Why should we baby boomers be duty bound to bail out the next generation?

I find myself listening increasingly to how a friend or relative is going to transfer their wealth to their children, writes Chris Blackhurst, and it makes me uneasy for those who don’t have a nest egg

My friend shrugged. He and his wife were selling their apartment in London. They had a country home and they’d planned to split their time between the two. Now, though, they were drawn to moving away from the capital completely.

It would be a wrench, he said. But there was a bright side. They would give some of the proceeds from the flat to their children, so they could buy their own places and join the property ladder.

It must be my age, but I find myself listening increasingly to how a friend or relative is going to assist their children, how they’re going to transfer their wealth.

It is my age. I’m a baby boomer, one of those born in the surge in population in the years of prosperity after the great depression and Second World War. I’m at the younger end of the boomer spectrum – in my early sixties not eighties – but I qualify nonetheless.

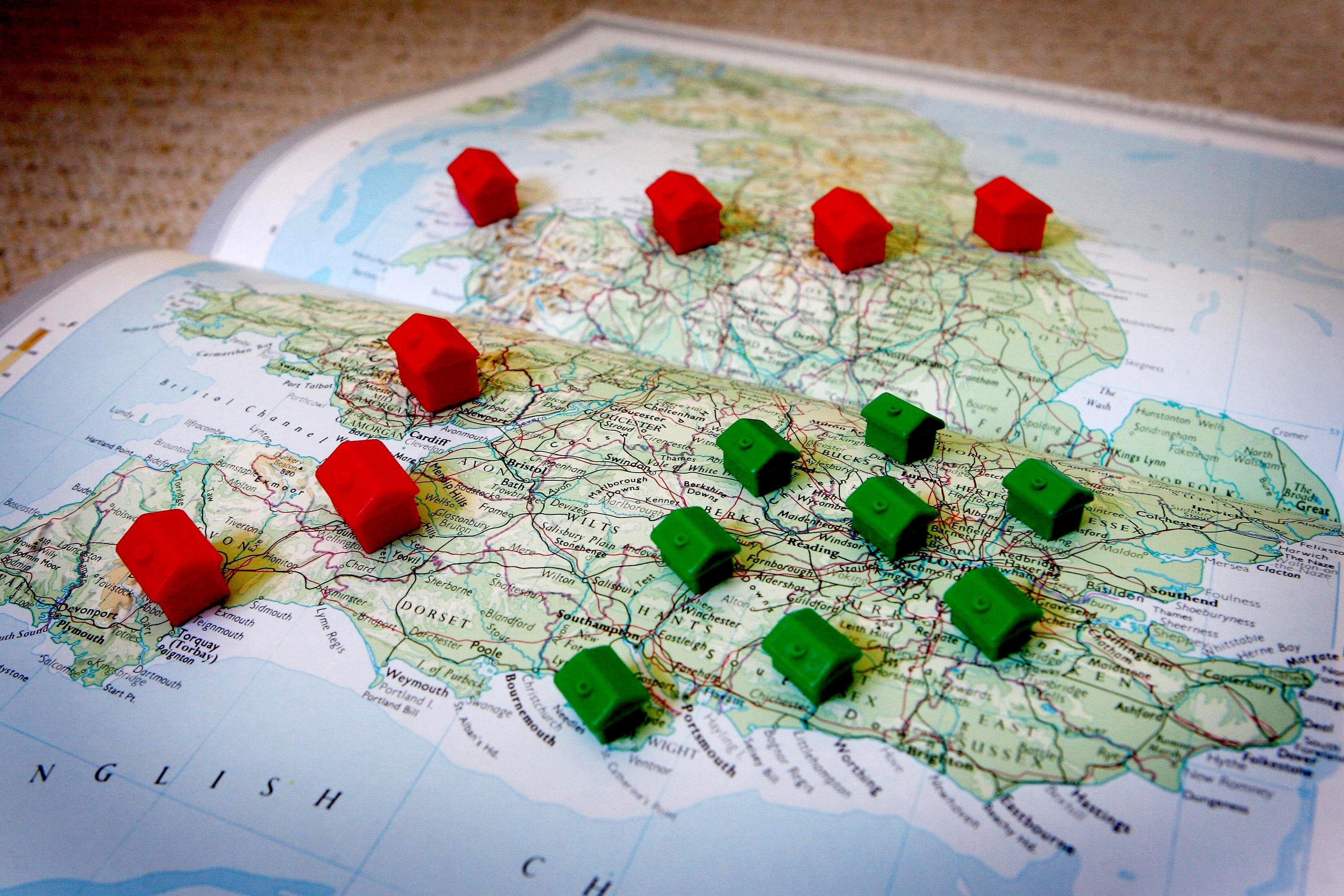

We’re the richest generation in history, thanks to property prices and stock markets rocketing during our lifetimes. Inevitably, that will mean our children will receive the biggest inheritance in history.

The New York Times this week reported that “the greatest wealth transfer in history” is well underway. Of the 73 million baby boomers in the US, the youngest are turning 60. The oldest are reaching 80. They are now beginning to die in larger numbers.

Some will leave behind not much all. Others, though, are leaving their heirs substantial sums held in various assets. In 1989, total family wealth in the US was $38 trillion. By 2022, that figure had more than tripled, to $140 trillion.

Between now and 2045, some $84 trillion is projected to pass down from older Americans to millennial and Gen X heirs. Of that amount, $16 trillion will be transferred within the next decade.

That’s the US. The phenomenon in the UK is the same, involving eye-watering sums. The children of the UK’s baby boomer generation can expect to inherit an estimated £1.2 trillion.

It seems odd of course, to be blithely discussing the elderly and riches when lots of pensioners are struggling to get by. But while they may be on low incomes, many of them own houses. And that’s where the money has been made.

Of course, too, there is inheritance tax, capital gains and other charges to pay but that will see remaining large amounts of cash going to younger generations. The impact on our society and economy is going to be profound. As The New York Times put it: “There are few aspects of economic life that will go untouched by the knock-on effects of the handover: housing, education, healthcare, financial markets, labour markets and politics will all inevitably be affected.”

Not all millennials and Gen X will inherit; many will not. That is bound to cause divisions and tensions as one bunch bask in their good luck, while the rest struggle.

Some will stop working because they no longer have to; the new rich will turn to private health; they will be looking to invest their newfound cash. Politically, millennials and Gen X are predominantly centrist or left of centre. Now, they’re wealthy they may find that outlook shifts, from left to right, socialist to more capitalist, Labour or Liberal Democrat to Conservative.

Where once they argued passionately for increased housing, more social and affordable homes, they could find that now they can afford to live in leafy, well-appointed areas themselves they’re not so keen. So, the next generation of nimbys is created.

It will not be plain sailing for the boomers. Many will have to pay for the costs of care for their elderly parents – mothers and fathers who are living much longer these days, thanks to advances in medical science and health education. This “sandwich generation” will have to pick up the tab.

Of greatest concern is the inequality caused by the disbursement of so much money unevenly. Many people stand to benefit, but a great many do not. That is a serious worry for governments and authorities.

It’s a clarion call on the left that as the property-owning, well-heeled Tory-leaning boomers move on, a block preventing the building of a more just society will have been removed. That’s not necessarily so, if those angry, young lefties find themselves joining that property-owning, well-heeled class.

Labour as well may not find a policy of raising inheritance taxes so popular if those worst affected are its very own younger supporters.

A great shift is taking place. It will have many consequences. But in the meantime, spare me – someone who got divorced and who has five children who must all be treated equally – the chat about giving young so-and-so a six-figure dollop to get them started.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments