A cliff-edge Brexit could cost each British household £2,000 – Theresa May needs to tread carefully

No deal would mean Britain being forced to trade with the rest of the EU under the minimal World Trade Organisation terms. This would mean 10 per cent tariffs on car exports to Europe and a plethora of other levies

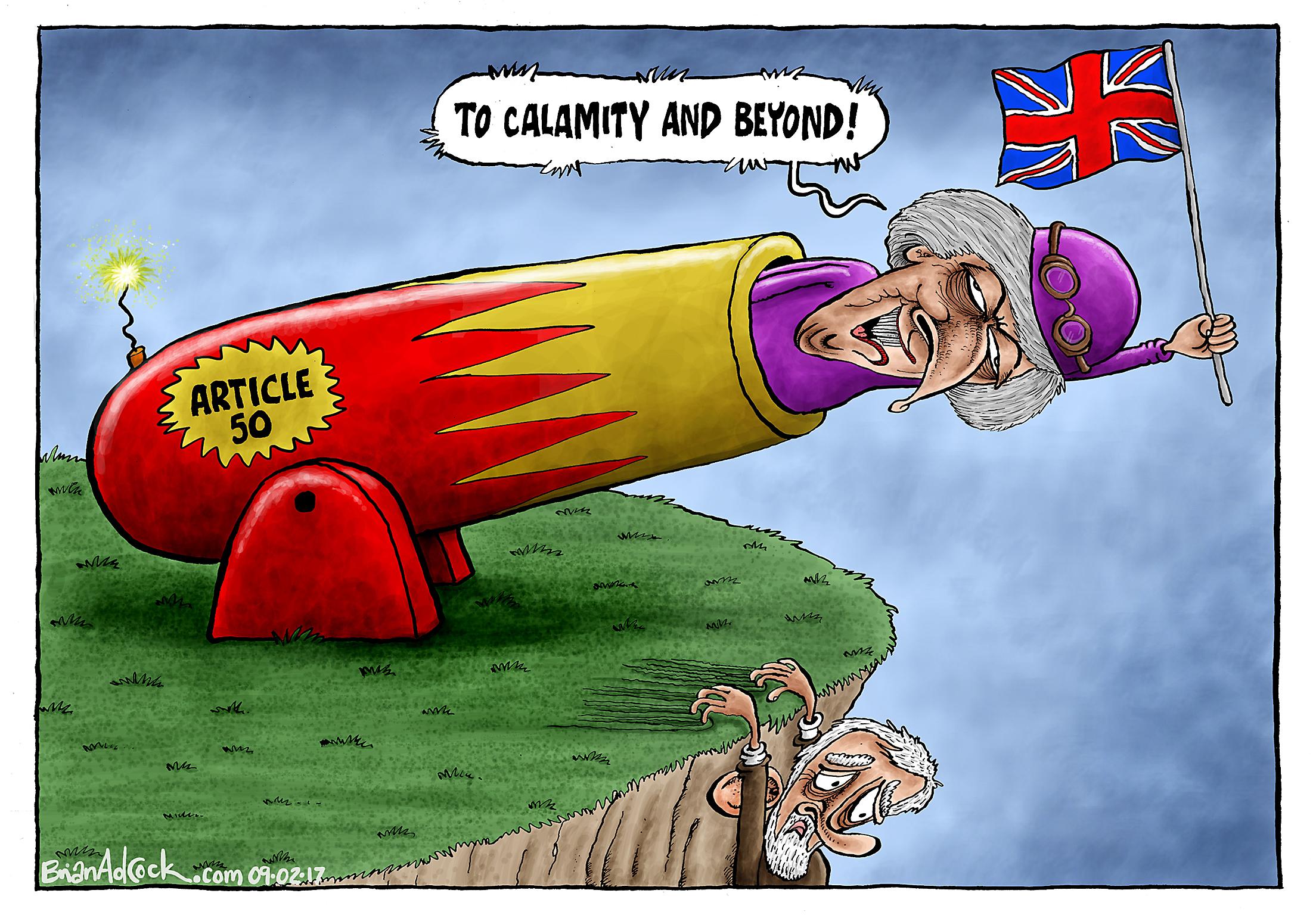

Parliamentary resistance has melted like ice cream under Theresa May’s Brexit blowtorch. The two year Article 50 divorce process will be triggered by the end of the month.

There now seems to be little likelihood of a vote by MPs on the terms of any final deal – at least any vote that could force ministers back to the negotiating table to secure something better.

Brexit is coming. And May has made it clear it will be a hard Brexit, with Britain quitting both the European Union single market and the customs union. Brexit may also be a prelude to Scoxit and the break-up of the United Kingdom, after Nicola Sturgeon’s demand this week for another Scottish independence referendum.

So what are the economic implications? What will sterling do when the trigger is pulled? Anyone who tells you with any confidence is a charlatan. It’s quite conceivable that there could be a further sharp depreciation of the pound – down to below $1.20 against the dollar, which would push up the inflation rate further.

Yet, it’s also possible that nothing much will happen at all, at least initially. Currency movements reflect the aggregated balance of opinion among tens of thousands of traders and asset managers both in the City of London and dispersed around the world.

Will traders, in the collective, think that this is the moment to mark sterling down again? Or will most judge its price already reflects the economic implications of the Brexit destination? This is what is known as an “emergent” process. One simply can’t know until the votes are in.

On the real economy, we should be just as wary of any confident and unconditional forecasts. The economy has performed better than most economists anticipated since the Brexit vote, mainly because UK households have carried on spending as if nothing happened last June.

Yet there are signs of a sharp recent slowdown from the official retail sales data, an important barometer of consumer sentiment. It’s possible that the triggering of Article 50 could be the moment when gravity kicks in and there is a sudden belt-tightening from British households as they face up to the reality of weaker future income prospects – and that this is what belatedly knocks the economy off its feet and pushes up unemployment.

Alternatively, there could well be more of the same as we have seen over the second half of last year, with households continuing to spend, running down their savings and borrowing more, all despite higher inflation and the clear view of the currency markets that everyone in the UK will ultimately be poorer as a result of Brexit.

What we can speak about with a much higher degree of confidence is the medium-term economic implications. “No deal is better than a bad deal,” the Prime Minister proclaimed at Lancaster House in January, apropos the free trade deal she hopes to conclude with the rest of the EU and the financial price tag Britain might face.

No deal would mean Britain being forced to trade with the rest of the EU under the minimal World Trade Organisation terms. This would mean 10 per cent tariffs on car exports to Europe and a plethora of EU levies on the goods that our firms sell to the Continent.

It would also mean no new customs arrangements to mitigate the administrative disruption of leaving the customs union. Think large queues of lorries at the borders as “rules of origin” checks are undertaken to protect the integrity of the single market and severe disruption of many UK companies’ supply chains.

It would mean re-locations of foreign banks and many thousands of jobs from the City of London to continental Europe as hopes of a regulatory “equivalence” agreement to allow financial business to continue relatively uninterrupted are dashed.

"A major economic shock," is the description in an internal Treasury document of such a scenario. "Open[ing] Pandora's Box," warns the President of the CBI.

And ministers have been told to prepare for this cliff edge possibility. Perhaps this is just a negotiating tactic. A cliff-edge Brexit would be economically damaging for the EU economy too (although less damaging than for the UK). Some say ministers have to act as if they would be happy to endure this (even if they are not) to avoid getting rolled over in the negotiations with the other 27 EU states on the financial terms of the divorce. This is the old logic of mutually assured destruction.

Yet it’s hard not to suspect that the “three Brexiteers” – Liam Fox, Boris Johnson and David Davis – actually believe it when they say a cliff-edge Brexit would be perfectly tolerable for Britain. If Liam Fox is capable of sitting beneath a giant image of a Tweet from his own account while claiming (on national television) that he did not send it then one has to suspect this is a politician capable of a Trumpian-level of reality denial. Perhaps not someone to trust your job with.

Credible independent estimates of the economic harm of a cliff-edge WTO Brexit for the UK range from 2.6 per cent of GDP to 5.5 per cent of GDP by 2020. That’s a cost of between £1,700 to £3,700 to every household in the country. But this is only the bird’s eye view. The pain would be concentrated on households whose employment is reliant on EU trade: car plant workers in the North, financial workers (most of whom are not in London), farmers. Remainers and leavers alike would suffer.

Short-term economic forecasting is inherently difficult. But we can pretty safely say that if you drive over a cliff, it doesn’t tend to end well.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks