Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.

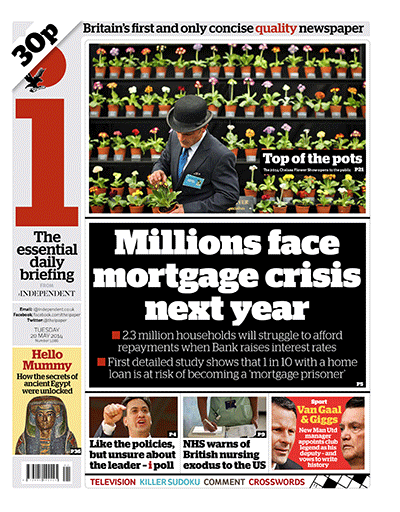

Build, build, build. Fifteen years of too little house-building have combined with the rebounding economy, state help for first-time buyers and our swelling population to threaten financial stability, the Bank of England Governor warned at the weekend. His words are timely. We lead today’s i on the first detailed study into the likely impact of next year’s expected rate rise. The alarming conclusion: between 2 and 3 million households could become “mortgage prisoners”, struggling to afford their repayments. Many will be unable to switch to better deals. Our cover story highlights just why action is needed to cool the housing market.

Neither the Coalition nor Labour offers a credible solution. More homes are being built: work began on 134,000 of them in the year to March 2014, an increase of 31 per cent. But we need about 300,000 new homes every year until 2031 to meet demand. None of the big three parties has shown the resolve to make this happen. (Honestly, which of us wants a new housing development nearby? Write in to let us know if you do, and we’ll forward your note to the Treasury.)

The uncomfortable reality for David Cameron and George Osborne is that their laudable attempt to restore the dream of home ownership is a danger to the economy. The Chancellor and the Bank of England will, sooner rather than later, have to make it tougher for people to get a mortgage: scaling back Help to Buy, tightening lending rules, and raising rates gradually, with plenty of notice.

My fiancée and I joined the property market in December, taking on the eye-watering debt required to buy one of London’s smallest houses. We, like so many other mortgage-holders, are in no rush to see the base rate rise. But it has to happen, and one hopes that when it does, Britain’s banks and building societies show the forbearance they did during the last crisis.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments