Britain's economic recovery is precarious and an economic storm could be coming

Rising debt, a house price bubble, cheap money - does any of that sound familiar?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.We are still living with the consequences of the storm, the banking crisis of 2008. The damage to banks, government budgets, production and living standards has been enormous and we are far from a return to normality. Moreover there are some ugly black clouds gathering which could portend worse to come.

I use the word “could”. I am always mindful of the day 20 years ago when I was greeted in my role as chief economist at Shell with a plaque, in Arabic, which translated meant “Those who claim to be able to forecast the future are lying even if, by chance, they are later proved right”. The reputation of economic forecasting as a science, which makes astrology looks respectable, reflects the same scepticism. And that scepticism was greatly reinforced by a total failure of standard economic models based on efficient financial markets to anticipate the last disaster.

My current sense of unease is sharpened by the big disparity between backward and forward-looking indicators. This week’s employment figures continued the remarkable run of positive data which has had economic ministers, including me when in government, scrambling to be the first in front of the TV cameras. The UK recovery is a really good story and surprisingly job-rich (even if productivity poor). But employment is a lagging indicator. Recent, forward- looking, surveys of business confidence suggest a deteriorating outlook, with the worst figures since the 2008 crisis.

Policy-makers in the UK clearly believe that the recovery story is set to last. The Autumn Statement due on the 25th of this month is very likely to be based on an optimistic view that the economy will continue to grow strongly and can absorb a period of fiscal contraction – of 5 per cent of GDP in four years – considerably more severe than actually achieved in the Coalition years. And monetary policy, we are told by the Bank of England, is to be tightened, if not immediately. Yet the context is a world in which growth is falling and worse is to come, creating weak export demand. Even if Britain were in great shape the global slowdown would be a serious matter. But, actually, the recovery is precarious and unbalanced.

Debt

Like other major developed economies, the UK has a large overhang of debt: overleveraged households, corporates and government. Total debt to GDP (excluding financial institutions like banks) rose in the pre-crisis boom from under 200 per cent in 2001 to 260 per cent at the time of the crisis, the increase coming almost entirely from mortgage borrowing on the back of the surge in house prices. Other developed economies had a similar rise but the UK’s was more extreme than most. Since the crisis, aggregate debt has risen further – to around 280 per cent – with a sharp rise in public debt (roughly from 40 per cent to 80 per cent of GDP) and a modest fall in household and corporate debt, though household debt is now rising back to the previous peak as mortgage borrowers chase a rising housing market. The current obsession with public debt, under a third of the total, obscures this bigger picture.

Debt matters since it can have a depressive effect on the willingness to invest – by companies and governments – and on the willingness of consumers to spend. The idea of “debt deflation” is one of the ingredients contributing to weak demand in the post-crisis world and the current pessimism about growth in otherwise healthy-looking economies such as the US and UK: the concept of “secular stagnation”. Japan is a case study in this particular pathology. The historic remedies for debt have included rapid inflation but that is absent today. The muscular economists of the Austrian School would argue that woolly-headed, soft-hearted politicians failed to purge the system of its debt legacy by not allowing large-scale failure by banks, over-leveraged companies and over-mortgaged households and have, as a consequence, merely put off the reckoning. They are right on the point that the legacy of debt remains.

Cheap money and asset bubbles

We are indebted to the central bankers and governments who, in 2008-9, reacted to the banking collapse by providing a monetary and fiscal stimulus which averted a deep depression and left us merely with a very nasty recession. But there is a lasting and troubling legacy. One is the scale of public debt, referred to above, which may not be as pressing as our government claims but cannot just be assumed away. More significant is the fact that many of our economies remain on the life-support system of ultra-cheap money. Official short-term rates are close to zero (or sub-zero as in Switzerland) and there is a reluctance to raise them and snuff out recovery (as happened in Sweden in 2012) and add to the problems of indebted households and companies. Long-term market rates are also at historic lows. Andrew Haldane’s conclusion that the long-term cost of capital is now the lowest since the time of the Babylonians is a witty description of extremely abnormal behaviour and a symptom of the global imbalance between savings and investment.

One side-effect of keeping economies growing through cheap money and credit creation through quantitative easing has been the generation of asset bubbles, especially in property markets. Britain demonstrates the problem in an extreme way, magnifying underlying imbalances between housing demand and supply. Double-digit housing inflation is not merely creating appalling social problems and division between classes and generations but grossly distorting investment from productive activities to property holding. The Bank of England has tools of macro-prudential management to curb this inflation but the extreme timidity in using them reveals the high level of dependence on this precarious and dangerous form of growth.

There is another problem too. Governments and central banks have limited room for manoeuvre. Having pushed monetary policy to the limits of what currently passes for acceptable and public debt to what is regarded as sustainable levels, there is no obvious place to go if we hit another recession. Unfortunately the risks of that happening are rising.

China and other external shocks

The recent visit of President Xi Jinping (and now Narendra Modi) has reminded us how dependent we now are on the big, emerging, economies. Much of the growth of the world economy in recent years has originated in China in particular. The current slowdown is already having profound effects on commodity markets and countries and companies dependent on them. I don’t subscribe to the extreme disaster scenarios for China but even a short period of low growth will cascade through the world economy as Chinese imports contract sharply, commodity prices fall further, surplus steel and other industrial goods hit glutted markets, dodgy Chinese credit leads to serious defaults and excess savings spill over into the Western financial system. Aggregate Chinese debt, mainly to business, is now close to British levels and the problems of Japanese and Western debt deflation could be about to hit China. It makes good sense to cultivate China to reflect the changing centre of gravity of the world economy. But in the short run it will bring economic grief.

This would not matter so much if there were compensating expansion in traditional markets nearer to home in Europe. But there is every reason to worry that, at best, the eurozone will limp along with unresolved problems of adjustment for the weaker economies, a recurrence of Greek debt servicing problems and the need for continued monetary stimulus. Moreover the combination of economic stress and the refugee crisis is fuelling the politics of identity; which is in turn leading to the risk of political disintegration and the weakening of the collective disciplines on which the Union depends.

Resilience and the financial sector

The factors I have outlined above represent a series of threats and worrying trends which contrast with the cheery self-confidence of the British government. There will be a reality check soon. Whether this reality check is a serious slowdown or something more dramatic will depend on the resilience of the banks and other financial institutions. The banks are certainly safer with more capital and, in the UK, Coalition reforms on ring-fencing. Stress testing has established an ability to cope with known unknowns. But the unknown unknowns lurking in a new generation of derivatives or in the opaque Chinese financial system could cause nasty surprises.

I don’t normally hang out with hedge-fund managers but a group I met this week felt that there were so many “black swans” floating about that it was easier to ignore them than to evaluate the risks. All agreed, however, that we are in for an uncomfortable period in which severe economic storms are all too plausible.

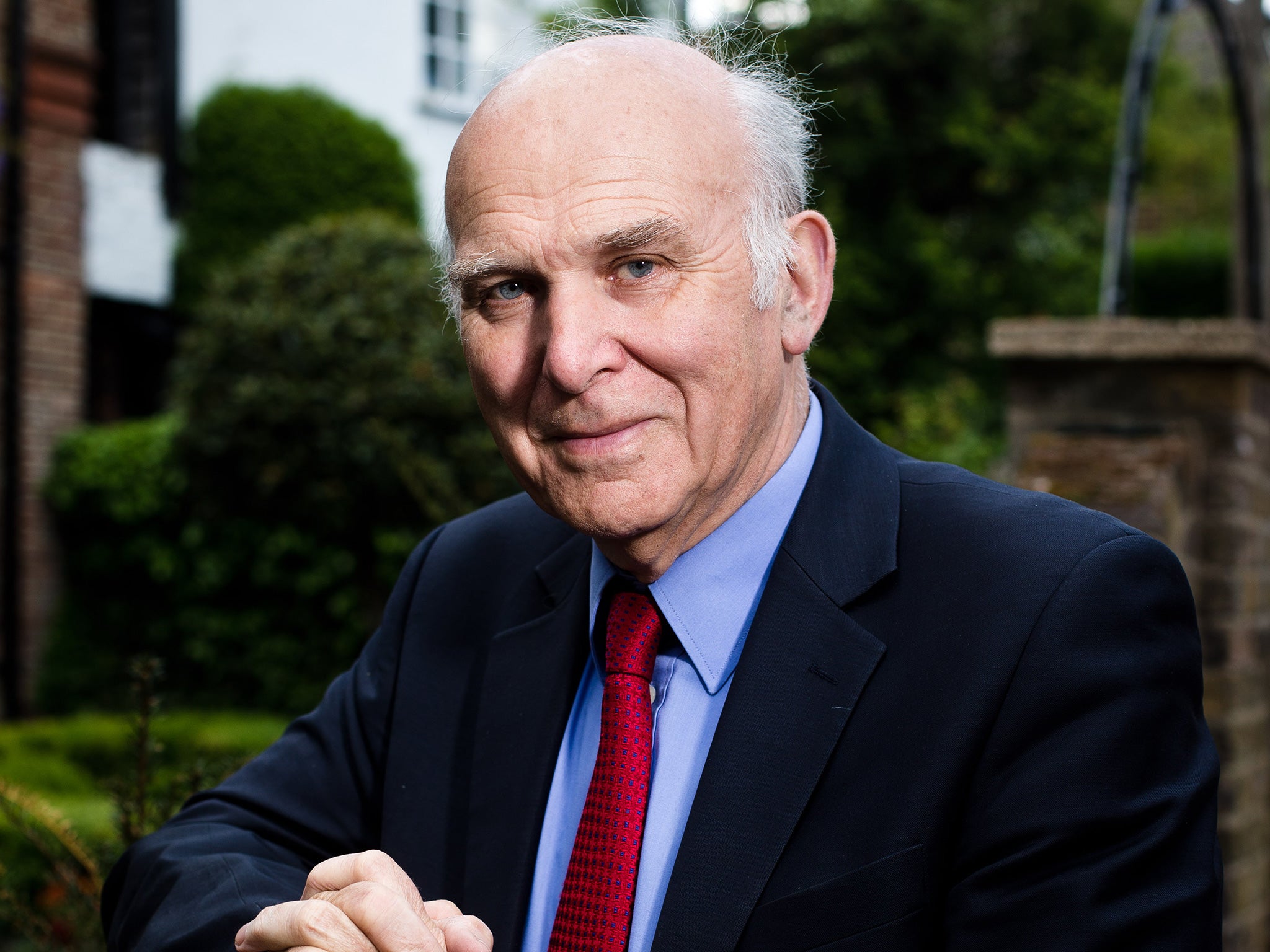

Vince Cable is the former Business Secretary in the Coalition and author of a new book “After the Storm” (Atlantic Press)

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments