Why isn’t the government talking about the major crisis in Britain that could topple the welfare state?

The government will have to find £36bn by 2030, and a staggering £83bn by 2040, to keep it going. That’s why it needs a wealth tax

How many more times do we have to repeat that Britain has an ageing population – which is going to cost a hell of a lot of money – for its politicians to wake up? A million times? Ten million times?

The Resolution Foundation has got the 2019 ball rolling early with a warning that if Britain simply wants to maintain the welfare state it has, it will have to find £36bn by 2030, and a staggering £83bn by 2040.

If you wanted to raise the second of those figures through income tax you’d have to nearly double the basic rate from the current 20p in the pound to 39p.

Of course, an elected politician making such a suggestion would have to accept becoming a client of the welfare state through jobseeker’s allowance after confronting voters with it. The threat of doubling income tax is not the sort of thing that goes down well on the doorstep.

Recognising this, the foundation has come up with a five-point plan that targets wealth rather than income. Britain has a vast supply of this. Much of it has been built up through the property price lottery, particularly in the southeast, and so can be filed under the heading “unearned”. It is also under-taxed.

The first of the foundation’s proposals would see the UK adopting Scotland’s progressive reforms to council tax, under which increases applied to the top bands only. The second would reduce entrepreneurs’ relief to its former level of £1m from the current overly generous £10m. The third would clamp down on inheritance tax loopholes and freeze the threshold at which it is charged.

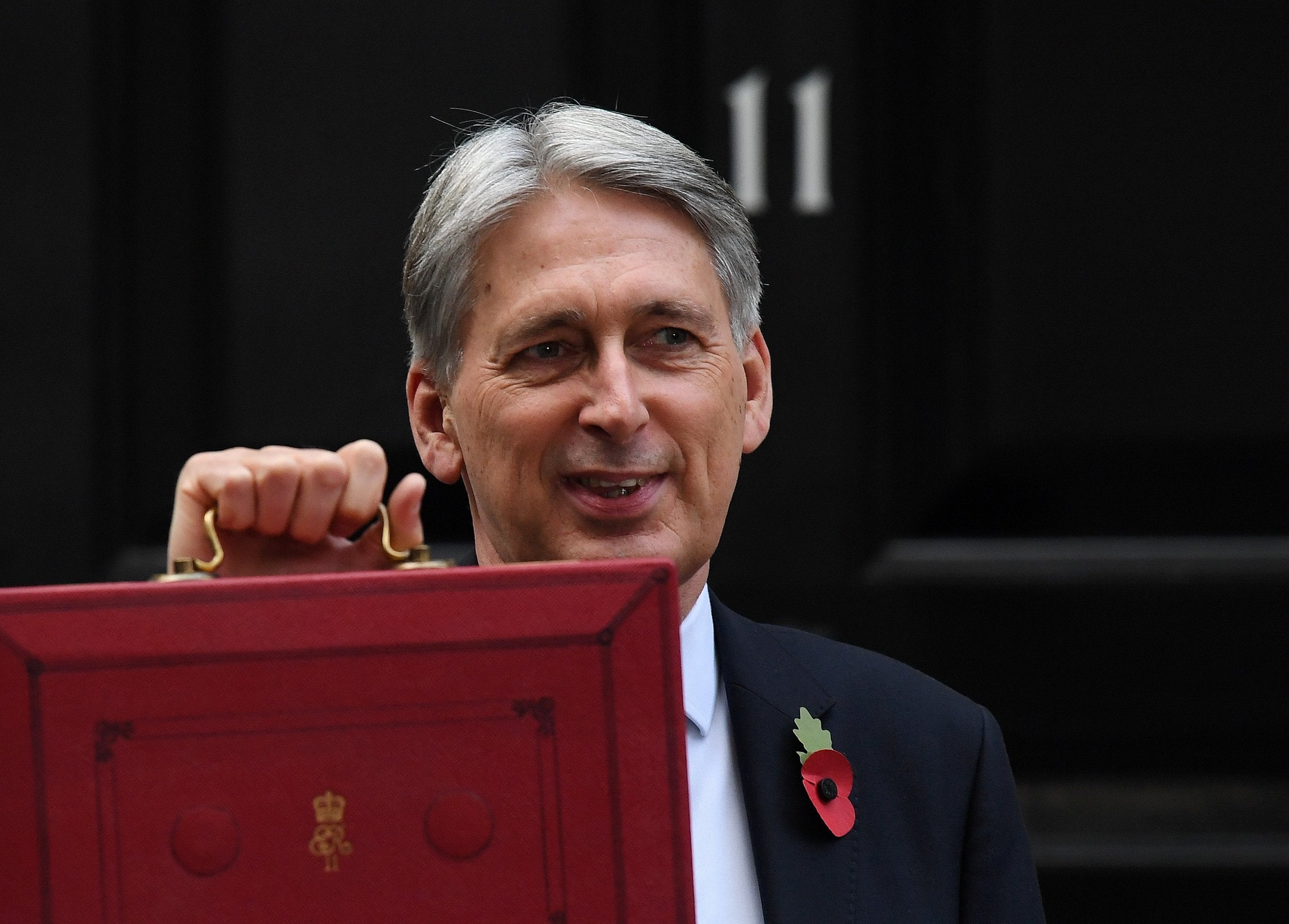

Point four would see the taxation of pensions made more progressive by capping the tax free lump sum at £40,000. The foundation wraps up by calling for the scrapping of the new ISAs introduced by former chancellor George Osborne aimed at the young. It says that they have proved to be “poorly targeted and expensive”.

Combined, these measures could raise a tasty £7bn by 2023. They’re a long way from filling the hole, but they represent a good start.

Of course, there’s a downside. Any proposed tax increase – however sensible – is inevitably going to produce moans and wails from those affected.

Here’s the thing: Britain has an ageing population, which is going to cost a hell of a lot of money. The foundation’s ideas are good. I tried to play devil’s advocate and come up with some drawbacks. It may be a consequence of the hangover from getting back to work after the festive holiday, but I struggled.

I found point five, which the foundation says will raise only £0.9bn, less persuasive than the others. But that’s largely because I think the young as a group have been kicked by their elders throughout the austerity years, and are about to get knocked to the floor by Brexit unless we can stop it.

That said, I’m willing to accept its criticism of the cost-effectiveness of the new ISAs. There may very well be better ways of picking Britain’s young people up off the floor.

In politics? Don’t like the others? That’s fine. But you’re going to have to come up with alternatives because (sigh)... Britain has an ageing population, which is going to cost a hell of a lot of money.

There. I’ve said it three times now. But it’s going to take saying it a lot more to wake Westminster up.

I’ve regularly criticised the current wretched Conservative government for having just one policy (Brexit). It’s going to cost more money than God. However, on those rare occasions that Tories turn their attention to life beyond that act of national self-immolation, they still like to talk about tax cuts. They completely ignore the fact that – and you can guess what’s coming – Britain has an ageing population, which is going to cost a hell of a lot of money.

That fact is recognised only by the party’s loony-tunes wing. It would respond to the challenge by burning the welfare state, and then cutting taxes.

The party’s more pragmatic MPs realise that the former idea would go down with a British electorate sick to the back teeth of austerity about as well as threatening to double income tax. So they chose ignore the fact that... well... you know.

Labour isn’t much better. Jeremy Corbyn and John McDonnell do at least recognise that they will need to raise more money to put their plans into effect. But they like to claim that they will usher in a nirvana simply through asking a small number of rich people and big companies to pay a bit more income tax and corporation tax.

The problem is that the welfare state, to which they are admirably committed, will require an absolute fortune just to keep it ticking over... Do I really need to repeat it again? I suppose I do. It’s because Britain has an ageing population, which is going to cost a hell of a lot of money.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments