Why taxing our bad habits won’t help Rachel Reeves in the Budget

Levies on alcohol, tobacco, gambling and other ‘vices’ raise huge amounts of income for the government, writes Chris Blackhurst. But with better health practices and criminal gangs cashing in, the Treasury is no longer enjoying a win-win situation

There are those on the left who wish private schools to be abolished completely. For them, VAT on school fees is the equivalent of a “sin” tax.

What if you’re Rachel Reeves and there is no money in the kitty? You’ve rather come to rely upon the £1.7bn or so that will be raised from the independent education sector – you will use that cash, as you’ve said you will, to invest in state schools.

This illustrates the dilemma with sin or “vice” taxes – typically the levies on alcohol, tobacco, gambling. But these days, with climate change, petrol can be added, and in our more health-conscious times, so can sugar. Now, private education.

Ideally, the government would like to see the back of the taxed item completely – or certainly see its popularity hugely curtailed, but as the Chancellor and her boss, Sir Keir Starmer, keep telling us, they have no money to do the things they’d like.

Worse, they claim the Tories have left them a £22bn black hole in the national purse that must be filled. So, you quite like the funding the tax generates; more than that, you actually need it.

There is a point at which the levy peaks, when receipts begin to fall. You’ve taxed them up to the hilt, demand has dipped and the Treasury’s income declines. As you wish to drive them out of existence or thereabouts, that should not matter, but it does, greatly, as you’re in government with little financial leeway.

Tobacco has hit its peak. Every year, pretty much, the chancellor announces an increase in the duty on cigarettes and other tobacco products. Often, as with the other vice levies, it’s one of the figures that will dominate the tabloid front page reports on the Budget.

It’s a set piece in the annual speech and the news is usually greeted with roars of approval from the back benches. Rightly so: smoking kills and it costs the NHS a fortune.

For the last five years, the Treasury has enjoyed a win-win situation. The excise rate, as it’s termed, on tobacco has gone up year-on-year and that has been met by commensurate growth in revenue for the government. Not any more.

In November 2022, the Office for Budget Responsibility, the watchdog that independently analyses the public finances, forecast total tobacco revenue collection of £11.42bn for 2023-24. In March 2023, this was revised down to £10.42bn.

Two subsequent revisions have seen it drop further, to £8.78bn – in other words, £2.6bn short of original expectations. The sharp contraction comes after excise increases that were substantially above the long-term average.

Health-wise, that would appear to be a satisfactory outcome – smokers are buying fewer tobacco products that do them harm. But are they? Research points to a rise in the consumption of illicit cigarettes and those brought into Britain duty free from abroad.

HMRC estimates this trade was worth, in duty and VAT, £2.8bn in 2021-2022. That was before the excise duty went up £1.66 in 2023.

Presumably, that made the smuggling and selling of illegal and non-duty paid cigarettes even more appealing. This, though, is criminal. The people engaging in this activity are breaking the law. By and large, they’re not individual chancers but members of organised gangs. It cannot be coincidence either that violence against shopkeepers and thefts of cigarettes from shops is also increasing.

Higher tax is causing some smokers to quit. But it is also driving others to find alternative supplies. Far from not smoking, they’re going underground and turning to criminals to fulfil their need.

That’s the same effect as has been experienced in the past elsewhere with other vices.

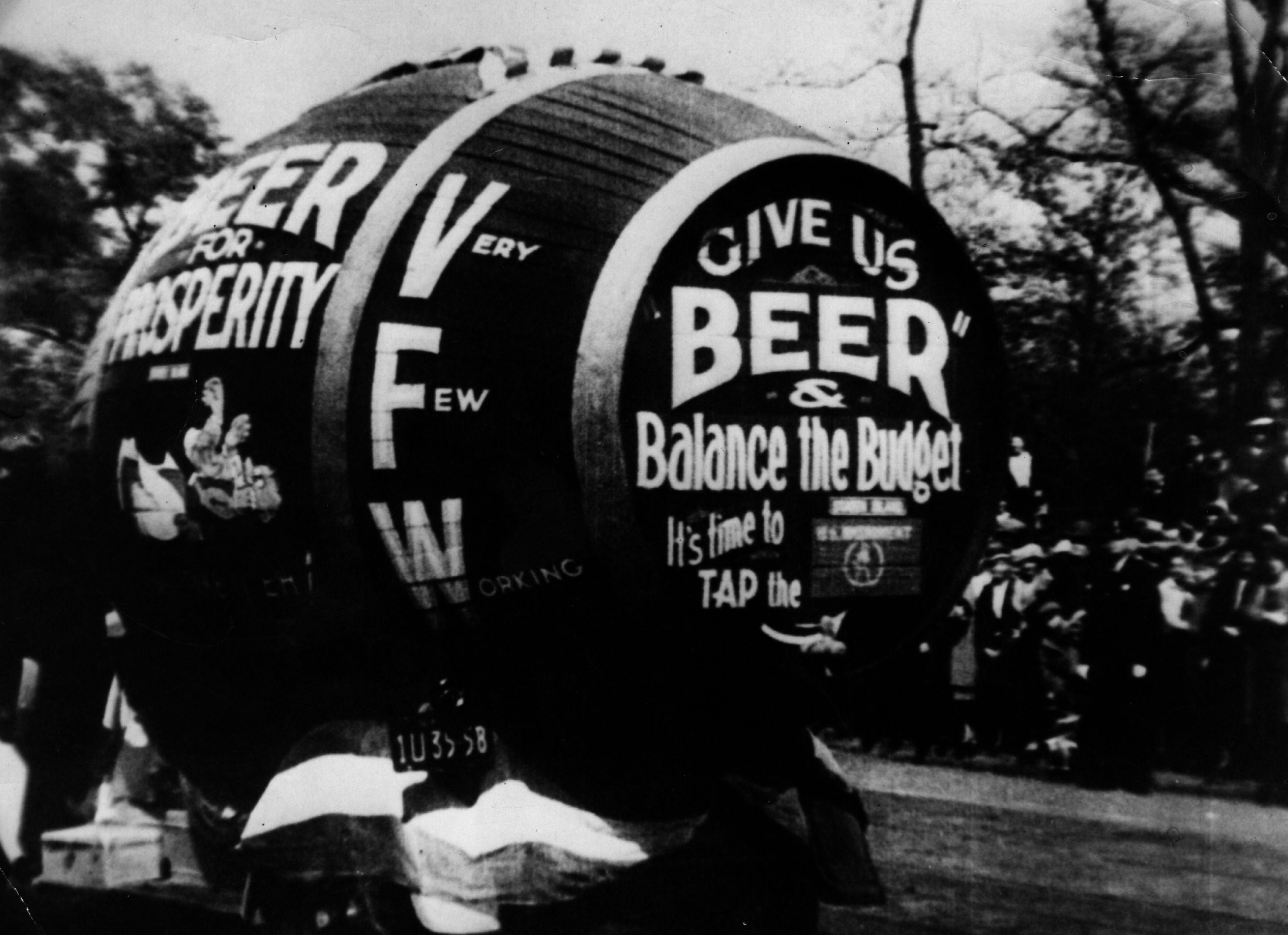

Prohibition in the US did not end the downing of alcohol, all it did was spawn a whole new industry in secret illegal stills. As with illegal tobacco, they were unregulated and the drinks they were manufacturing were frequently more damaging for health, with a higher alcohol content, than the branded banned liquors. An entire gangster class grew up as a result.

Likewise, with gambling. It can be addictive, causing mental health and financial problems. Restricting it ever tighter makes perfect sense – except that will not end betting. It will for some, but not all. There will be those who go to backstreet bookies; the societal pressures will remain, and the criminals will prosper.

So, the problem for Reeves is this: does she appease her colleague Wes Streeting at Health and the considerable lobby behind him, by being seen to make smoking an even more expensive habit, while at the same time decrease the amount coming in and run the risk of pushing some smokers towards buying from the gangs?

If she did not so urgently require the cash, it would not be so great a conundrum. But she does – witness the scrapping of the winter fuel allowance for some pensioners.

Perhaps she will keep the duty at the present level and go for the money; or perhaps, given the screams from Health and Social Care, she won’t. Certainly, right now, if the government’s predicament is as billed, the logical move is the former. What to do?

It’s not Reeves’ fault – she is inheriting a national balance sheet that has come to depend on smokers for cash. In the years ahead, the same could apply to private schools. The government desperately wants the VAT income from school fees to plough back into the hard-pressed state sector.

Who knows, a future Labour chancellor may mourn the passing of private schools.

The chancellor of the Exchequer may be the second most powerful job in government, but let no one pretend it is easy.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks