The Brexit apocalypse has been deferred – for now

Nearly 70 per cent of final demand comes from consumption and consumers don’t react to political events in the stark way economists expected. Remember more than half the voters got the decision they wanted, so why should they suddenly panic?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Why were the forecasts so wrong? Before the Brexit vote the Treasury published a report outlining the dire consequences of a leave vote. With cover and appendices it ran to 90 pages. It looked at two possible scenarios, a shock and a severe shock.

Its judgment was: “In both scenarios, a vote to leave the EU would result in a recession. Setting the shock scenario against the OBR’s Budget 2016 forecast, the analysis shows that immediately following a vote to leave the EU, the economy would be pushed into recession with four quarters of negative growth.”

The severe shock case was worse: not only four quarters of recession but also an economy that would have declined by 1.4 per cent by the end of this year.

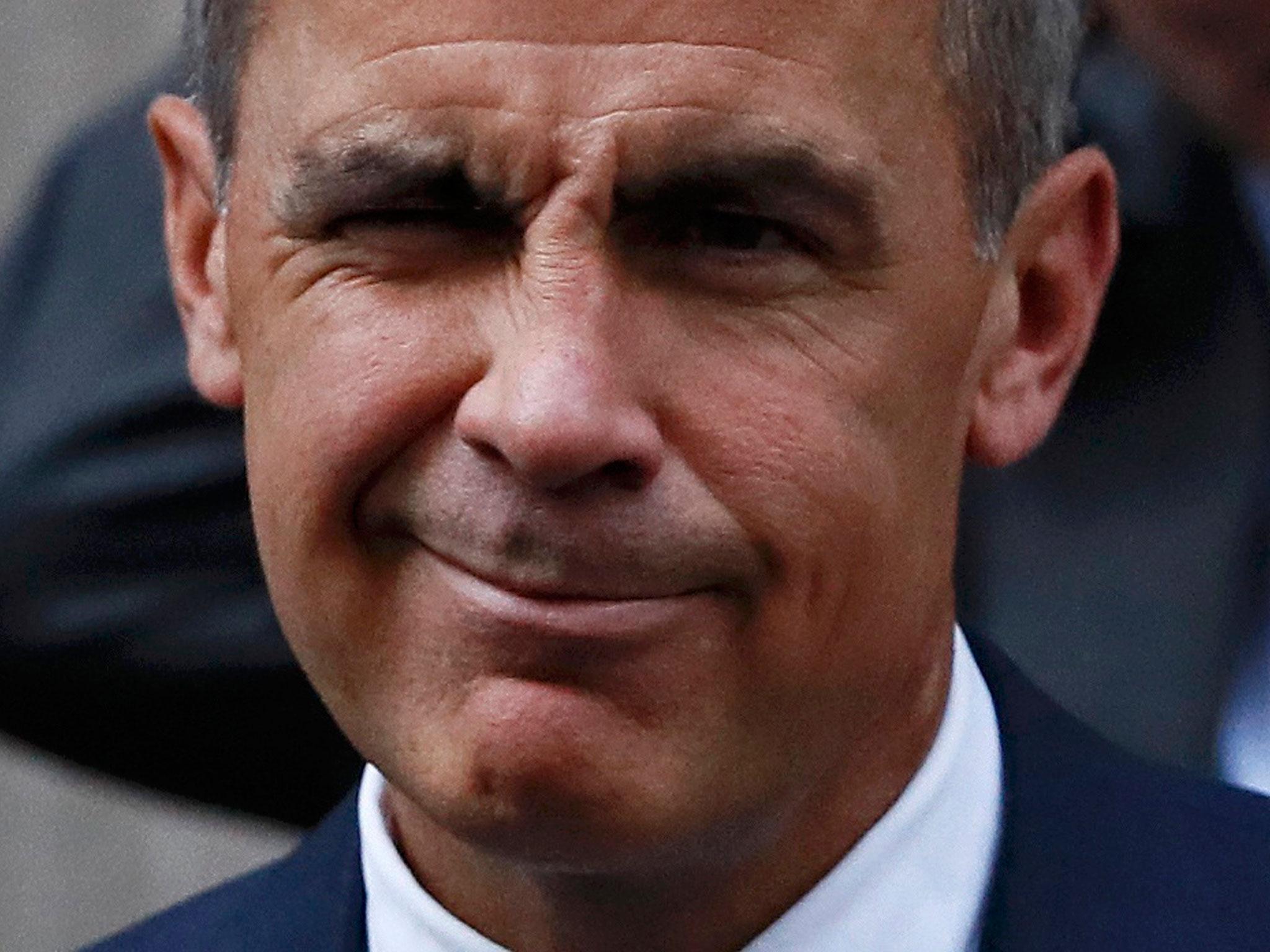

These possibilities of recession, the Treasury reported, were supported by the Mark Carney, governor of the Bank of England and Christine Lagarde, managing director of the International Monetary Fund. They were not alone. In his introduction, George Osborne, the then chancellor, noted: “I am grateful to Professor Sir Charles Bean, one of our country's foremost economists and a former Deputy Governor of the Bank of England, who has reviewed this analysis and says that it ‘provides reasonable estimates of the likely size of the short-term impact of a vote to leave on the UK economy’.”

We do not have full figures yet for this year, but in the third quarter the economy is estimated to have grown by 0.4 per cent and it looks as though the final quarter will show similar growth. For what it is worth, both the Bank of England and the Office for Budget Responsibility now have a central estimate that growth next year will be 1.4 per cent.

That Treasury report was right about two things, though. It projected a fall in the pound of 12 per cent under the shock scenario and 15 per cent under the severe shock one. Well, we have had a fall of around 15 per cent on the trade-weighted measure, so we are in severe shock territory. And it was right about a hit to government revenues, though for the wrong reason. It thought that recession would lead to an increase in government borrowing. There does seem to have been some rise in the government deficit – or more accurately it is not coming down as fast as expected. The trouble is that a shortfall in tax revenue was evident even before the Brexit vote for reasons that are not yet clear. We will learn more in the months ahead.

Apocalypse deferred or no apocalypse at all? The first point to make is that the official outlook for next year is for somewhat slower growth than projected ahead of the vote, for without Brexit growth might have been 2.3 per cent. So far there has been zero impact on growth, or as near zero as makes no difference. But some slowing is expected from now on. How serious? Well, let’s look at the reasons why the experts have so far been so wrong.

First, they underestimated the importance of momentum in an economy. Nearly 70 per cent of final demand comes from consumption and consumers don’t react to political events in the stark way economists expected. Remember more than half the voters got the decision they wanted, so why should they suddenly panic? If anything they should be cheering. In any case big political events are quite rare, so there was little for the economic modelers to go on.

Second, they underestimated the impact of the fall in sterling. You don’t need many British people to decide to spend their holidays at home, or many more foreigners to spend money here, to tip the travel and tourist industry into a boom.

Third, the cut in rates and the additional money pumped into the system by the Bank of England must have had some effect. Though that decision back in August now looks premature, it can’t have done damage to demand and may have helped a bit. The housing market has continued to remain strong at the middle and bottom ends, though at the very top there has been a fall-off. Mind you, that fall-off probably has more to do with the surge in stamp duty charges than any inherent weakness in demand.

Fourth, the boom in shares must have had some impact on steadying confidence. True, the link between share prices and consumer confidence is a fuzzy one, and true, if you allow for the fall in sterling the rise has been less marked. But the fact than most people with a portfolio of financial assets have ended the year 20 per cent richer than they were at the beginning must have helped support the economy a bit.

Finally, after the initial shock, the fact that the “experts” had been so wrong emboldened the business community. The immediate impact was indeed a huge decline in the purchasing managers’ indices, which track business confidence and have in the past given a very good indication of future economic growth. But two months on, the PMIs bounced back and started again to signal solid growth ahead.

Now let’s look ahead. There is no evidence yet of a serious slowdown in growth but some evidence of a slight one. The PMIs are signaling a good first half of the year, particularly for the all-important services sector that makes up nearly 80 per cent of the economy. Exports seem to have perked up a bit too. But we have yet to see the impact of the fall in the pound move through the supply chain, so people are still enjoying a real increase in their living standards. A lot depends on prices in the coming months. If inflation goes above about 2.5 per cent real pay would be stagnant. In addition, employers are squeezed not only by higher import costs but also by the rise in pay, thanks in part to the living wage. As yet there has been no rise in unemployment but the top has come off the job market boom.

So it is possible that in another six months not only will real pay be pretty stagnant but unemployment will be creeping up. This would certainly take the edge of consumption. There is a further possibility that the housing market will top out, thanks to higher global interest rates. It would be plausible for at least one increase in UK rates to come this year.

There is one further possibility that might damage confidence. It is that the Brexit negotiations will get nasty. That will not have much impact on consumers. Indeed they may try to switch to buying British goods rather than European ones, which would support the domestic economy. But it would be naïve not to accept that rough negotiations will hit business confidence.

All this sounds rather negative and it is. But it is not apocalyptic. The prospect is for a period of somewhat slower growth than would otherwise have been the case. In that sense Brexit will damage the economy. As for Europe, it too faces economic challenges and arguably greater ones than the UK.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments