Twitter files for IPO, hopes to avoid Facebook's mistakes

The micro-blogging service was valued last month at around $10.5bn (£6.65bn)

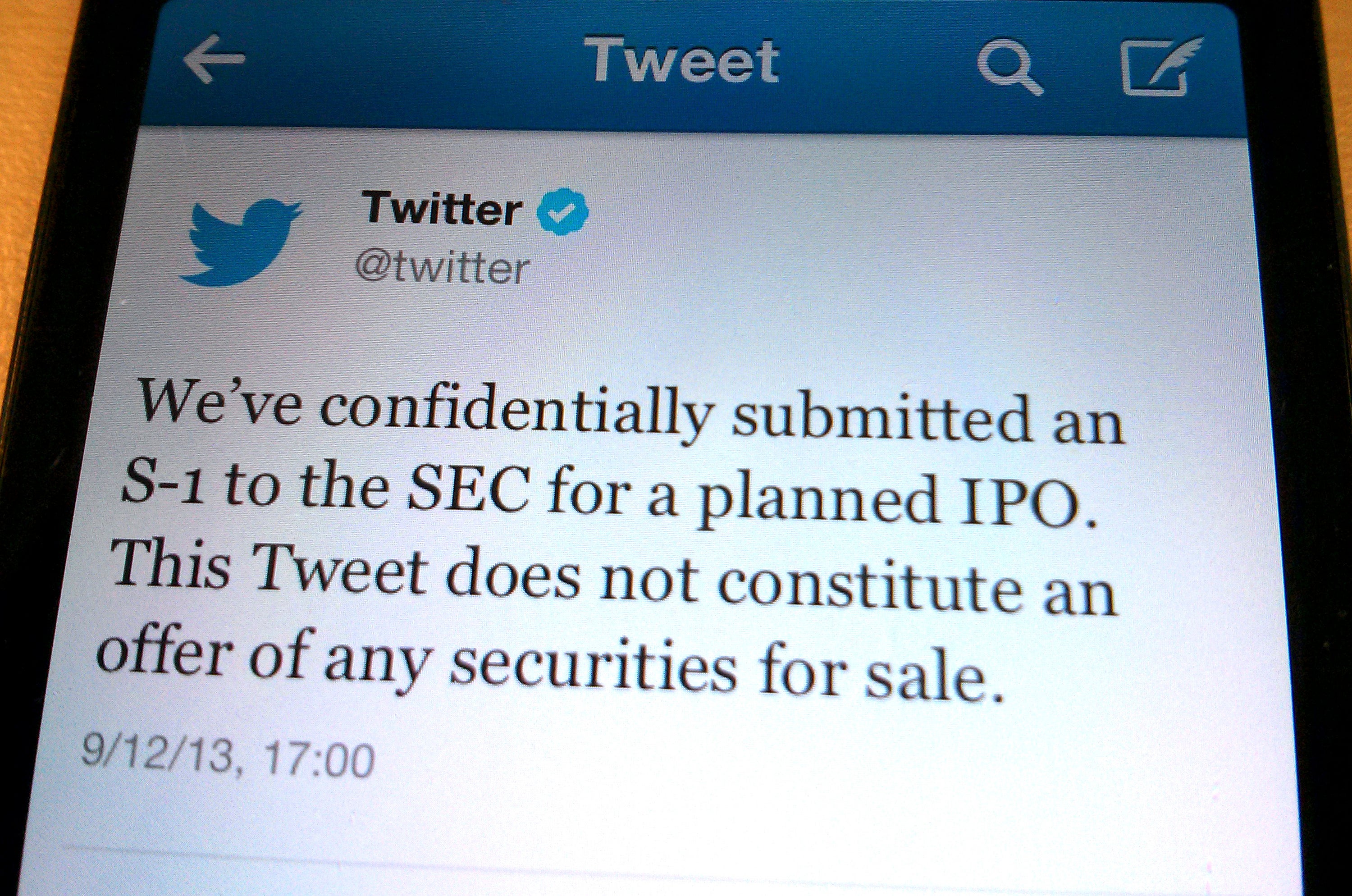

The ball has been set in motion for one of the most hotly anticipated listings of recent times, with Twitter filing paperwork for an initial public offering. Appropriately, the micro-blogging service announced news of its plans via a tweet.

With its platform continuing to grow in popularity, the company has long been suspected of plotting a move to go public. Launched in 2006 by Jack Dorsey and Biz Stone, Twitter now attracts over 200 millions users every month, with large corporations, celebrities, governments and private individuals around the world using the platform to publish 140-character messages in real-time.

The listing plans came to light with a tweet published on the company's official account: “We've confidentially submitted an S-1 to the SEC for a planned IPO. This tweet does not constitute an offer of any securities for sale.”

In other words, Twitter announced that it had filed the initial paperwork for a listing with the Securities & Exchange Commission, the US market regulator, using a new rule that allows companies with less than $1bn in revenues to submit the documents confidentially. The rule allows such companies to keep details of their finances private until the moment they begin courting investors.

Twitter's potential move towards a public offering has been a constant source of speculation on Wall Street ever since Facebook made its stock market debut last year.

Although the micro-blogging service's listing is likely to be significantly smaller, it is expected to attract widespread interest among investors. Twitter was valued at around $10.5 billion (£6.65bn) last month by one of its investors, GSV Capital Corp. After its shares reached a record high this week of $45 apiece, Facebook is currently valued at around $109bn.

Twitter's IPO is being handled by Goldman Sachs, who will hope to avoid the problems that marred Facebook's transition to public ownership. The social media giant's shares spent an extended period under their IPO offer price as investors balked at the initial valuation of $38 apiece. Following its $16bn IPO, Facebook quickly lost more than half of its value, though its recent success in generating mobile advertising revenue has more than restored its fortunes.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks