Are sanctions working? Why Russia’s economy continues to grow

Sanctions on Russia ‘might not be having the impact the West had hoped’

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Sanctions on Russia “might not be having the impact the West had hoped” a financial expert has said after the International Monetary Fund’s forecast.

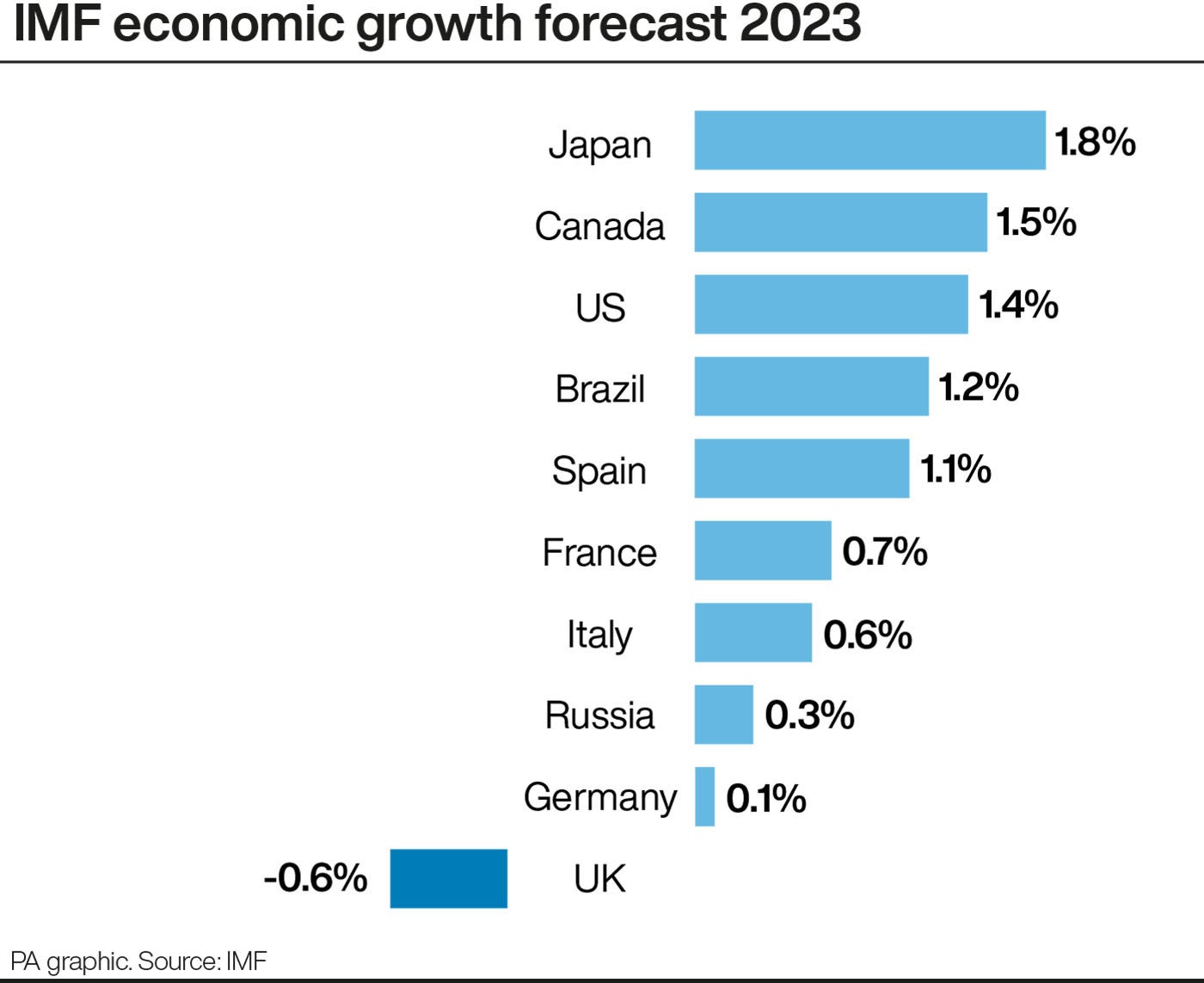

On Tuesday, the IMF predicted the British economy would contract 0.6 per cent against the 0.3 per cent growth pencilled in last October - which puts the UK last in terms of G7 nations.

The grim forecast put Britain even behind Russia, which has been hit with sanctions after its invasion of Ukraine. While Conservative MPs have been sceptical towards any doom, it has raised questions as to whether sanctions are hurting the Kremlin as much as desired.

The IMF has said Russian output will expand 0.3 per cent in this year and 2.1 per cent next year, defying earlier predictions. Russia has been tipped as an emerging economy as it continues to trade with other countries and there predicted downtown has not been as severe as they feared. A spokesman from the fund said: “At the current oil price cap level of the G7, Russian crude oil export volumes are not expected to be significantly affected, with Russian trade continuing to be redirected from sanctioning to non-sanctioning countries.”

Santa Zvaigzne-Sproge, chartered financial analyst and head of investment at financial service Conotoxia, said: “In terms of sanctions, the immediate impact on Russia’s fiscal and military footing seems not as strong as the West had hoped.”

She said that Russia has found new markets for its oil and gas production in response to the EU’s limitations but there could be longer term effects, such as a “brain drain” in top jobs.

“Meanwhile, the UK, similarly to the EU countries, is still fighting off raging inflation,” she added. “As these countries face the biggest fall in living standards on record, the lowering of gas prices may not be fully reflected in the purchasing power of households.”

“As these countries face the biggest fall in living standards on record, the lowering of gas prices may not be fully reflected in the purchasing power of households.

“The UK's Purchasing Managers Index (PMI) shows that the construction industry is full of uncertainties about the economic outlook and has slowed demand due to reduced risk appetite and higher borrowing costs.

“Furthermore, the financial and military help to Ukraine may have put additional pressure on the UK’s budget. It is also worth pointing out that all the above difficulties are faced by the UK in addition to already various concerns related to Brexit.”

She added, however, that the countries’ respective challenges mean the forecast is “not the best gauge” to draw conclusions.

The UK has said it has sanctioned more than 1,200 people and 120 businesses since Russia’s invasion of Ukraine. This includes sanctioning major banks, including Sberbank and Credit Bank of Moscow, as well as phasing out oil imports and banning the export of critical technologies.

In addition, the government has been removing selected banks from the SWIFT international payments system which it says will cripple Putin’s regime of access to finance.

“[We have] stopped Russian aircraft from flying or landing in the UK and banned their ships from our ports – cutting Russia off from the international community,” a government statement adds. In Europe and the US, governments have capped the price on Russian oil exports to $60 per barrel.

Dr Margaryta Klymak, tutorial fellow in economics with the University of Oxford, said there is however “some evidence” that Russia has already been affected by sanctions.

“In particular,” she said, “There have been negative effects on Russia’s financial sector, drop in imports (especially of high-technology products) and exports, as well as recorded negative net FDI inflows. The effect of sanctions might not have been as fast or effective as expected but the negative impact of sanctions on Russia is predicted to increase gradually over time.”

Fred Winchar, chief executive of US financial broker Max Cash, said that although the figures are not showing it yet - there is pressure on Russian finances.

“The country's average economic growth has reduced by 2 to 3 per cent,” he said.

“This has put pressure on the import bills and constrained public finances, making it difficult for the country to finance the war. With the sanctions in place, it remains to be seen whether the Russian economy will recover anytime soon.”

“These sanctions and export controls have effectively severed Russia's access to key technologies and industrial inputs necessary for its military operations. This has led to a decrease in the number of professional soldiers that Putin can deploy.”

Leigh Hansson, partner at US law firm Reed Smith, added: “Despite commentary suggesting that sanctions on Russia have had little effect, I think it is clear that they are making an impact.

“The initial wait and see approach which was adopted by many companies at the outset of the invasion has been superseded by a more active approach from the private sector.

“Pressure has increased as time has gone on, and companies, if they have not already, are looking to end or minimise their Russian business. There’s been something of an exodus, and so clearly the sanctions are having some effect.”

Walid Koudmani, chief market analyst at online investment platform XTB.com, said the IMF forecast further outlines” the declining and difficult state the UK economy is in”.

He continued: “With inflation outpacing most EU countries and as it continues to feel the real impact of Brexit on both the workforce and the prices of goods and services.

“Furthermore, while the economic sanctions imposed on Russia have had somewhat of an impact on the country’s economy, particularly at the start of the conflict, they have backfired and have made living conditions in the UK even more difficult with energy costs several times higher than what they are in the US despite natural gas prices dropping significantly over the last month.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments