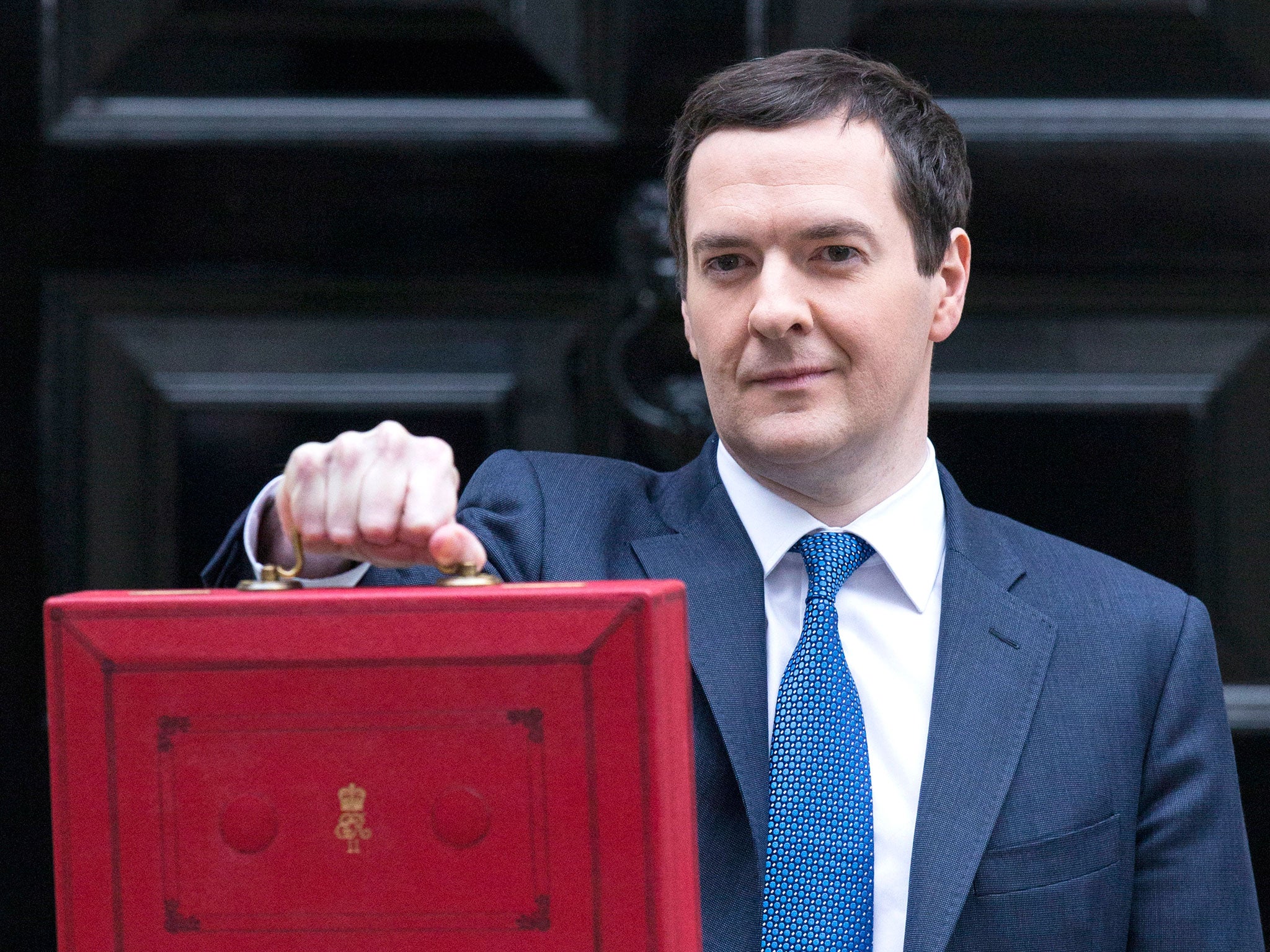

Budget 2015: 7 things we know will be announced by George Osborne

A rundown of what we know so far, from round-the-clock Sunday shopping to increasing the inheritance tax threshold

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne's Budget will mark a historic moment for him and his party as he spells out the details of the first Conservative budget in more than 19 years.

Just like Gordon Brown did during his 10 years at the Treasury, Mr Osborne does not waste any opportunity to make a political manoeuvre and with one eye on replacing David Cameron as Prime Minister when he stands down before the 2020 election, expect this Budget to be jam-packed full of measures that will plot his way to Number 10.

As ever with such a strategic Chancellor, parts of the budget are briefed out beforehand, heavy hints are made, measures are ‘all but ruled out’ and speculation builds over what rabbit Mr Osborne will pull out of the hat this time around.

Welfare

We now know where roughly £2.2bn of cuts will fall, but there is still another £10bn unannounced. Mr Osborne said at the weekend he had identified where the whole £12bn of cuts will come from and we are likely to discover the vast bulk of them on Wednesday.

The Institute for Fiscal Studies has estimated the current spending cuts laid out in the Tory party manifesto amounts to around £1.5bn.

They include freezing working age benefits for two years, which will save about £1bn according to the IFS, while other pledges, such as reducing the benefit cap and removing housing benefit from young people are expected to save around £300m.

Mr Osborne announced that the benefit cap for claimants out of London will be reduced to £20,000 a year outside London and £23,000 in the capital, which will affect 90,000 households.

BBC to fund free TV licences for elderly

Another £650m a year will come from the decision to hand over responsibility for funding free TV licences to the BBC, contributing towards the Chancellor’s £12bn savings goal.

The £12bn overall figure may only make up a small fraction of the overall welfare budget of around £220bn.

But considering David Cameron has ruled out any cuts to the £95bn cost of pensions or universal pensioner benefits as well as pledging not to make cuts to the £12bn child benefit spending, it leaves around £112bn of the welfare budget vulnerable.

Inheritance tax

The Chancellor will implement a flagship pledge in the Conservatives’ general election manifesto to ensure that people can hand down their assets to their children or grandchildren when they die.

At present, inheritance tax is charged at 40 per cent above a threshold of £325,000 for an individual and £650,000 for married couples and civil partners.

A “family homes allowance” that would raise the threshold to £500,000 for an individual and £1m for couples will be announced. It is set to take effect in April 2017 at a cost of £1.05bn a year, to be funded by reducing tax relief on pensions for people with incomes over £150,000 a year.

Sunday shopping

Mr Osborne will announce the biggest shake-up of Sunday trading laws for 20 years by introducing round-the-clock Sunday shopping by relaxing trading laws, which he will predict will lead to a significant economic boost.

Under current legislation larger retailers in England and Wales are only allowed to trade for six hours between 10am and 6pm on Sundays, although shops with less than 3,000sq ft of floor space can open all day.

The move is expected to be included in an Enterprise Bill in the autumn, but the new rules will not apply in Scotland, where trading laws are devolved to Holyrood.

Early adoption fund

The government has already announced a £30 million fund to speed up the search for adoptive parents for children in care in England. It will cut the average 18-month wait it takes currently to find a family for children at the moment.

The measure will help 3,000 children in local-authority care waiting to find a family home, with a focus on harder-to-place children.

Mr Osborne said that it was a “tragedy” that so many children ready for adoption were waiting long periods to find new homes. More than half have spent more than 18 months in care, even though there is a surplus of potential adoptive parents.

The number of children adopted increased from 3,200 in 2010 to 5,050 in 2013-14. The average time it took to place a child with adoptive parents fell from an average 656 days in 2012-13 to 533 days in 2013-14.

Austerity

The Chancellor has pledged to run a budget surplus in "normal times," but he has yet to define what normal times means, nor what definition of a budget surplus he plans to use.

Tax

David Cameron pledged to ban tax rises during the election campaign, or at least direct taxation such as income tax, national insurance and VAT, which between them account for two-thirds of all tax revenues.

The Chancellor all but ruled out a cut in the top rate of tax, which currently stands at 45p and is paid by those earning more than £150,000. The memories of the bad press he received from his 'omnishambles' Budget in 2012, when he cut the top rate of income tax from 50p to 45p, will deter him from another controversial cut for the highest earners.

Mr Osborne is also wary of giving the richest a tax cut at the same time as he announces a cut in tax credits for the poorest workers.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments