Tesla stock continues to crater as Elon Musk goes further down Twitter rabbit hole

“Musk is viewed as ‘asleep at the wheel’ from a leadership perspective for Tesla,” market analyst Dan Ives says

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

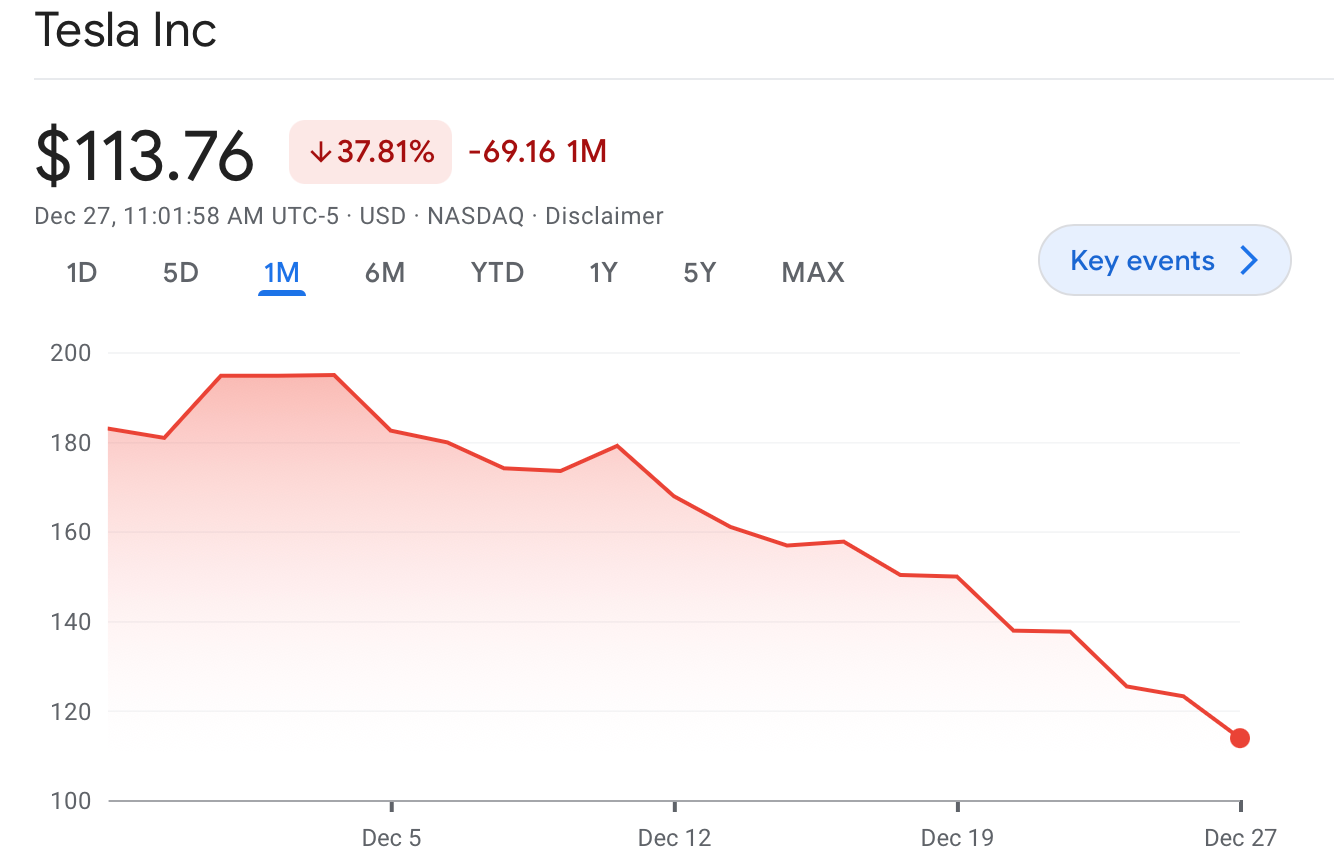

Your support makes all the difference.Shares in Tesla plunged by more than 8 per cent in early trading on Tuesday as Elon Musk’s erratic Twitter ownership appeared to weigh heavily on the electric vehicle maker.

Tesla stock had cratered to under $113 by 12pm, setting a new 52-week low, and has lost more than two-thirds of its value since Mr Musk first offered to purchase the social media platform in April.

The tech-heavy Nasdaq has fallen by 34 per cent, or around half of Tesla’s losses, so far in 2022.

CNBC reported that Tesla’s latest tailspin followed from news that its Shanghai factory will reduce production in January, after it was forced to shutdown in December due to Covid lockdowns.

Investors and analysts have blamed Tesla’s abysmal 2022 performance on Mr Musk’s protracted takeover of Twitter and pointed to his embrace of far right conspiracy theories as turning off many potential customers.

“Musk is viewed as ‘asleep at the wheel’ from a leadership perspective for Tesla at the time investors need a CEO to navigate this Category 5 storm,” Wedbush Securities managing director and longtime Tesla bull Dan Ives wrote in a research note last week.

“Instead Musk is laser focused on Twitter which has been an ongoing nightmare that never ends for investors, with hopes a new CEO is picked in the coming weeks as a first step forward,” Mr Ives wrote.

Now we need leadership from Musk to navigate Tesla through this downturn and emerge strong on the other side of the storm. The Street does not want to see Ted Striker moments from Musk in this jittery macro and critical juncture for EV adoption globally. Key few months ahead

— Dan Ives (@DivesTech) December 23, 2022

Mr Musk has said he plans to step down from running Twitter once he finds someone “foolish enough to take the job”.

The electric automaker has also faced falling demand amid fears the US economy is heading into a recession and increased competition from the likes of Ford and Chevrolet.

It has now shed more than $800bn in market capitalisation from its peak of $1.24 trillion in November 2021.

Formerly the world’s richest man, Mr Musk’s net wealth has fallen by $133bn to $139bn in 2022, according to Bloomberg estimates.

Mr Musk has sold $22.9bn worth of Tesla stock since April to fund his takeover of the social media company.

The Independent has requested comment from Tesla.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments