Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

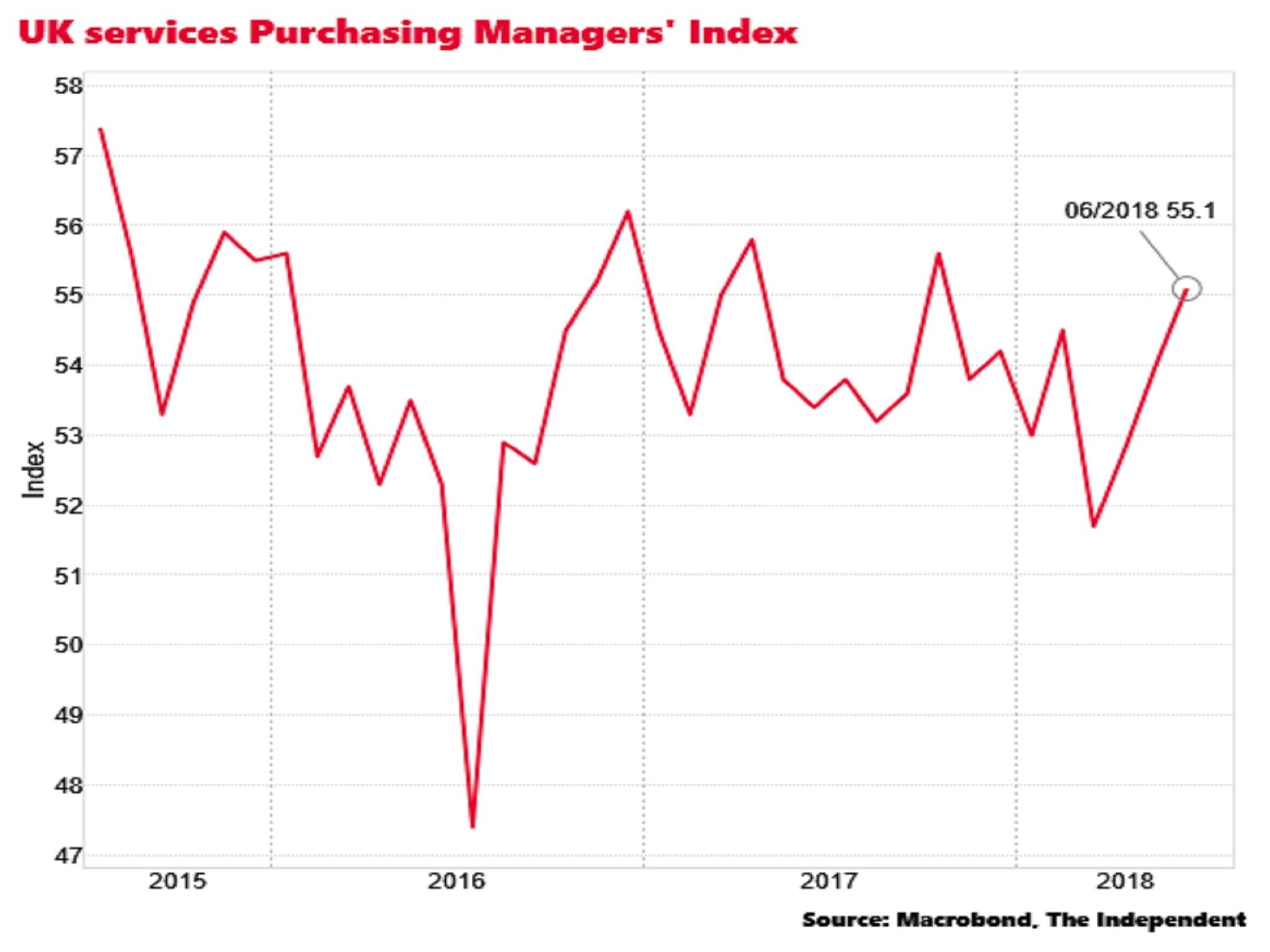

Your support makes all the difference.The UK’s services sector unexpectedly picked up speed in June according to the latest survey snapshot of the sector, raising the possibility of an August rate hike by the Bank of England.

The Purchasing Managers’ Index hit 55.1, up from 54 in May. Any figure above 50 indicates growth.

City of London analysts had expected it to show no change.

Services account for around 80 per cent of the UK economy and analysts said the most recent surveys were consistent, on historical trends, with overall GDP growth picking up to around 0.4 per cent in the second quarter of 2018.

The services PMI covers hotels and restaurants, transport, finance and IT, although not the retail sector.

“Stronger growth of service sector activity adds to signs that the economy rebounded in the second quarter and opens the door for an August rate hike,” said Chris Williamson of IHS Markit, which compiles the survey.

“It remains encouraging yet also surprising that current business activity continues to show such resilience amid relatively moribund confidence regarding the year ahead outlook.”

Growth was just 0.2 per cent in the first quarter according to the latest official data.

The Bank of England has judged that the growth slump reflects the temporary impact of major snowstorms in February and March, but the Office for National Statistics had detected signs of an underlying slowdown.

The Bank's Monetary Policy Committee held off from raising interest rates in May, but three members of the nine person committee voted to put up the cost of borrowing in June, raising the chances of a majority opting for a hike in August, when it next meets.

Sterling rose to $1.3193 in the immediate wake of the data, although it was still flat on the day.

But some economists were more sceptical.

“The survey is not always a reliable indicator for the official activity data which will ultimately determine the Committee’s next step,” said Samuel Tombs of Pantheon.

“Since 1998, the PMI’s forecast for the preliminary estimate of GDP growth has been wrong by 0.25pp on average...It would be premature to conclude that an August rate hike is likely until the first monthly estimate of GDP for May is published next week.”

The ONS is in the process of shifting from its traditional process of publishing quarter on quarter GDP growth estimates to the release of a new monthly series.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments