Liz Truss and Kwasi Kwarteng should be grateful to the Office for Budget Responsibility

Editorial: The OBR report is not a frippery – it is there to provide a vital reassurance to markets and the British public that the government is behaving ‘responsibly’

When George Osborne set up the Office for Budget Responsibility in May 2010, he declared that it would “remove the temptation to fiddle the figures by giving up control over the economic and fiscal forecast”. The then chancellor added, presciently: “I recognise that this will create a rod for my back down the line, and for the backs of future chancellors. That is the whole point. We need to fix the Budget to fit the figures, not fix the figures to fit the Budget.”

So it has proved. Mr Osborne seems a veritable god of fiscal rectitude by comparison with the present incumbents, and indeed he has now been disowned by Liz Truss and her diminishing but loud band of zealots: these are, after all, people who absurdly claim the market chaos was because investors feared Keir Starmer becoming prime minister. (The 33-point Labour poll lead has strangely coincided with a modest stabilisation of sterling.)

Mr Osborne’s aim was for the OBR to help burnish the UK’s credibility in financial markets; and to keep future administrations “honest”. He had in mind the possibility of a radical Labour Party running up debts by indulging in unfunded commitments; little did he realise that a radical populist Conservative government would be the one dismantling the “guard rails”.

It has become increasingly clear precisely why the present chancellor, Kwasi Kwarteng, refused to publish the OBR audit and forecasts with his mini-Budget last week. It was not just arrogance, in the sense that he thought the OBR foolish or captured by some intellectually crippling “orthodoxy”, though that must have been a factor.

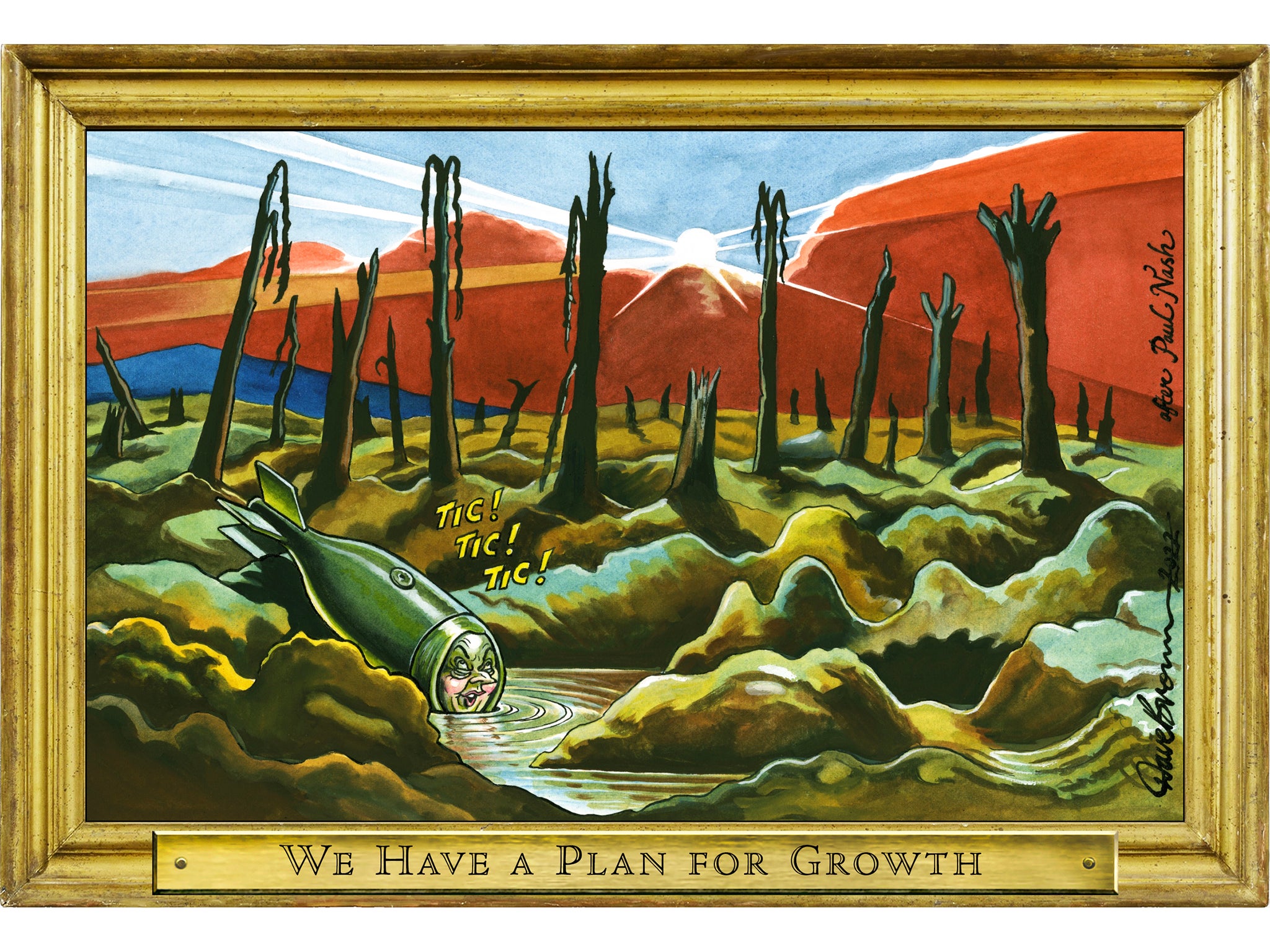

It was also cowardice because Mr Kwarteng knew full well that the markets – and indeed the public and his own MPs – would be concerned if the OBR rubbished his “plan for growth”. A budget for growth accompanied by an official forecast predicting recession and unsustainable budget deficits would not have been very helpful. So it was suppressed, counterproductively.

It is no end of a lesson, and cost the nation dear. Never again will the Tories be able to breezily claim they are the party of fiscal responsibility.

One irony is that the OBR, like Andrew Bailey at the Bank of England, is now in a much stronger position to stand up to Mr Kwarteng’s bullying. If hitherto obscure members of the budget responsibility committee or the rather more high-profile governor of the Bank of England were to resign in protest at the reckless policies of the chancellor, then the resignation of the chancellor would not be very far behind.

Ms Truss will not now pursue any dangerous plans to “reform” the Bank, Treasury and OBR, or sack any more of their leaders. It’s a pity they fired Sir Tom Scholar, permanent secretary to the Treasury, as summarily as they did.

The 48-minute meeting between the chancellor, prime minister and members of the budget responsibility committee has no doubt put things on a more realistic footing for all concerned. The OBR will provide some fresh forecasts privately to the chancellor by 7 October, and they will make for grim reading. The OBR will be consulted on the next fiscal event on 23 November. At that point, normal service should be resumed, and the official forecasts for inflation, the budget deficit, unemployment and so on should all be consistent and rooted in reality.

The OBR, if it is to fulfil its remit and act in the national interest – and indeed avoid ridicule – should not be too helpful to the government by assuming wildly optimistic things about the ability of tax cuts for the rich to transform growth and productivity in the short to medium term. The tax cuts, in other words, will not pay for themselves, as Ms Truss promised everyone. She will need to think again.

If the budget deficit is to be on a sustainable basis, including the energy-price support policy, then some countervailing measures will have to be taken on public spending. Yet ministers have reiterated the last comprehensive spending review still stands.

To keep up to speed with all the latest opinions and comment sign up to our free weekly Voices Dispatches newsletter by clicking here

Mr Kwarteng has given the impression that pensions will not be cut, but working-age benefits may well be. Something will have to give, and deep cuts in public spending will tend to depress economic growth and deepen inequalities. The distributional charts produced by the OBR will no doubt mirror those produced by the still independent Institute for Fiscal Studies, and confirm that tax cuts for the very wealthy will be funded by cuts to those at the bottom of the pile.

In any event, providing the OBR manages to resist the threats and blandishments of the Treasury, it will do exactly the job that Mr Osborne envisaged for it all those years ago. The OBR report is not a frippery; it is there to provide vital reassurance to markets and the British public that the government is behaving “responsibly”.

Ms Truss and Mr Kwarteng are both rather wilful personalities and have been captured by some fanciful economic ideas. They probably still resent the OBR fussing about their bold visions of a “new economic era”; but they should be grateful that the OBR is still around to keep them honest – and prevent the UK from careering towards insolvency on the dreams of the gnomes of Tufton Street.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments