George Osborne is destined to be remembered as the most inept Chancellor in British history

Endless grim news confirms our worst fears about the man running the Treasury. And until workers see a growth in their real earnings, our economy is going nowhere fast

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.It wasn’t a great week for the Coalition. First the Prime Minister made his much-awaited EU speech, which increased the levels of uncertainty for UK businesses just when they needed it least. Firms are sitting on loads of cash but are not willing to invest it as consumers aren’t spending; they are even less likely to do so now after David Cameron’s intervention.

This may have satisfied his Eurosceptic MPs, but was disastrous in economic terms. Any foreign firm considering setting up business in Britain as a gateway to Europe will inevitably be having second thoughts. The speech was clearly bad for growth and jobs.

Then the IMF lowered its growth forecast for the UK, and its chief economist, Olivier Blanchard, called for a fiscal U-turn. A few weeks earlier Mr Blanchard had argued in an important paper that fiscal multipliers – estimates of the impact of tax hikes and spending cuts on overall GDP – were much larger than the Office for Budget Responsibility had factored in, with the implication that any decline in growth was likely to have been caused by 11 Downing Street.

Debacles, cont'd

Next, the PM was caught out on a party political broadcast where he claimed the Coalition had been reducing the country’s debts even though they have been increasing it. Data on the public finances released last week also confirmed that, far from having cut the deficit by a quarter, it has in fact risen over the last 12 months. Then there was the Pizza¬gate PR disaster, when Dave and Slasher noisily celebrated their apparent success over a deep dish in Davos. Commentators took it to mean that GDP numbers – that the two would have already seen – were going to be positive. Debacle on debacle.

As I had feared, the growth numbers were bad again. The recession deniers had forecast positive growth, of course, but this was just wishful thinking: even the hopeless MPC had predicted a fall in output. A 0.3 per cent contraction means that the economy hasn’t grown for the last year at all. The economy is running on empty. In terms of the speed at which lost output has (not) been restored the economic pygmies in the Coalition are now responsible for a much worse slump than the Great Depression.

The economy was growing nicely when the Coalition took over in the spring of 2010. Indeed over the period Q32009-Q32010 the Labour government under Alastair Darling generated five successive quarters of growth; the economy grew by 2.7 per cent. During the succeeding nine quarters, Q42010-Q42012, under George Osborne the economy has grown by 0.4 per cent, zero over the last year. Four of the last five quarters have been negative.

For comparison purposes over the last five quarters, in contrast to Mr Darling’s growth the economy has shrunk by 0.3 per cent. The economy has still not restored half of the drop in output experienced from 2008Q2-2009Q2 of 6.5 per cent, and there is no chance under current policies that output will be restored before the 2015 election. Our part-time Chancellor will go down in history as the most inept ever; his austerity strategy has failed; borrowing is up, and the economy has been flatlining for two years. Ed Balls can now say he warned us this was going to happen. Told you so. Triple-dip here we come.

Boris Johnson stirred things up at Davos when he said it was “time to junk the language of austerity” and that the language of cuts was “not terribly useful in this sort of climate”. Good for him. He went on to argue for infrastructure spend on housing and transport for starters, and that “the hair-shirt Stafford Cripps agenda is not the way to get Britain moving again”. I couldn’t agree more – at long last someone who is prepared to lift animal spirits. At last someone in the Tory ranks is stirring things up.

One big puzzle

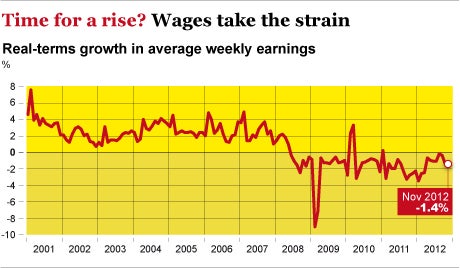

There is one big puzzle; poor growth jars with the recent news on the labour market, which showed some improvement. Of course some of this has to do with workers being hours constrained. The main explanation, though, appears to be that instead of big increases in unemployment, there have been big falls in prices, that is in wages and earnings. The graph above illustrates the movement in real earnings over the last decade; it simply takes annual weekly earnings (AWE) growth and deducts from it from inflation.

So if weekly wages grew by 5 per cent and the consumer prices index rose by 2 per cent real earnings increased by 3 per cent. It is clear that real earnings growth has been negative since the start of the recession – with one brief exception in early 2010 as the economy started growing before the Coalition took office and stopped that. Between March 2008 and November 2012 weekly earnings have risen from £440 a week to £472, or by 7.3 per cent; over the same time period prices have risen by 17.2 per cent, so real earnings are down by a tenth.

Wages have taken the strain. Falling real wages means that people’s living standard are falling, and they aren’t spending. How¬ever, this fall has been mitigated somewhat for people with mortgages by the decline in their mortgage payments due to low interest rates on their trackers. This means that any increase in interest rates would decimate living standards of working people even further, so sorry savers. Falling real wages have prevented unemployment from rising.

Recent work by Paul Gregg and Steve Machin suggests that wages recently have become a lot more responsive to an unemployment shock, that is the wage unemployment elasticity of pay (the “wage curve”) has risen. My own research suggests that hasn’t happened in the United States, which may help to explain why it has had a much bigger rise in unemployment for around half the drop in output the UK had. Until workers start to see a growth in their real earnings, this economy is going nowhere. Maybe those folks in Davos should think about sharing some of their profits with their workers. Hey boss, can I have a pay rise?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments