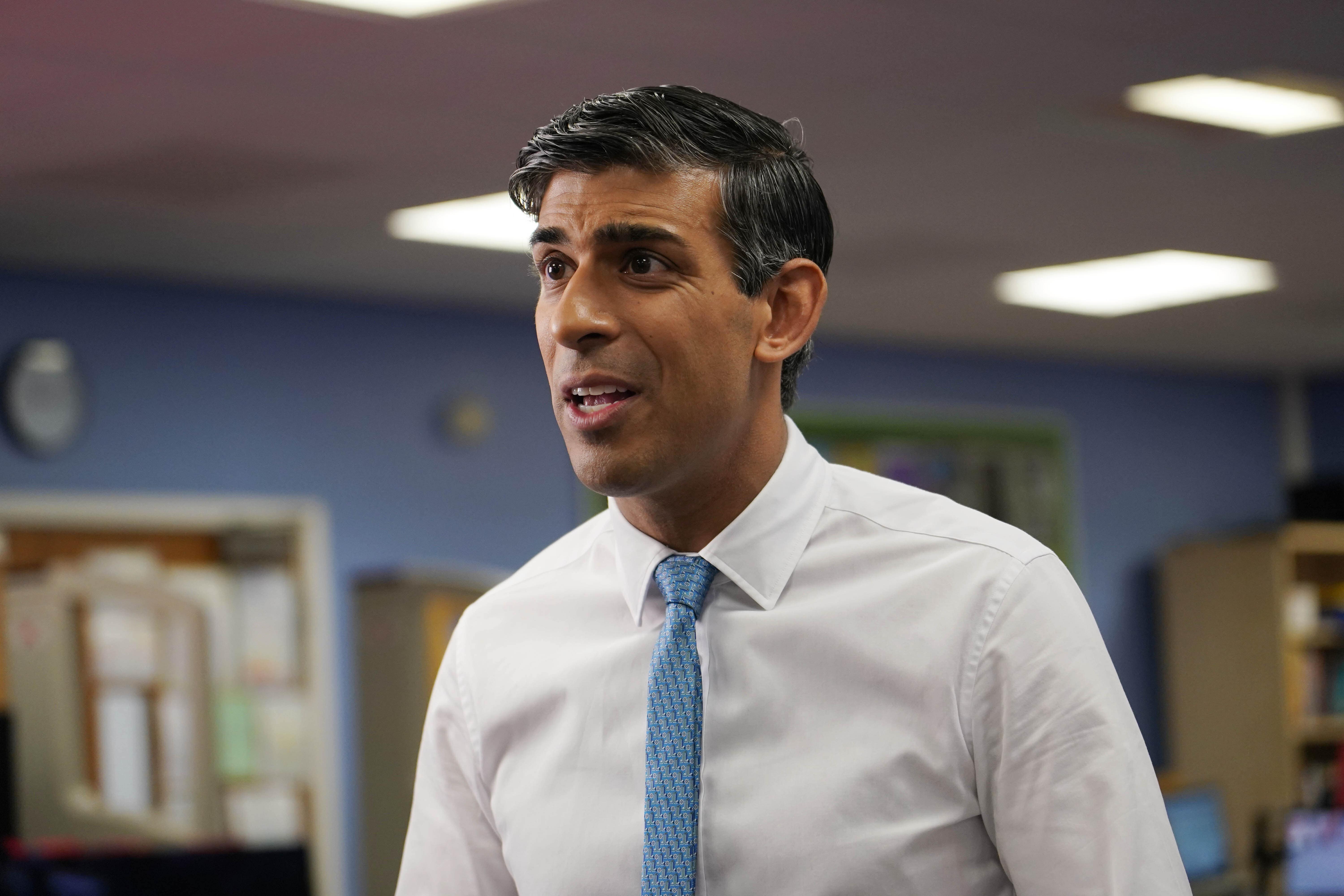

The fall in inflation is a boost for Sunak – but it leaves him no wriggle room

While economic recovery may be on the horizon, writes Andrew Grice, my worry is whether this is enough to make people think the PM has fulfilled his promise

Today’s bigger than expected fall in inflation is welcome news, but Rishi Sunak cannot celebrate – for there is a growing recognition among ministers that inflation has blown a hole in his general election strategy.

First the good news: the consumer prices index dropped from 8.7 per cent in May to 7.9 per cent in June, due largely to the falling cost of petrol and diesel. Core inflation, which excludes items such as food and fuel, dropped from 7.1 per cent to 6.9 per cent, though it is still sticky, and food price inflation remains high at 17.3 per cent.

Sunak now has a better chance of delivering his pledge in January to halve inflation by the end of this year, though government officials say it will be “tight”.

Today’s slightly improved picture might persuade the Bank of England to raise interest rates by 0.25 percentage points on 3 August rather than 0.5 percentage points. The financial markets now expect interest rates, currently at 5 per cent, to peak at 5.75 per cent rather than 6 per cent.

Now for the bad news: the economic and political cycles are out of alignment. Inflation has delayed the economic recovery Sunak needs. Despite today’s inflation figures, interest (and mortgage) rates will be higher for longer than expected and, some economists fear, could even push the UK into recession.

Sunak wouldn’t choose to hold an election next year, but he can’t escape one (his time officially runs out in January 2025). He believes he cannot do what governments often do before elections – boost spending on public services or cut taxes, or both – as that would undermine his drive to bring inflation down to its 2 per cent target.

Jittery Conservative MPs have already priced in pre-election tax cuts, but Whitehall insiders tell me such a sweetener is now far from certain. They say Sunak and his chancellor Jeremy Hunt agree that they won’t reduce taxes until inflation has been beaten. Nor will they raise borrowing to fund tax reductions, just as they refused to increase it to fund the public sector pay increases announced last week.

In the prime minister’s eyes, the political pressures are not as straightforward as claimed by the Tory MPs who want tax cuts yesterday. I’m told he believes the Tories need to prove their economic competence to outflank Labour – a tacit admission that Keir Starmer and his shadow chancellor Rachel Reeves have made inroads in an area where the Tories could once take their supremacy for granted. Sunak thinks Labour’s higher borrowing – it proposes an extra £28bn a year of green investment by the second half of a five-year parliament – could still leave Starmer’s party vulnerable in the heat of an election.

Sunak knows he cannot risk spooking the markets after the Truss debacle last autumn. So that means no unfunded tax cuts or tweaking of Hunt’s fiscal rules to manufacture room for tax cuts, because that would go down badly in the markets and allow Starmer and Reeves to claim Labour is more fiscally responsible than the Tories.

Whitehall sources tell me that Hunt, who originally hoped to announce tax cuts in his autumn statement in November to take effect next April, might not now be in a position to announce any immediate cuts in his Budget next March either. Implementation might have to be delayed until 2025 and pre-announced next March as a signal of intent, with the Tories challenging Labour to scrap the tax cut if it wins the election. Starmer and Reeves would probably side-step this elephant trap and avoid such a commitment. They do not want the words “Labour tax rise” to feature in pre-election headlines.

The promise of post-election tax reductions will not satisfy impatient Tory MPs who fear losing their seats. They hope Sunak and Hunt are lowering expectations and will still deliver pre-election tax cuts next March. Allies of the PM and chancellor insist they are not doing so, arguing that defeating inflation first is good politics as well as good economics.

Insiders describe Sunak, the former chancellor, as “stubborn” and “inflexible” on the economy. As one minister put it: “Rishi is convinced he will be proved right, and he will prove his critics wrong. He will not deviate from the path he has chosen.”

That path is littered with thorns. There are no soft options for Sunak, only hard choices. He is still boxed in by inflation, and is running out of time.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments