Private schools catering to the global elite are spending lavishly because of their huge UK tax breaks - it has to stop

If these institutions paid tax in the manner of other private firms the Treasury’s coffers would be swelled by an estimated £100m a year. Add in the business rates exemption and the annual tax break is closer in value to £250m

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The right-wing media relishes exposing charity “fat cats” and highlighting galling examples of luxury and excess in the not-for-profit sector. But there’s one fat-cat charity scandal these outlets have ignored.

In Britain today there are hundreds of private clubs. They are often blessed with manicured lawns, sumptuous historic buildings and state-of-the-art sports and entertainment facilities for the enjoyment of members. Many offer expensive activities such as golf, shooting and horse-riding.

And who benefits from these impressively well-appointed institutions? “The very wealthiest families in the world,” concedes a manager of one.

And yet these private clubs are designated as charities and benefit from significant tax breaks. They pay little VAT on some of the services they buy, and no corporation tax on their financial surpluses. They can also slash their business property rates bill by up to 80 per cent.

If these institutions paid tax in the manner of other private firms the Treasury’s coffers would be swelled by an estimated £100m a year. Add in the business rates exemption and the annual tax break is closer in value to £250m.

And yet the crusaders against charity excess from the fourth estate have been strangely silent on this scandal. Perhaps it’s because these institutions in question are known as “independent schools”. And unlike the right-wing media’s usual targets, these charities do not provide help to the poor and afflicted but instead service the offspring of the world’s global elite.

There are around 1,200 public schools in the UK, almost all of which have charitable status. Why are they charities? The answer lies in history. The great public schools of England – Eton, Winchester, Charterhouse, Westminster and the rest – were established centuries ago to school the sons of the poor, who otherwise would have received no education. Over the centuries the background of the pupils changed, and the schools began to cater, instead, for the gentry and the aristocracy (as they ditched their private tutors). Then the upper middle classes got in on the act too. Even their daughters were sometimes admitted.

If that had remained the case, the charitable designation of such schools might have remained uncontroversial. After all, these were still institutions of learning. But unfortunately the people who run these schools could not locate the restraint button.

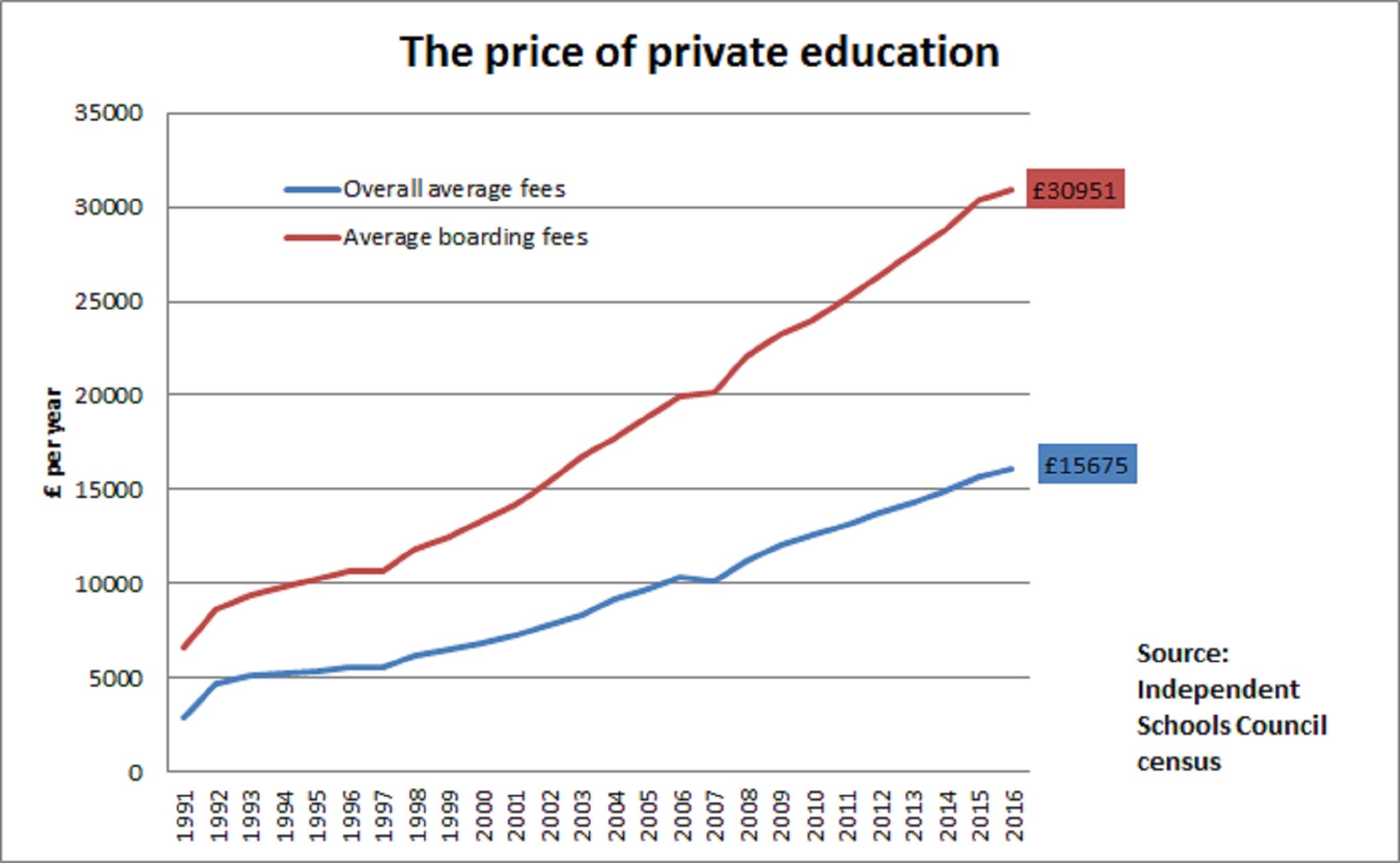

Fees have been rising above the rate of inflation and earnings growth for decades. And the 2008 recession did not break that trend. New figures last week from the Good Schools Guide showed that in London fees have risen at three times the rate of consumer prices over the past five years, a time when earnings growth has been exceptionally weak. That implies a 20 per cent increase since 2012. The average cost per child to attend private school in the capital is now £16,500.

At the top end it’s even more extreme. To attend St Paul’s, George Osborne’s old school, costs £23,562 a year, up from £18,840 in 2011. The annual price of a place at Westminster, attended by Nick Clegg, has risen to £26,322, up from £22,854 five years ago. Eton, alma mater of David Cameron and Boris Johnson, charges £37,000 a year to the parents of boarders – up from around £30,000 five years ago. That’s higher than the average national pre-tax salary.

Even the private schools themselves admit the middle classes are now being priced out. “These schools will soon be solely populated by fee-assisted pupils from low-income families and the offspring of the super-rich,” says Ralph Lucas, editor of the Good Schools Guide. Last year Tony Little, the outgoing headmaster of Eton, said “we are all very aware of this effect [of high fees] on the middle classes” and suggested less well-off parents might consider “no-frills” alternatives to the top-tier boarding schools.

Prices have exploded because schools have rushed into a facilities arms race to attract the international super-rich, who increasingly have an appetite for a British public-school education. “Schools used to show off their swimming pool, now they show off their theatres, fitness studios and recording suites,” said Lucas of the Good Schools Guide.

“We have allowed the apparently endless queue of wealthy families from across the world knocking on our doors to blind us to a simple truth: we charge too much,” Andrew Halls of King’s College School in Wimbledon admitted three years ago. “The most prestigious schools in the world teach the children of the very wealthiest families in the world.”

The traditional response of the private schools to attacks on their charitable status has been to dismiss criticism as the dismal politics of envy. But it’s not very credible to accuse Halls of harbouring such motives – unless we’re to believe he’s some kind of left-wing Manchurian Candidate. And if the headmaster of Eton says there’s a problem with fee levels, there’s probably a problem.

Another traditional line of defence of the schools is to argue that parents who send their children private save the state money and so they deserve the tax break. But that becomes less compelling when the editor of the Good Schools Guide says the tax-paying middle classes are being priced out. Do the oligarchs of China, Russia and the Middle East deserve the tax break?

The private schools lobby, instead, have fallen back on noblesse oblige, talking up the fact that state school pupils can increasingly make use of their facilities too. Yet the extent of this effort is not very impressive. According to the Independent Schools Council’s own figures only 3 per cent of private schools sponsor an academy and only 5 per cent loan teaching staff to state schools. “Crumbs off your tables” is the way the Chief Inspector of Schools, Sir Michael Wilshaw, has described this offering.

Moreover, why the massive expenditure on these ancillary sports and music facilities in the first place? These are peripheral to any educational purpose. In the 1980s, the Victoria and Albert Museum used to advertise itself with the tongue-in-cheek slogan “an ace caff with quite a nice museum attached”. Some of these schools have become luxury country clubs with quite a nice school attached.

What about scholarships for low-income pupils? The private schools claim they spend more than £700m on such schemes, more than the charitable tax break they receive. Yet these schools do not seem very keen on increasing the number of scholarships they offer. When the Charity Commission moved in this direction five years ago, the Independent Schools Council took the Commission to judicial review. The courts ruled the Commission had indeed been too prescriptive in its demands on private schools.

Yet the Commission has not given up. Late last year it introduced new guidance “encouraging” private schools to open up their music, arts and sport facilities to state school children as part of the public benefit test for charitable status and to report on these efforts annually. Labour is still exerting pressure, having raised the issue before last year’s general election.

In economic terms there are two main dynamics here. First, private schools seem to be pulled in different directions. Wealthy clients expect luxury and exclusivity. But regulators and politicians expect a common benefit. It’s hard to reconcile the two.

Second, there appears to be a collective action problem. Individually, some schools recognise they have a problem. But if they are the first to act by cutting fees, they risk being hit hard as the plutocrats seek the reassuringly expensive option.

Here’s a way out. If schools don’t like the regulatory intrusion and the political pressure for an additional contribution to the common good, let them unilaterally give up their claims to be charities. If the cost of bursaries to the poor really is higher than the tax benefit, as they insist, there will be no net financial disadvantage for them.

Let them spread their wings and join the rest of those private British businesses that cater to the shifting tastes and whims of the global super-rich. Let independent truly mean independent.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments