year, experts say.

We’re ending out coverage of today’s inflation announcement, but keep reading independent.co.uk for updates on the cost of living crisis.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments