Why did bitcoin crash? Cryptocurrency price spike study on market manipulation precedes 2018 low

'Herd mentality seems to play a big role,' one analyst tells The Independent

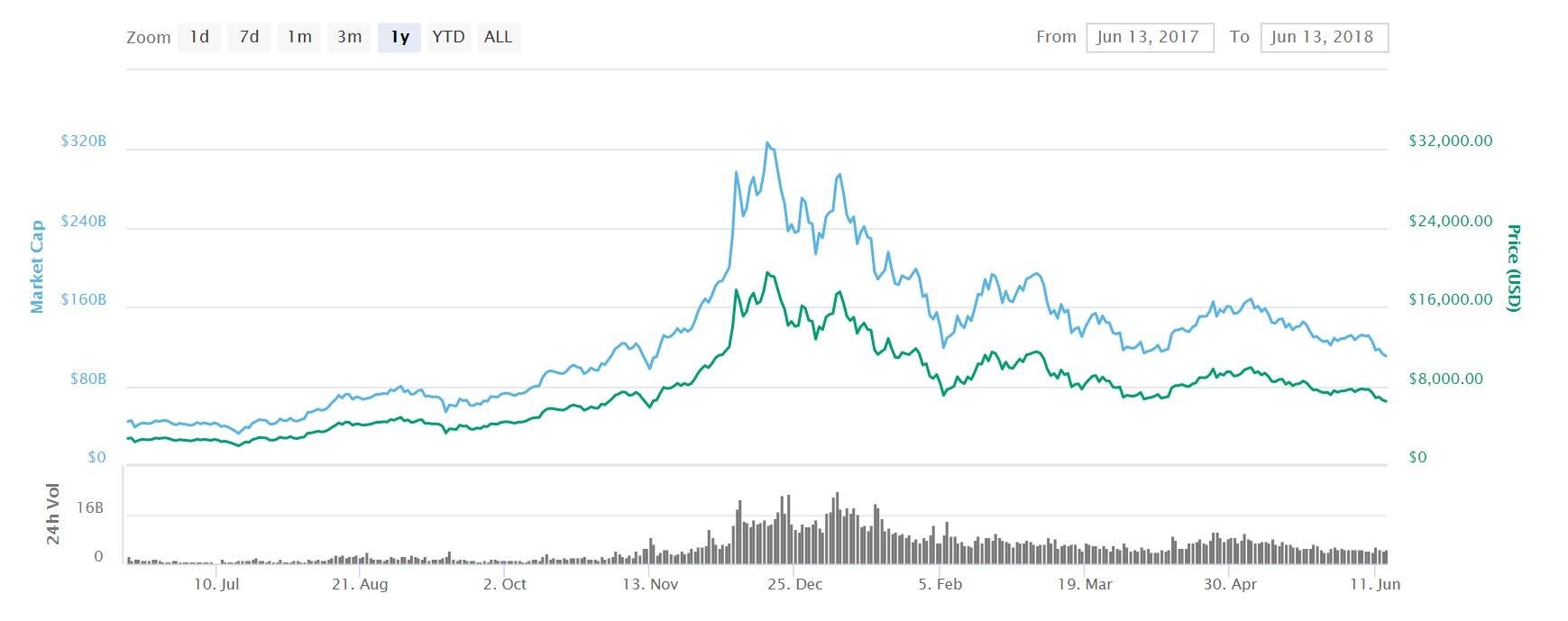

Bitcoin's value has dropped significantly since it hit historic highs in 2017, with the latest price crash pushing the cryptocurrency below one third of last December's $20,000 peak.

While it is difficult to pin price drops on any specific event, experts and analysts have suggested the most recent fall in value can be attributed to a new study which suggests market manipulation was behind the 2017 bubble.

Researchers at the University of Texas investigated the Bitfinex exchange and a virtual currency called Tether that was created by the Bitfinex owners.

Entitled Is Bitcoin Really Un-Tethered?, it suggests that the remarkable price rise was artificially inflated through manipulation of the platforms.

Following its publication earlier this week, bitcoin fell to below $6,300 for the first time since November. The study followed a similar price crash at the start of the week that came after news emerged that hackers had successfully targeted the Coinrail cryptocurrency exchange in South Korea.

Bruno Peroni, director of investor relations at cryptocurrency investment platform Atlas Quantum, said the combination of these two events in short succession is responsible for such a dramatic change in fortunes.

Speaking to The Independent from the MoneyConf fintech conference in Dublin today, he said: "The chatter in popular communities and forums certainly suggests that the double-blow of a South Korean exchange being hacked, as well as a new probe from the CFTC into manipulation, are putting a lot of pressure on exchanges and are impacting the latest dip."

Other factors to consider for the latest price crash, according to Mr Peroni, include reports from state-run Chinese newspaper People's Daily that claim China will continue to clamp down on illegal fundraising through cryptocurrency platforms.

Oliver Isaacs, a leading blockchain adviser, also told The Independent that this mixture of factors contributed to the recent price action."

"Herd mentality seems to play a big role in the cryptocurrency markets and sellers seem to be in control at the moment," he said. "A corrective rally might bring the price back above $7,000, however technical analysis shows a strong recovery is unlikely in the short term."

Like many other analysts, Mr Isaacs is "very optimistic" for the longer term future of bitcoin and other cryptocurrencies, although he warned that clear regulatory systems will need to be put in place before it is considered a legitimate store of value and a reliable medium for financial transactions.

News of the Coinrail hack, while damaging in the short-term, could actually prove positive in the longer run, according to the chief operating officer of one exchange.

"The Coinrail hack shows that the fast-paced, evolving world of cryptocurrency is continuing to hold strong appeal to fraudsters and hackers, which in turn grows the level of risk for the market," David Sapper, COO of Australian cryptocurrency exchange Blockbid, told The Independent.

"However, hacks on exchanges aren't a new thing and prices of cryptocurrencies will recover as they have done so before."

Despite this broad positivity, analysts were forced to revise optimistic price predictions from the start of the year, with a panel of cryptocurrency experts recently changing their predictions from $33,000 by the end of the year, to just $14,638.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks