Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Sir Stephen Nickell’s appearances before the House of Commons Treasury Select Committee are usually worth tuning in for. That’s because, unlike so many witnesses, the distinguished veteran economist and now senior official at the Office for Budget Responsibility actually tries to give a straight answer to MPs' questions.

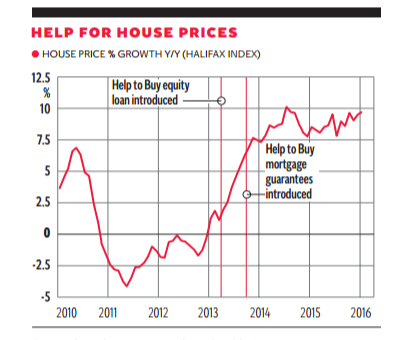

Back in March 2013 Sir Stephen was quizzed about the likely impact of George Osborne’s new wheeze of offering generous state financial support to homebuyers. Sir Stephen eased back in his chair, like a don in an Oxbridge common room, and mused: “The key is: is it just going to drive up house prices? By and large, in the short run the answer to that is yes. But in the medium term will the increased house prices stimulate more house building? Our general answer to that would probably be: a bit. But the historical evidence suggests not very much.”

One could almost hear the explosion from the Treasury as the words slipped from Sir Stephen’s mouth. That was certainly not the answer the Chancellor wanted to hear from one of his official fiscal watchdogs. The verdict seemed to endorse the complaints of a raft of other independent economists which had criticised Help to Buy as a bad policy on the grounds it wouldn’t actually help first time buyers in the long term since it would merely push up house prices.

But was Sir Stephen right? The Department for Communities and Local Government (DCLG) last week published an independent evaluation of Help to Buy by Ipsos Mori and Christine Whitehead, a housing economist at the London School of Economics, which seemed to take a different view. The report concludes Help to Buy has been a success, helping tens of thousands of people get on the housing ladder who would not have otherwise been able to. The report says it has resulted in more homes being built than otherwise would have been. Finally, it finds “little evidence” the policy has contributed to house price inflation.

So must critics of the policy, including Sir Stephen, feast on their past words of warning? Not so fast. The DCLG report only evaluates the equity loan element of Help to Buy. This is the part that offers first-time buyers of newly constructed homes 20 per cent equity loans from the Government on easy terms. The more contentious mortgage guarantee element of Help to Buy, which gives a state guarantee on the mortgages for people who can only muster a 5 per cent deposit and was launched later in 2013, has not been independently evaluated.

When I asked the DCLG whether they planned a similar exercise for the guarantee scheme they said I’d need to ask the Treasury. The Treasury, in turn, pointed out the mortgage policy was already being annually reviewed by the Financial Policy Committee of the Bank of England. Yet the FPC has never published research on the impact of Help to Buy on house prices or housing supply. The FPC is only really concerned with the financial stability implications of the scheme.

“The clear rigorous research on what the actual impact [of Help to Buy as a whole] has been has not yet been done so we do not know for certain,” says Professor Paul Cheshire of the London School of Economics.

It is difficult to disentangle cause and effect in any major market because lots of things are happening at the same time. For instance, the low returns on other financial assets in recent years will probably have encouraged many people to invest more in housing.

Yet Professor Cheshire is in little doubt that Help to Buy has also served to boost prices significantly. “Since we already know with cast-iron certainty that housing supply is almost completely price-inelastic because of our planning system, any competent economist realises that anything you do on the demand side primarily affects the price of housing,” he says.

The campaign group Shelter is also confident Help to Buy has pushed up prices. It points out the policy has made a significant contribution to the aggregate value of new mortgages and cites research by the Government’s own National Housing and Planning Advice Unit in 2008 that showed a 1 per cent increase in mortgage credit was associated with a 0.36 per cent increase in average house prices. Given the take-up of the scheme, this would imply Help to Buy has pushed up average house prices by around 3 per cent since 2013.

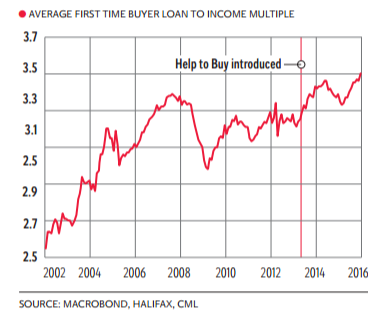

Professor Cheshire stresses that this price effect must be central to any overall verdict on the benefits of Help to Buy. “There is no reason to think the number of people who have benefited from the scheme is anything like the number of people who have actually been helped by it because house prices have gone up so people who would otherwise have been able to afford to buy are not able to afford to buy,” he says.

It’s possible that the equity loan element might have boosted supply, as the DCLG study suggests. But, as Sir Stephen remarked three years ago, the effects are probably not large. And this putative benefit must be set against the opportunity costs of how else the £6bn of funding for this scheme could have been spent. The annual state house building budget, for instance, is currently only £1bn.

Meanwhile, the bigger picture of the UK property market is not seriously disputed. House builders are not constructing enough houses to meet demand. Construction starts in the year to September 2015 in England were around 137,000; up from the 2009 low of 86,000 but still catastrophically short of the widely estimated annual new demand of 250,000 a year.

House prices are 25 per cent higher than at the beginning of 2013 according to the Halifax and still rising by around 10 per cent a year according to that index. Prices are certainly going up far more rapidly than average earnings, which have risen by just 5 per cent over the same period.

Those trends are truly terrible news for first-time buyers. According to the Council of Mortgage Lenders the average loan-to-income ratio for first-time buyers is now 3.5, up from 3.25 when Help to Buy was launched and the highest on record.

Even when they can get a mortgage new buyers are having to leverage up more than ever, making them seriously vulnerable to negative equity if prices correct or to default if interest rates rise. And more fuel is heading to the fire. Last autumn the Chancellor unveiled a special Help to Buy scheme for London, which will offer equity loans of up to 40 per cent of the value, rather than just 20 per cent.

State loans and mortgage guarantees are, in the end, policies that support housing demand at a time when the Government’s focus ought to be trained, laser-like, on increasing housing supply. At best they are a distraction. And the overwhelming likelihood remains that this policy has made the UK’s housing crisis worse. Help to Buy has not helped.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments