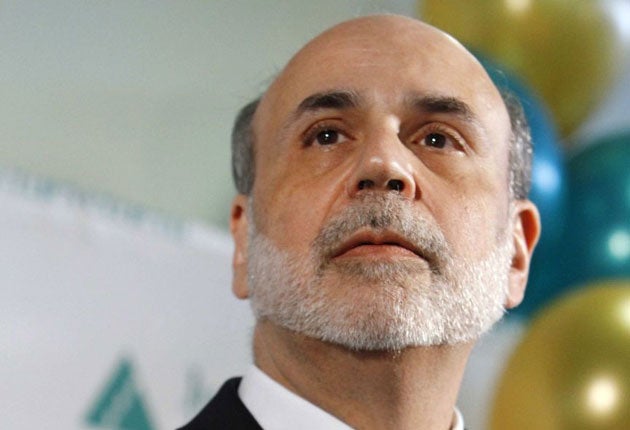

Bernanke makes markets twitch but what counts is the economy

Higher interest rates will be a signal the economy is healing

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.It’s a twitchy time for financial markets, and for a very simple reason.

No one knows how and when the US Federal Reserve will end its extraordinarily easy money policy – but they hope to learn more today. Ben Bernanke, the Fed chairman gives his twice-yearly testimony to Congress, speaking to committees of the House today and the Senate tomorrow. His words will be diced and sliced, sucked and chewed, for any signal as to how he thinks the Fed should proceed, with his answers to questions more important than the testimony itself.

This is massively sensitive for the markets. Thus a hint from him last month that the Fed might start tightening sooner than most people expected sent the interest rate on ten-year treasury securities up from below 2.2 per cent to 2.7 per cent. A more emollient speech last week pulled it back to 2.5 per cent. These are huge swings for a huge market and a lot of people will have made and lost money as a result, and not just in America for all bonds markets have been affected to some extent.

So what will he say? Well, we don’t know, but I was in Washington on Monday and a few things did emerge from conversations there. The most important is that he will seek to calm the markets. Fed board members are split down the middle on the timing for tapering down the monthly purchases of government securities, the key element in the US equivalent of our quantitative easing. We know that from the minutes of their meetings. But everyone agrees that swings of the markets over the past few weeks have been dangerously and unnecessarily abrupt. I got the impression some Fed board members were pretty shaken by what occurred.

The second point that emerged is that the preoccupation with what the chairman or other Fed members say, while understandable because there is money at stake, is ultimately much less important than what the economy does. The more the recovery strengthens the faster the Fed will tighten policy, with it first ending the monthly bond purchases and then, some time later, starting to nudge up its key lending rates. The point here is that while words about policy matter, policy will be determined by the progress of the real economy and the decision-making window for the Fed is quite narrow.

The third point is that no one knows quite how the economy will respond to the ending of the exceptionally loose monetary policy. We have never been here before, or at least only with the unwinding of war-time financial measures. The economic and financial commentators got the reaction to the tightening of fiscal policy wrong – remember the fiscal cliff that we were all so worried about? Well it seems the economy is coping with that just fine, with a recovery in investment offsetting the squeeze on government spending. Expect a poorish quarter for growth, but not the catastrophe many economists predicted.

There is little doubt that any sizable rise in interest rates would have a serious effect on household finances, for many families are on a knife edge. Higher monthly mortgage payments would tip them from just about getting by into grave trouble. But we are not going to get higher short-term rates for a long time. What is in prospect from this autumn onwards is something much narrower: the Fed gradually stopping financing the government by the back door, a policy that may not have been very effective anyway.

Let’s wait and see what Ben Bernanke says and let’s also catch the market reaction. But much more important, let’s watch whether the recovery is sustained (which I think it will be) through the rest of this year and beyond. There is a knee-jerk reaction that higher interest rates, as and when they come, are bad for the economy. There are times when that will indeed be the case. But it is more helpful to see the relationship the other way round. Higher rates will be a signal the economy is healing, getting back to normal – and that, surely, will be very welcome.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments