We know the country is in a state – now Labour must fix it, not play the blame game

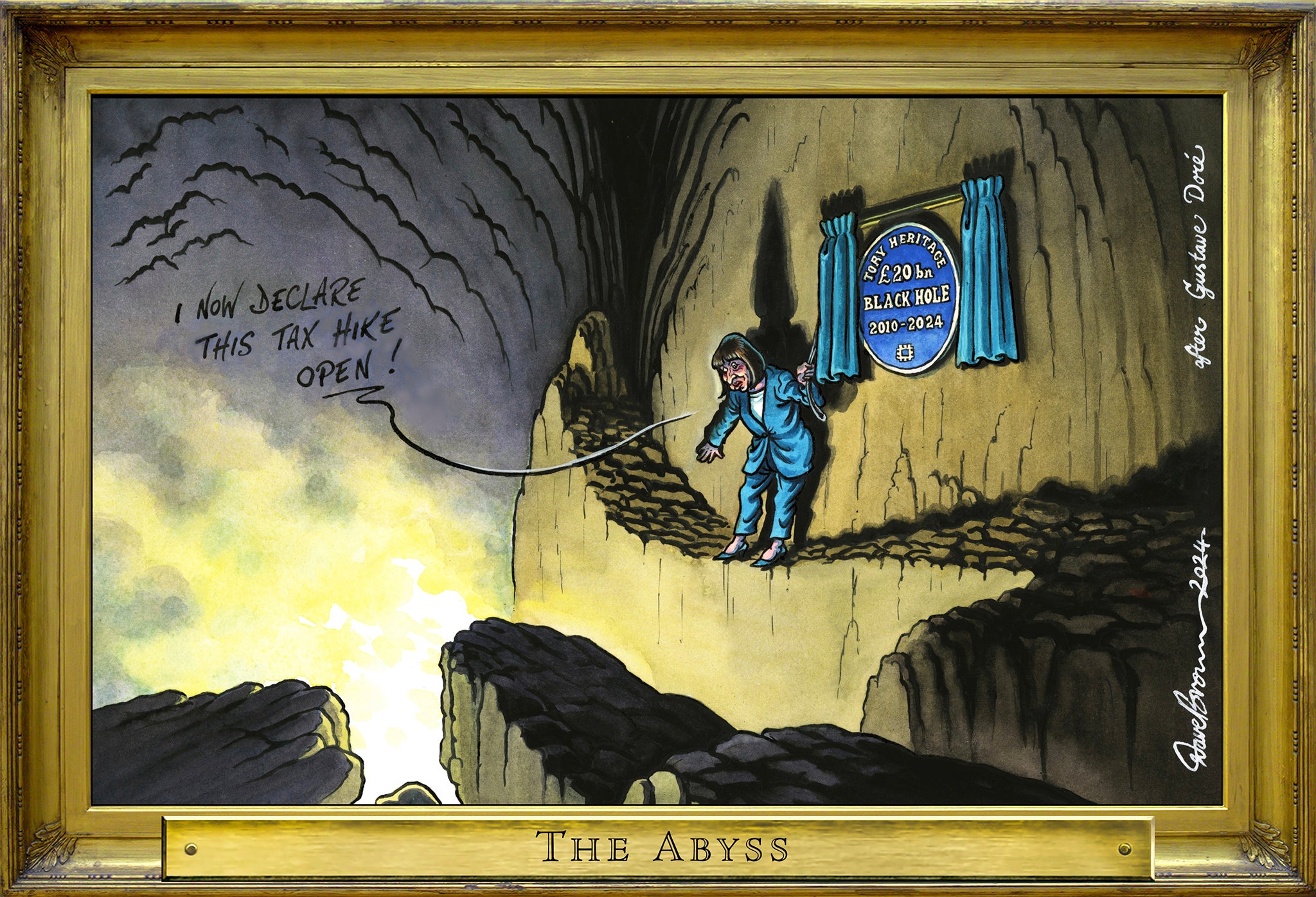

Editorial: Labour has made such a song and dance about ‘things being worse than we thought’, as the public braces for the chancellor’s verdict on the public finances. Rather than tinkering with stealth taxes to fill the £20bn black hole, Rachel Reeves should risk unpopularity and reverse the recent 2p cut in national insurance

The Labour tactic is becoming a bit obvious. Every incoming minister has thrown up their hands in theatrical horror and declared that, bad though they knew things had been under the Conservatives, they were shocked to discover that things were even worse than they had thought.

Shabana Mahmood, the new justice secretary, was first out, within hours of the election, to declare that overcrowded prisons were so close to their limit that she had no choice but to take emergency measures to release offenders early. Wes Streeting, the health secretary, was not far behind with his announcement that the NHS was “broken”; and on Friday, he said he was “absolutely appalled” to be told that the Care Quality Commission, which inspects health and adult social care providers, was “not fit for purpose”.

At his first Prime Minister’s Questions on Wednesday, Sir Keir Starmer said, when asked about problems with care allowance payments: “We have a more severe crisis than we thought as we go through the books of the last 14 years.”

On Monday, it will be the turn of Rachel Reeves, the chancellor, who will announce the findings of the Treasury’s review of the state of public finances. To no one’s surprise, government sources are already briefing journalists that the review will identify £20bn a year or more of hidden spending pressures.

It is true, of course, that a new government can never really know exactly what it is inheriting until a series of difficult decisions start to pile up on ministers’ desks. As Ms Reeves said in a TV interview, the recommendation of the pay review body that teachers should receive a 5.5 per cent rise was on the outgoing education secretary’s desk before the election but was not disclosed to the public.

But it was not a secret that public sector pay was going to be a problem and that the recommendations were likely to be higher than the 3 per cent assumed in the government’s plans.

Equally, it was not a secret that the prisons were full, that the NHS backlog was at record levels, that local councils, universities and Thames Water were on the verge of bankruptcy, and that compensation for the infected blood scandal would cost billions more than had been provided for.

The voters knew that a reckoning would have to be made after the election, and opinion polls suggested that they expected taxes would have to rise to pay for it. That is what The Independent said repeatedly during the campaign. We thought a bit more honesty from both parties on this point would have served democracy better.

Indeed, it is only because Labour pretended so hard during the campaign that it would not raise taxes (with a few specified exceptions) that it has to make quite such a song and dance about things being “worse than we thought”, in order to try to conceal its inevitable U-turn.

Still, we are well into the U-bend of the U-turn now, and we need to move on from chastising Sir Keir and Ms Reeves for their obfuscation before the election to warn them against making the wrong choices when they do come to put taxes up in the Budget this autumn.

They need to guard against anything that smacks of confiscation – although some kind of mansion tax on more expensive properties might be useful in diverting resources from unproductive uses, wealth taxes more generally would discourage investment. In particular, heavier taxes on pensions would cut across Ms Reeves’s ambition to mobilise pension funds for investment in a growing economy.

Paul Johnson of the Institute for Fiscal Studies has said it is no use tinkering with fiddly stealth taxes here and there: Ms Reeves needs a significant source of extra revenue, and the best option might be to reverse the most recent cut in national insurance – the 2p in the pound cut that came into effect in April at a cost to the Exchequer of £10bn a year.

No one likes tax rises, and any tax rise is likely to have a negative effect on growth, but reversing the last tax cut may be the fairest and least growth-inhibiting of the tough choices that Labour could make.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks