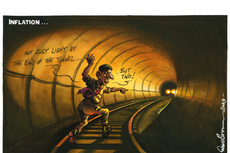

Why have interest rates gone up, what does it mean and will they come down?

Today the Bank of England’s Monetary Policy Committee decided to increase the base interest rate from 5% to 5.25%

The Bank of England has once again met to discuss what it needs to do to keep inflation under control.

It has been hiking interest rates since December 2021 as inflation ran rampant.

But what do higher interest rates mean, will they continue to go up, and what does the Bank expect to happen to the economy? We try to answer some of those questions here.

What happened to interest rates today?

The Bank of England’s Monetary Policy Committee decided that it would increase the base interest rate from 5% to 5.25%.

This is the 14th straight rise in the Bank’s base rate, and brings the rate to the highest since April 2008.

What will higher interest rates mean?

For borrowers it is bad. If you have a variable rate mortgage it means that the interest that you pay every month will increase pretty soon.

If you have a fixed-rate mortgage, or are planning to take out a new mortgage, it means you will probably pay more in interest when you remortgage or borrow the money to buy your home.

But you are not immune if you do not own your house. These higher interest rates also often find their way to renters as well.

There is a benefit for savers though. The base rate going up will increase the amount that your bank will pay you in interest on the money you have in your bank account.

Will rates continue to go up, will they stay the same, or could they come down?

Forecasting the future is impossible, but markets still bet on it to make money if their bets are right.

The Bank said that markets expect its base interest rate to keep rising to 5.8% in the last quarter of this year, 5.9% in the last quarter of next year, before falling, although not much, to 5% in the last quarter of 2025.

The Bank itself does not say what it will do to interest rates in future, but it did imply on Thursday that they might have to stay higher for longer.

What’s the Government’s inflation target, and is it on track?

The Government said at the end of last year that it planned to halve inflation from 10.7% at the time to 5.3% by the end of this year.

The Bank’s economic projections, which could easily be wrong, are now that the Government will meet this objective quite comfortably. It expects Consumer Prices Index (CPI) inflation to fall to 4.9% in the final quarter of the year.

Most of this will be because of falling international energy prices, which have very little to do with anything the Government has done.

What’s the economy doing?

The Bank said that it does not expect the economy to go into recession this year, despite previous forecasts, although margins are slim and the margin for error around its forecasts could allow for a recession.

The Bank said that this year UK gross domestic product (GDP) will rise by 0.5%, an upgrade from the 0.25% it had forecast in May. However, it downgraded its 2024 growth forecast from 0.75% to 0.5% and its 2025 forecast from 0.75% to 0.25%.

Bookmark popover

Removed from bookmarks