Pound sterling value rises thanks to better UK GDP figures

The Office for National Statistics said that growth in the three months to March was 0.2 per cent, rather than its previous estimate of 0.1 per cent

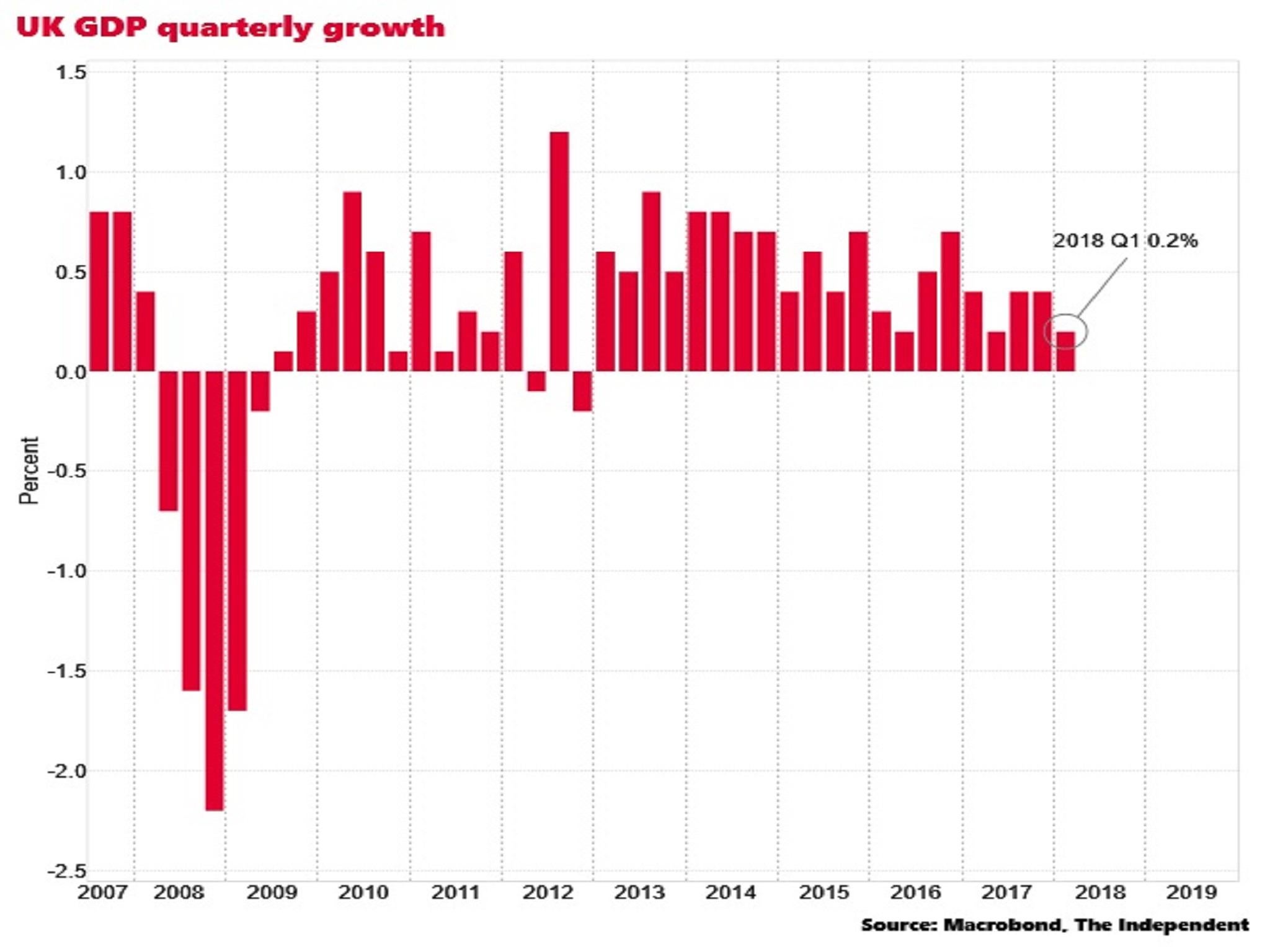

UK GDP growth in the first quarter of 2018 has been unexpectedly revised up on the back of less weak construction activity, sending sterling up.

The Office for National Statistics said that growth in the three months to March was 0.2 per cent, rather than its previous estimate of 0.1 per cent.

The pound jumped to $1.3153, up 0.61 per cent on the day, in the wake of the data, as traders increased their bets on an earlier interest rate hike from the Bank of England.

“Odds of an August rate hike from the BoE have now increased and the upwards revision is in keeping with the bank’s comments that Q1 data is typically subject to revisions,” said David Cheetham of XTB, an online trading company.

In May the Bank had forecast that the GDP figure would ultimately be revised up to 0.3 per cent and that it would bounce back to 0.4 per cent in the second quarter.

The revision is likely to bolster those on the Bank’s Monetary Policy Committee who think rates should rise sooner rather than later to counter inflationary pressures.

However, sterling remains close to a seven-month low against the dollar, reflecting concerns about progress in the Brexit negotiations between the UK and the EU, with the British cabinet still divided about what sort of trade and customs deal to seek.

Upward revision

The ONS had previously estimated that construction, which accounts for around 6 per cent of output, had slumped by 2.7 per cent in in the fierce snowstorms of February and March.

But its latest analysis – based on more recent data from the sector – points to a contraction of just 0.8 per cent, meaning it was less of a drag on overall output growth.

However, there was also some adverse revisions in the latest Quarterly National Accounts as the ONS also downgraded its estimate for growth over 2017 as a whole from 1.8 per cent to 1.7 per cent.

The ONS noted that the UK was the only G7 economy to show a slowdown over 2017, mainly due to the spike in inflation stemming from the slump in sterling after the Brexit vote. The rest of the G7 saw a sharp pick-up in growth last year.

And the year on year rate of growth in the first quarter of 2018 for the UK was just 1.2 per cent, the lowest in almost five years.

The ONS said business investment fell by 0.4 per cent in the first quarter of the year, while household consumption rose by 0.2 per cent.

The household saving ratio fell to 4.1 per cent, down from 4.5 per cent previously.

Factoring in household investment in housing, the household sector as a whole was a net borrower for the sixth successive quarter, which the ONS said represented “increasing prices squeezing their budgets”.

The ONS and the Bank of England have diverging views on the extent to which the first quarter growth slump represents an underlying slowdown or simply a weather-related blip.

Despite Friday’s upgrade, the ONS still stressed that construction’s weakness was spread over the entire quarter, not just the snow affected months.

“We remain cautiously upbeat about the economy’s near-term prospects and continue to think that the MPC will press ahead and raise interest rates at its next meeting on 2 August,” said Ruth Gregory of Capital Economics.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks