Mr Kipling cakes firm says food cost inflation is ‘past its peak’ so no more price hikes this year

The group said trading profits for the full year were set to be at the top end of market expectations

Recent food cost inflation is “past its peak”, said Mr Kipling cakes firm Premier Foods, which is consequently not planning any more price hikes for its products for the rest of the year.

The group – which supplies retailers with a raft of household favourites including Super Noodles, Oxo cubes and Bisto – said its trading profits for the full year were set to be at the top end of market expectations after it pushed through price rises in recent months to offset “significant” cost inflation.

Consequently, Alex Whitehouse, Premier Foods chief executive, said: “We believe the recent period of significant input cost inflation is now past its peak and have no further price increases planned for the rest of 2023.”

The grocery sector has been under pressure in recent months, with food producers facing challenges such as an increase in the price of ingredients.

Suppliers and retailers have also been in sharp focus amid concerns that cost cuts are not being passed on quickly enough down the supply chain, and ultimately to shoppers in stores, with Britain’s competition watchdog investigating the grocery sector over worries about profiteering.

The London-listed company has reported a 21 per cent rise in sales in the first quarter of the financial year when compared to a year earlier, while the company said it had again grown its market share in the last quarter, with sales of branded products almost 18 per cent higher in the 13 weeks to 1 July.

The firm, which has over 4,000 staff across 15 sites in the UK, said revenue growth in the grocery arm is set to “moderate in forthcoming quarters, as year-on-year effects of higher prices reduce”.

It added: “The company’s portfolio continues to demonstrate a high level of relevance to consumers in the current economic climate.

“Following a strong first quarter, and with exciting plans behind the group’s leading brands for the remainder of the year, it now sees trading profit for FY23/24 at the top end of market expectations.”

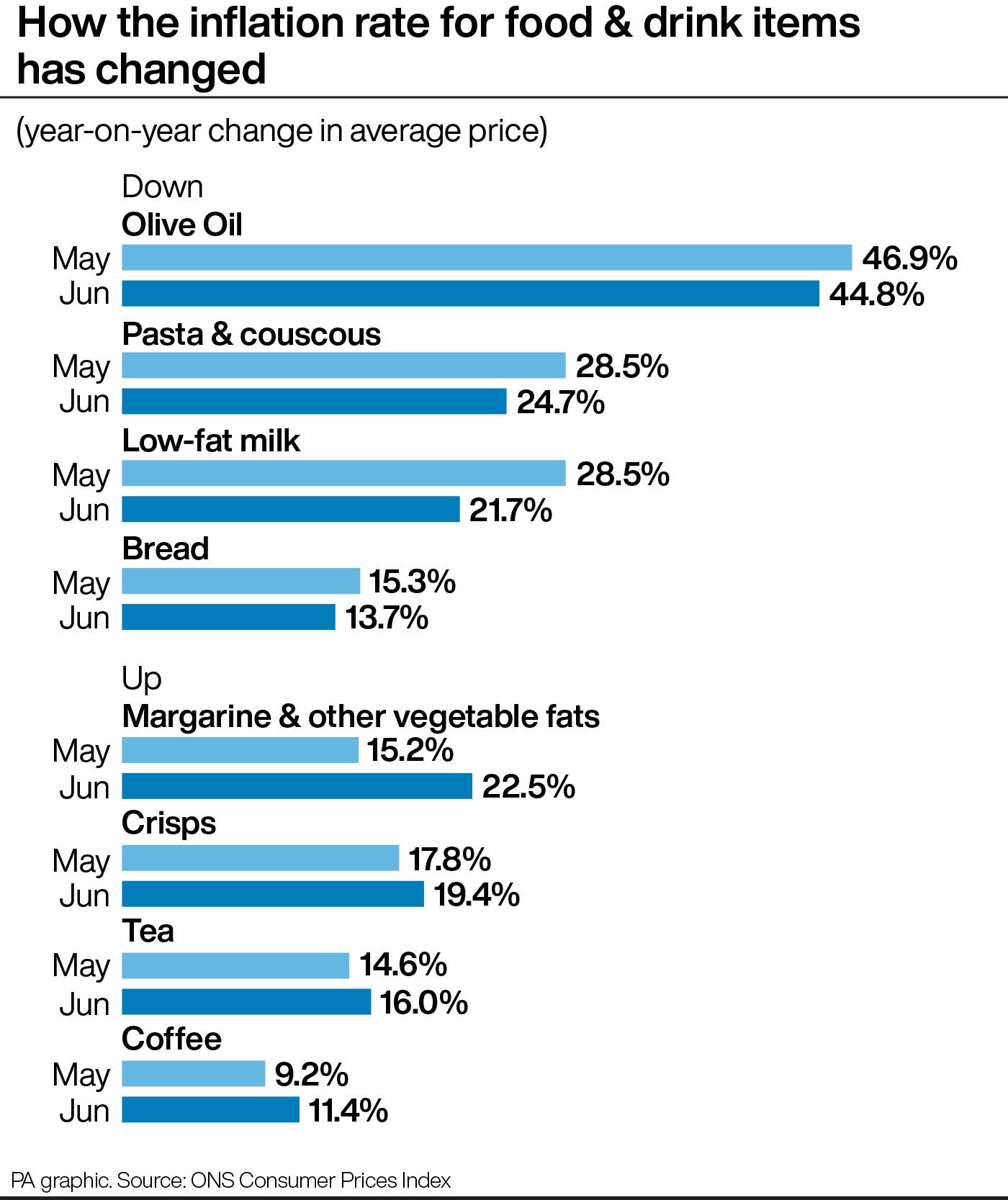

This comes after the rate of the UK’s price rises fell on Wednesday from 8.7 per cent to 7.9 per cent, the latest official figures showed, offering welcome relief to families struggling with the cost of living crisis.

The consumer price index measure of inflation up until June showed a bigger-than-expected fall, as the Office for National Statistics (ONS) revealed that the rate of increase had “slowed substantially” to its lowest annual level since March 2022.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks