UK inflation - live: Tories call for cut to interest rates despite market gloom over rising prices

Rate of Consumer Prices Index inflation falls to 2.3 per cent in April

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Tories are calling for the Bank of England to cut interest rates despite market gloom over new inflation data.

Analysts say the chances of a cut in June are now slim after inflation fell to 2.3 per cent in April from 3.2 per cent in March - the lowest level in nearly three years - but above the 1.9 per cent to 2.1 predicted by some analysts.

But Sir Jacob Rees-Mogg, the former Conservative business secretary, argued the Bank should have cut rates already because “inflation is a lagging indicator.”

Paul Scully, a former minister, said cutting the rate would “bring relief to many who are fixing their mortgages for the next few years”.

Paula Bejarano Carbo, NIESR economist, added said persistent core inflation and strong wage growth data suggested the Bank “may exert caution at its upcoming meeting and hold interest rates, despite today’s encouraging fall in the headline rate.”

Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales, said a June cut was now “unlikely”.

Reeves: Labour will be ‘much more ambitious’ than government

Labour will be “much more ambitious” on the economy than the government if it wins the election, Rachel Reeves has said.

The shadow chancellor said her party would bring “stability back to our economy” and invest more in renewables.

She said Labour would invest more in “home-grown renewables so we’re less reliant on Putin and dictators around the world for our basic energy needs and can bring energy bills down for families and pensioners”.

Hunt declines to be drawn on potential interest rate cut

Jeremy Hunt declined to be drawn on when he thought the Bank of England would cut interest rates.

The chancellor said the central bank would cut rates when it was “confident that it is sustainably at its target”.

Analysts said the Bank was likely to be more cautious on a potential cut in June because inflation fell by less than expected.

Watch more below:

Economy ‘not out of the woods yet’ - shadow Treasury minister

Today’s inflation figures show the economy is “not out of the woods yet”, Labour’s shadow Treasury minister Darren Jones has said.

The MP for Bristol North West said inflation was heading “in the right direction” but there was more work to be done.

He told Sky News: “Core inflation is still around 3.6 to 3.9 per cent, which is hotter than the markets were expecting it to be. This is not out of the woods yet. It is in the right direction but there is still much more to be done.”

Mr Jones pointed to Labour’s “securonomics” agenda, which includes measures to build “homegrown, secure, renewable energy”.

The shadow minister said: “The one reason that the headline rate of inflation has come down closer to 2 per cent today even though the cost of other things are remaining a bit too high is because of the energy bills.

“The problem there is if something happens in the world and gas prices rocket again, we are going to be back into that inflationary environment with very high bills.”

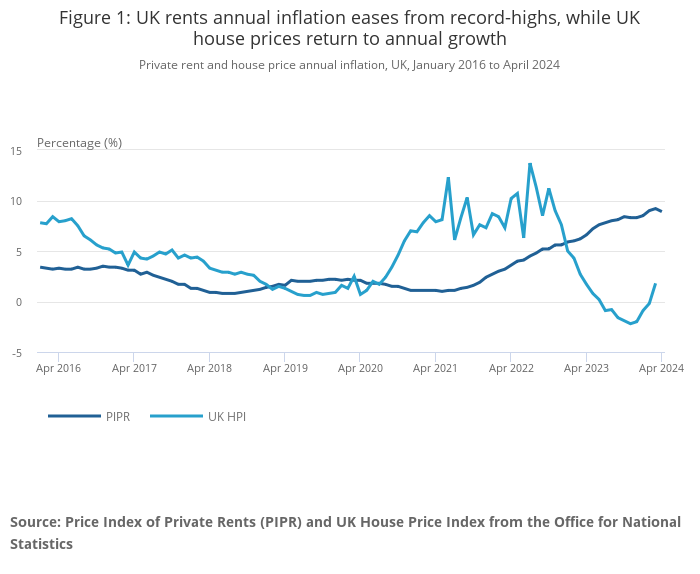

Average house price rises by 1.2%...as rents rocket 8.9%

Average UK house prices increased by 1.8 per cent in the 12 months to March, according to official figures.

The Office for National Statistics (ONS) said it lifted the average house price across the UK to £283,000.

It represented a recovery in pricing after house prices had fallen by 0.2 per cent in the 12 months to February.

Meanwhile, the ONS also revealed that UK private rents increased by 8.9 per cent in the 12 months to April, as house price inflation slowed slightly from 9.2 per cent growth in the year to March.

ONS chief economist Grant Fitzner said: “Average UK house prices grew over the year for the first time since last summer.

“House prices saw an annual rise in every nation and region, except London and the South East, with Scotland seeing the fastest annual growth.

“After two years of unprecedented and generally accelerating annual growth, private rental price rises showed tentative signs of easing.

“Most nations and English regions saw a slowdown, with a notable easing in London.”

BT fined £2.8m over contract failures for 1.1m EE and Plusnet customers

BT has been fined £2.8 million by the industry watchdog after EE and Plusnet failed to provide clear and simple contract information to more than a million customers before they signed up.

Ofcom said that since June 2022, BT’s EE and Plusnet businesses made more than 1.3 million sales without providing customers with a contract summary and information documents, which affected at least 1.1 million customers.

Full report:

BT fined £2.8m over contract failures for 1.1m EE and Plusnet customers

Ofcom said BT broke its consumer protection rules by failing to provide them with clear and comparable information before signing up to contracts.

ICYMI: Martin Lewis explains what inflation fall means for interest rates

Martin Lewis explains what inflation fall means for interest rates

UK inflation fell to the lowest level in nearly three years in April as energy prices continued to cool, according to official figures. Consumer Prices Index (CPI) inflation slowed to 2.3 per cent in April, down from 3.2 per cent in March, according to the Office for National Statistics (ONS). It marks the lowest level since July 2021 when inflation was recorded at 2 per cent – the Bank of England’s target level. Financial guru Martin Lewis explained what this drop means for you in terms of interest rates when he appeared on Good Morning Britain on Wednesday (22 May).

Tories call for rate cuts despite gloom over inflation data

Two Tory MPs are calling for interest rates to be cut despite market gloom over today’s inflation figures.

Sir Jacob Rees-Mogg, the former Conservative business secretary, argued the Bank should have cut rates already because “inflation is a lagging indicator.”

Paul Scully, a former minister, said cutting the rate would “bring relief to many who are fixing their mortgages for the next few years”.

‘Shaky start’ to year casts doubt on future tax cuts

A “shaky start” to the financial year casts further doubt on the chancellor’s ability to cut taxes in a potential pre-election fiscal event, an economics company has said.

Alex Kerr, assistant economist at Capital Economics, said: “Overall, the chancellor will be disappointed that April’s figures do not provide more scope for tax cuts at a fiscal event later this year.

“Moreover, we expect slower nominal GDP growth and wage growth to dampen tax receipts growth later this year.

“And the rise in market interest rates since March’s budget alone suggests he may have even less fiscal ‘headroom’ (perhaps about £6.5bn) for tax cuts than the £8.9bn left over in March.”

Paula Vennells should be made homeless, postmaster suggests

Rubina, a sub postmistress who was accused of taking £43,000 in 2010 and sentenced to a 12 months in prison, has suggested the only way Paula Vennells will “learn” anything from the Post Office scandal is if she’s stripped of her assets and made homeless, Archie Mitchell reports.

When asked whether she wants to see Paula Vennells go to prison, she told Times Radio: "I don’t want Paula Vennells to go to prison because she won’t learn anything.

“The only way she’ll learn is everything being stripped of her, her assets, her mark against her name so that she can’t get employment, made homeless. That’s how I want her to pay back what she did to us”.

"When people like [her] go to prison, they don’t learn anything. After three or four months or six months later they’ll be out”.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments