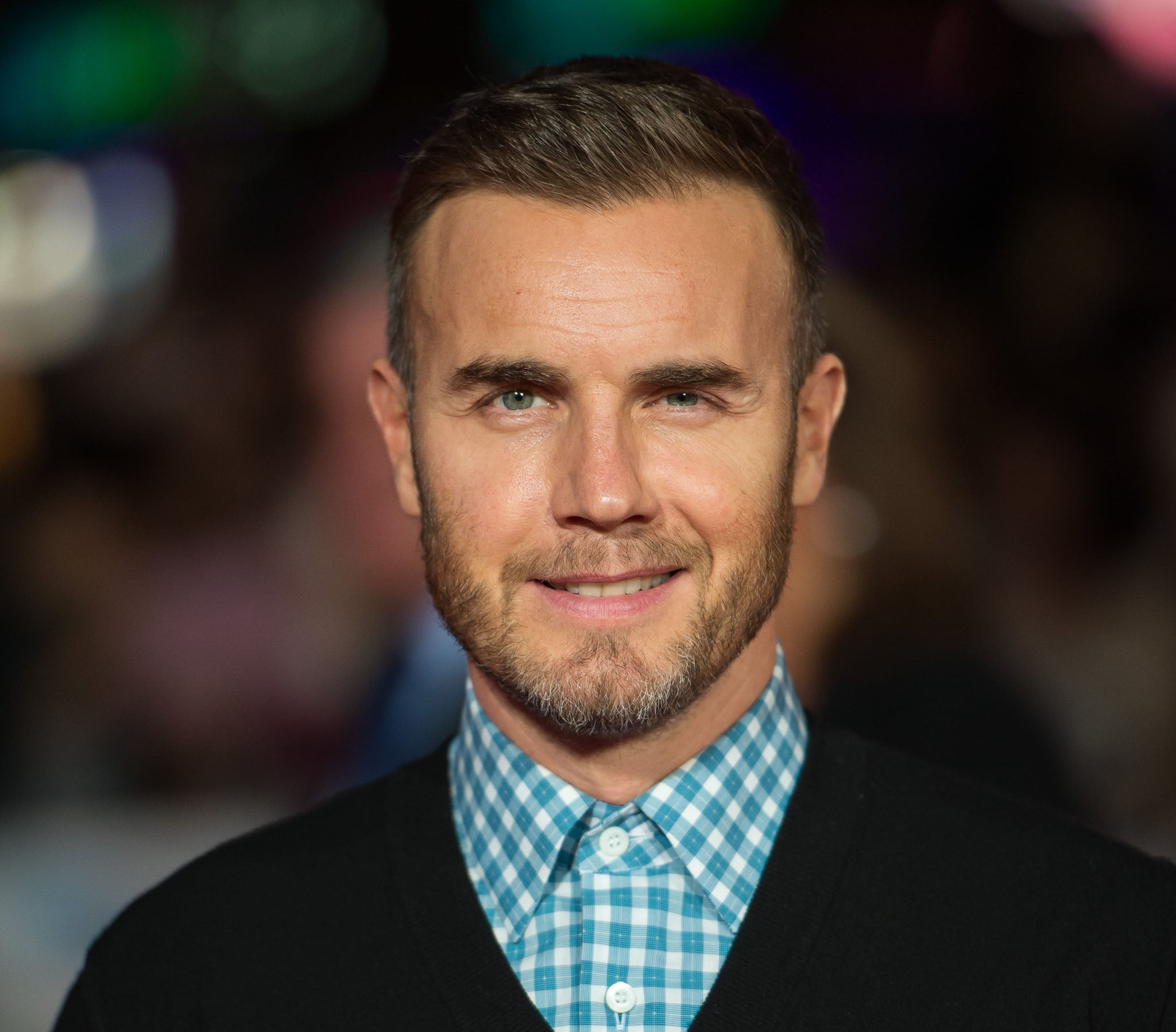

Gary Barlow gets pilloried – and then we throw our money at Starbucks

Did he lack Patience with tax returns? Or perhaps he got an accountant so he would Never Forget

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Flush-cheeked songster Gary Barlow is being harangued and maligned by a sturdy bunch of internet warriors – plus the MP Margaret Hodge – who aim to take back his OBE over his involvement with Icebreaker Management. Last week a judge ruled that the company was little more than a tax shelter into which £66m had been kept safe from fiscal paws.

Until now, I had no idea that there was such a Venn-diagram overlap between “Folk who admire the fair, meritocratic splendour of Her Majesty’s honours system and will not see its sanctity besmirched” and “Hardline anti-tax avoidance activists”, but I live and learn.

Barlow is a bad man, it turns out. Interestingly, it is Barlow alone who appears to be carrying the can for Icebreaker Management. Not his Take That brethren. Not lovely little Mark Owen. Not saucer-eyed scampish Mark with his little cherub face. Or Howard Donald – no one seems mad at him – although I always suspected Howard’s dreadlocks during the Nineties were a bid to suggest he was fully homeless as a tax-avoidance ruse. No, it’s Gary Barlow’s attempts to be more “tax efficient” that have caught the public’s attention.

I would worry more about Barlow’s psyche but I was lucky enough to catch the entire hour of prime-time Bank Holiday Monday scheduling devoted to the fact that Gary Barlow OBE is a survivor. On and on the documentary trundled, with friends and family wheeled out to breathlessly pay tribute to his tenacity. In brief: he piled on a load of weight and lost it all again.

It was a bewildering hour of videocamera footage featuring a fat man piling his plate at a buffet, accompanied by Barber’s Adagio for Strings. Deeply silly television, but it may explain why it’s currently so much fun for portions of the internet and media to give Mr Goody Two Shoes a solid drubbing. Jimmy Carr’s tax avoidance is never forgotten, Bob Geldof’s non-dom status is never mentioned, The Rolling Stones spent the 1970s fleeing the tax man, yet this is the era in which they cemented their status as living legends. Ken Dodd kept cash under his bed, the silly, naive fool.

The public’s reaction to tax avoidance is confused and erratic, which isn’t surprising because so is the Government’s. I watched Cameron on Good Morning Britain when he was pushed to decry Barlow’s tax avoidance. On Saturday’s Today programme I heard George Osborne chatter excitedly about Britain’s “competitive” approach to business taxes. If Britain was truly disgusted by tax avoidance we could en masse boycott Google, Starbucks, Caffe Nero, Amazon and Top Shop in one grand majestic unilateral snub. As this involves minor personal consumer inconvenience, we help these companies prosper. We throw them our money and by turn they grow larger, more powerful, more efficient at being tax efficient.

Meanwhile, we pillory, sporadically, individuals over meetings held years ago with their accountant whose No 1 stipulation of employment was to make their client tax efficient within the wonky, ever-shifting boundaries of the law. I cannot become truly boggle-eyed about Barlow, Owen and Donald being advised in a meeting to use a brilliant, legally watertight scheme to shelter cash, and taking this advice largely because we employ accountants at a considerable cost to know the things we don’t.

It’s interesting that so many commentators believe that in this case they would leap from their padded, swirly office seat yelling, “How dare you suggest a tax reduction scheme? Yes, you say it’s legal but it’s ETHICALLY DUBIOUS! Let me pay more money than I need to! I need to know that the children’s wards of Britain have enough heart monitors.”

Meanwhile, there is no stigma attached to a self-employed person registering themselves as a Limited Company purely for the affable tax breaks and that yummy VAT kickback. All absolutely legal. Not evasion, just avoidance and borne from a time when the hardworking individual sat in their accountants office and thought – possibly petulantly – about how hard one had worked for the money and how they would like more of it kept for their kids, holiday, home improvements.

The funny thing about tax avoidance is we moan and moan and moan but, like Gary Barlow, we’ve all had our hands in the buffet.

Twitter: @gracedent

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments