The demise of BHS is a sickening story of capitalist excess

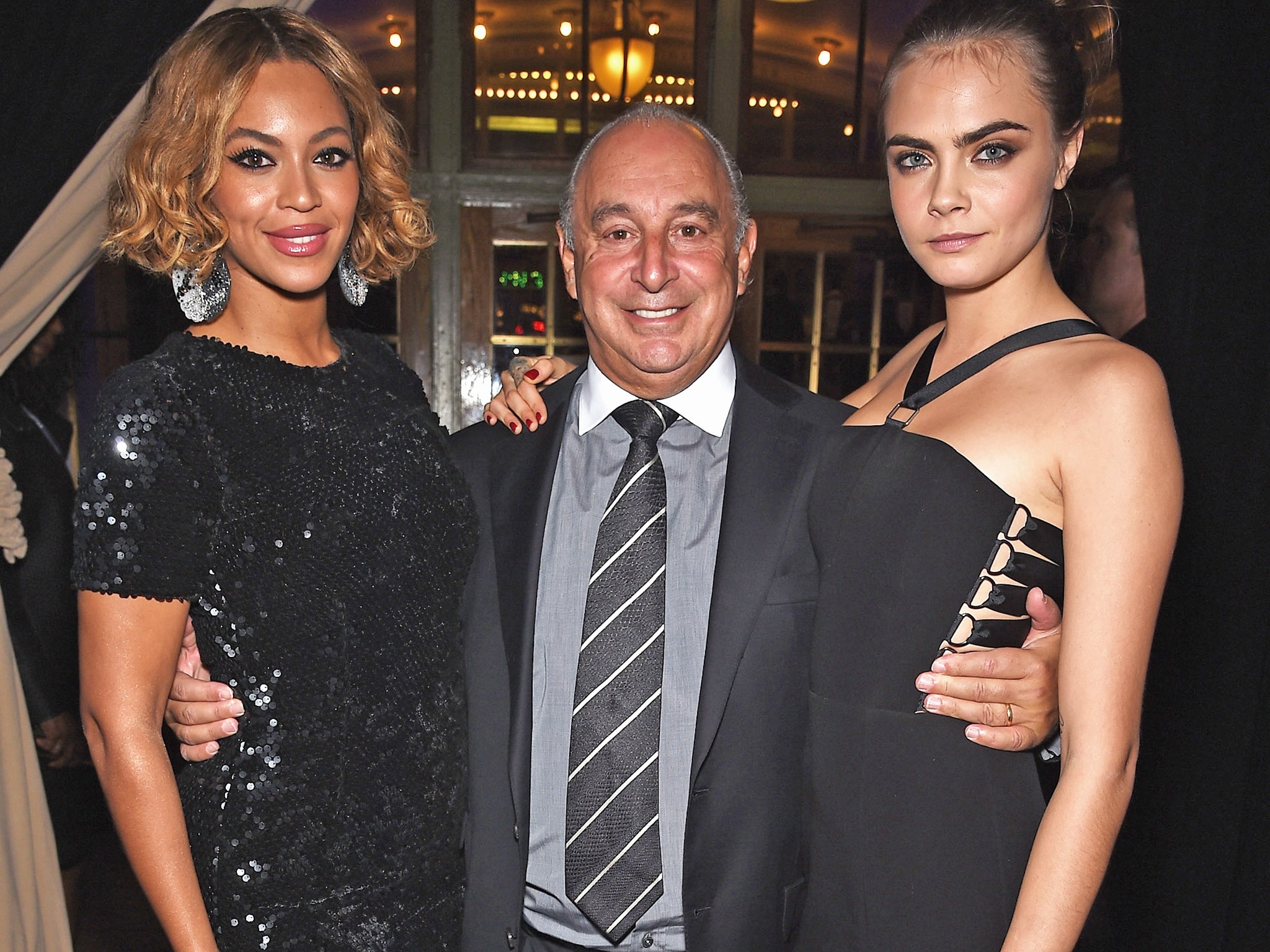

The clamour for Sir Philip Green to be stripped of his knighthood is louder by the minute. By the time he has accounted for himself in front of MPs, that might be the least we think he deserves

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.If anyone still wanted evidence that parliamentary select committees have become one of the main pillars of British democracy, this week has provided ample evidence.

On Tuesday we had the wonderful spectacle of Sports Direct boss Mike Ashley self-flagellating over his errors in allowing malpractice to flourish within his vast retail empire. And yesterday we saw open warfare between the two factions who between them conspired, if that isn’t too spicy a word, to bring down BHS and destroy the livelihoods of around 11,000 employees.

For theatre alone yesterday was exhilarating. There was proper drama and some rather jolly, if amateur, phrase-making.

Darren Topp, the BHS chief executive, told MPs that Dominic Chappell, the former bankrupt racing driver who bought BHS off Sir Philip Green for £1 in March 2015, had repeatedly threatened to kill him. These threats, said Mr Topp, were prompted by the transfer of £1.5m to the retail chain’s Swedish arm. Separately, Michael Hitchcock, a former financial adviser to BHS, described Mr Chappell as “a Premier League liar and a Sunday pub league retailer, at best”.

His paymasters at BHS, ultimately including Sir Philip, approved the sale to Chappell and his crew. From the initial sessions alone – Sir Philip is due to appear next week – we already have a painful account of the brutal relationship between these two parties.

Whatever the result of the various inquiries currently being carried out by MPs, the Insolvency Service, and potentially the Serious Fraud Office, we know enough to conclude that this whole saga stinks. Especially its leading players.

We know, for instance, that after buying BHS for £200m in 2000, Sir Philip Green stripped out costs and squeezed suppliers, enriching himself and his family to the tune of nearly £400m, before selling it to someone wholly unfit to run it, in a deal that may not stand up very well to the scrutiny it is now being given.

In the meantime, he transferred ownership of his companies to his wife, who happened to reside in Monaco, so that he could (legally) avoid income tax. All this is above board, but if capitalism is to acquire and retain popular support, such behaviour will have to meet common disapproval and distaste, if not disgust.

What should strike even the most ardent pro-business minds as appalling is what happened to the pension liability of BHS under Sir Philip. When he bought the company, it ran a pension surplus. It now has a deficit of £571m.

This affects 20,000 members, and because the liabilities have been transferred to the Pension Protection Fund, many other businesses too. As things stand, the bill for £12m in employee wages is likely to be met by the levy which firms are charged to be part of the Fund's scheme.

In other words, Sir Philip Green made hundreds of millions from a business he stripped right back, minimised his income tax paying his wife who happened to live in a tax haven, loaded nearly £600m onto the company pension liability and sold it to a completely unsuitable former bankrupt – and now it’s gone belly-over-arse, as it were, others are going to pay for it.

This is sickening. It’s no wonder that the clamour for Sir Philip Green to be stripped of his knighthood is becoming louder by the minute. By the time he has accounted for himself in front of MPs, that might be the least we think he deserves. Increasing his paltry offer of £80m to the rescue fund for the pensions would be a good start.

Just what his responsibility truly is, we shall find out in the coming days. This may be the select committee’s biggest coup yet.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments