Britain's £40bn debt deficit is our ghost of Christmas yet to come

Household debt is conveniently being forgotten as the presents are wrapped

“Why didn’t anyone see it coming?”, Her Majesty reportedly asked the then Governor of the Bank of England, Mervyn King, about the 2008 financial crash. Well, some did warn that Western economies were very dangerously imbalanced. Vince Cable MP was one; author Nicholas Nassim Taleb was another.

And The Independent carried several Cassandra stories on our front page, warning about Britain’s “debt time bomb”. I was Economics Editor at the time. I wish we’d shouted even louder.

Many nations were caught in that crash, but, for some reason yet to be fully understood by economists, the British have long been peculiarly prone to living beyond their means.

For decades this insatiable desire for the latest consumer goods, from Vespa scooters and monochrome televisions in the 1950s to the latest Nike trainers and Apple wonders today, has pushed up household debt, depressed industrial investment and pushed our balance of trade with the rest of the world ever further into the red.

In the 2000s, as finance was deregulated and the banks invented ever more creative ways to pile up and repackage debt, we now know this would inevitably lead to disaster.

Only the immediate aftermath of the 2008 financial crisis and the onset of Britain’s overlong Great Recession, with falling house prices and rising joblessness, made Britons curb their usual retail addictions, though it wasn’t so long after that they were after another hit, particularly in the absurdly overheated London property bubble.

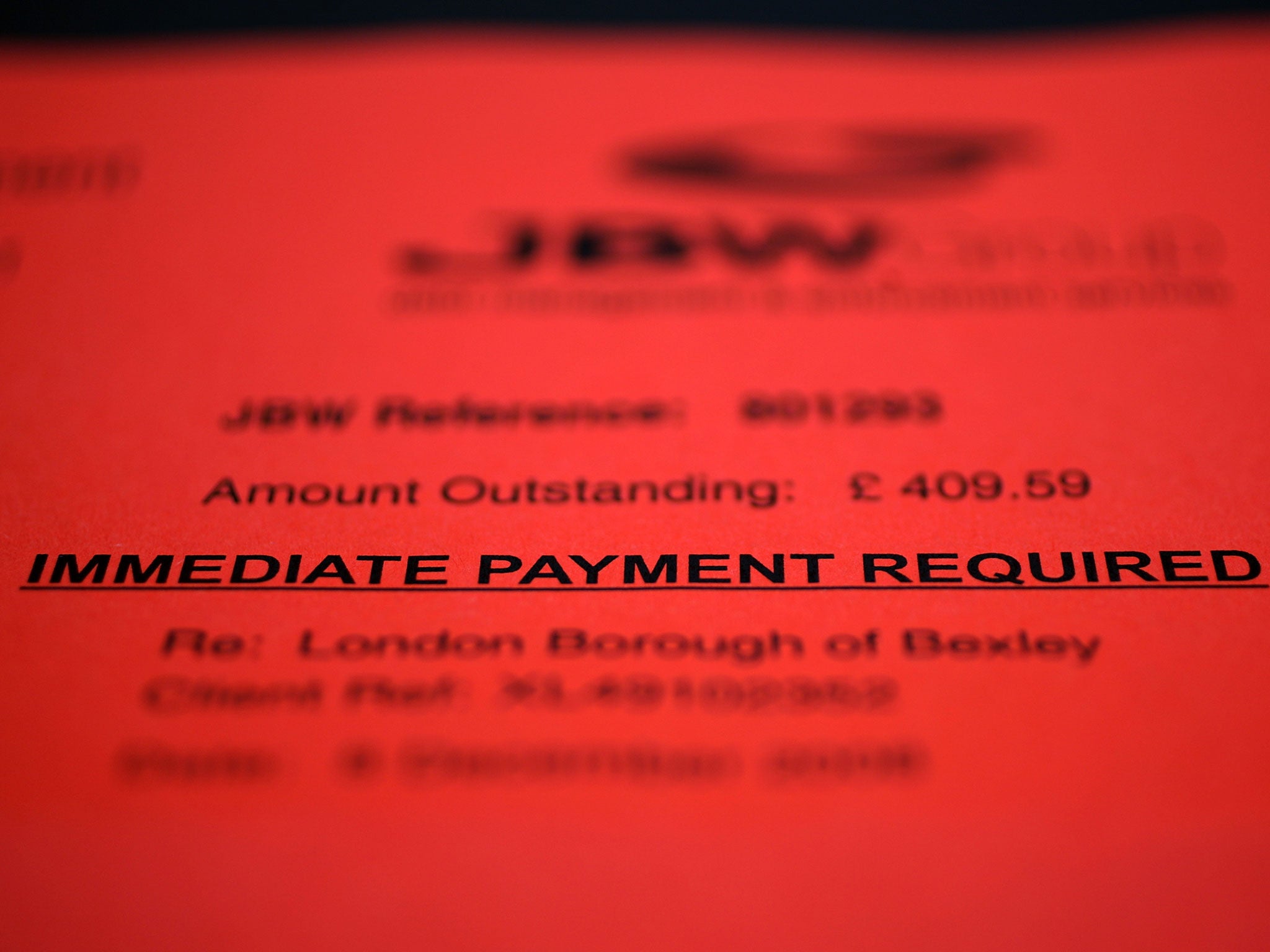

While most political debate is fixated on the public finances and government debt, yet again household debt is conveniently forgotten as presents are wrapped.

It may be an unseasonable warning, but the ghost of our indebtedness is likely to haunt our futures again. I wonder what the Queen makes of that economic situation.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks