These GDP figures show the Bank of England didn’t know what it was doing

A monkey throwing darts at a dartboard could hardly have done worse

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

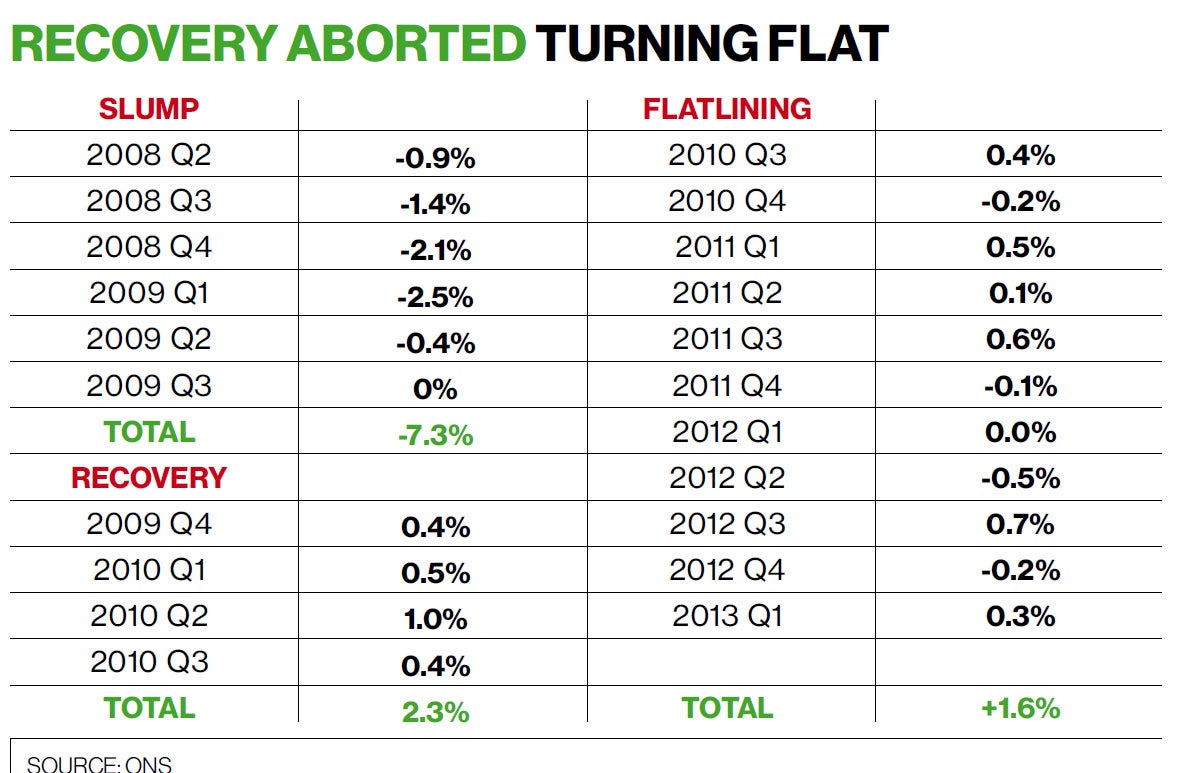

Your support makes all the difference.The data from the Office for National Statistics on the quarterly changes to GDP last Thursday were especially interesting. The statistical authority did revise away the double dip by raising the data for Q1 2012 from minus 0.1 to 0, so there are no longer two successive negative quarters (see table). However, it should be said that this not the end of the matter, given that more revisions are likely to come for several years and the double-dip may yet reappear like an unwanted phoenix from the ashes.

And overall, what is called the 2013 Blue Book lowered total growth under the Coalition since Q3 2010 by 0.1 per cent.

The biggest news, though, from the data release was the downward revisions to recession itself in 2008 and 2009. This recession looks likely to be twice as long-lasting as the Great Depression, measured by how long it will take to restore lost output. It took 48 months in the Thirties; we are 62 months in and counting this time around.

The ONS now estimates the recession was even deeper than we thought. As can be seen from the table, output is now estimated to have dropped a cumulative 7.3 per cent in what I call the slump phase, the five quarters from Q2 2008 to Q2 2009, compared with an estimate of 6.5 per cent in the June 2012 Blue Book.

Of particular note is the deduction of a whole percentage point from the first quarter of 2009, from minus 1.5 per cent to minus 2.5 per cent, as well as a downward revision to Q2 2009 from minus 0.2 to minus 0.4. This means the economy today is some 4 per cent below the starting level of GDP in 2008, and 17 per cent below the level the economy would have been at if trend growth had persisted. To put it bluntly, we are still in a big mess.

In addition, quarterly GDP growth for Q4 2007 estimated from the 2012 June Blue Book was also revised downward. When the estimate was first produced growth was 0.6 per cent, and is now only 0.1 per cent, down from 0.2 per cent in the 2012 Blue Book.

Even though the data for Q1 2008 was not revised down in this Blue Book, it was initially 0.4 per cent and is now 0.1 per cent.

Interestingly, in the August 2008 Inflation Report the Monetary Policy Committee forecast that there was going to be no recession, and most importantly did not spot that Q2 2008 was a turning point and the start of the worst recession in living memory. It also had already received these two estimates, and in its “backcast”, which attempts to predict what will happen to revisions, suggested they would be revised up.

So now we know in August 2008 that the MPC under Sir Mervyn King had no idea where the economy had been, no idea where it was at that time, and absolutely no idea where it was going, and still hasn’t. A monkey throwing darts at a dartboard could hardly have done worse.

The economy grew nicely, by 2.3 per cent under Labour in the four-quarter-long recovery phase from Q4 2009 to Q3 2010, when fiscal and monetary stimuli were working together. Then came Slasher George and his austerian outriders Sir Mervyn King, Danny Alexander and Nick Clegg. In the quarters since then the economy tanked, and has grown a total of only 1.6 per cent, of which 0.7 per cent, from Q3 2012, is attributable to Labour’s investment in the Olympics.

So 10 quarters have produced pathetic growth of 0.09 per cent a quarter. At that rate it will take at least another four years to restore lost output to its starting level. The economy is in a dead-cat bounce.

And then there was the Spending Review, which was necessary because the lack of growth has decimated George Osborne’s vicious and deluded plans hatched to deal with the deficit. There were spending cuts as far as the eye could see, and plans for firing another 160,000 public sector workers, which will increase unemployment again.

The ultimate insult, though, was when Mr Osborne lied to the House of Commons when he claimed the deficit had fallen when it was clear it rose last year by £227m, according to the official data from the ONS. It was £118,524m in 2011/12 and £118,751m in 2012/2013. As in up. It has to be said also that it was pretty hard to understand what Mr Osborne actually announced.

Indeed, Paul Johnson, director of the Institute of Fiscal Studies, complained in his post-review briefing: “Let me start by getting a moan off the collective chest of the IFS. The documentation and explanation accompanying yesterday’s Spending Review announcements was woeful. That may not seem like much of a headline. But it matters. Publishing such a small amount of information with so little explanation is not an exercise in open government.” So much for transparency.

It also remains clear that the austerians have one and only one plan for growth. It is their knight in shining armour, Mark Carney, who will ride into town next week with a big salary and the Government’s hopes resting on his shoulders.

I am watching three things. First, personnel changes. Charlotte Hogg being hired and his press officer, Jeremy Harrison, being brought in from Canada and Paul Tucker leaving are all good signs.

Second, whether the MPC does more quantitative easing, and of what type, over next three months.

Third, how Mr Carney votes, and if he is in a minority.

I suspect we will initially see everyone voting for no change, so as not to embarrass him, and then finally everyone voting for more easing, for the same reason. But good luck to him – he will need it.

Incidentally, there was a big farewell drinky for Sir Mervyn King at the Bank of England last week, where I understand lots of past and present MPC members were present along with the Chancellor, who made a congratulatory speech.

My invitation appears to have been lost in the post, because it hasn’t arrived yet. I can’t believe the Tyrant King wouldn’t invite me. I bet Gordon Brown wasn’t invited either. The King is dead, long live the good Dr Carney.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments