Tax return deadline 2015: Could new app Zaptax turn January 31 into a pain-free date?

Rhodri Marsden discovers how technology is revolutionising financial literacy

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.A large number of self-employed people – along with a hefty smattering of those that aren't – will currently be casting nervous glances at the calendar and playing a popular game known as Tax Return Chicken. We're all aware of the sensible advice not to leave the completion of self-assessment returns until the evening of 31 January, but that's precisely what many of us do, nudged into procrastination by an intense dislike of sums, a head-in-sand approach to personal finance and a deep-seated fear of official forms.

Anyone who breaks out in hives when they read the phrase "Value of qualifying investments gifted to non-UK charities in boxes nine and 10" might find an app called Zaptax useful; available in iOS, Android and web-browser flavours, it guides you through the tax-return process via a series of refreshingly simple questions and then submits the whole shebang to HMRC for a fee of £19.99 when you've reached the end. (A bit like an accountant, but one that doesn't shout at you on 31 January.) It's just one example of how technology is assisting with financial literacy, democratising information in an industry that has been curiously slow in sharing its digital capabilities with the rest of society.

"I'm trapped in self-assessment and have been for years," says Zaptax's founder, Nathan Evans. "I didn't want to pay an accountant, but I found the process really frustrating; even HMRC's welcome screen was confusing. I always thought that it could be done better and the idea of the app is to make it as easy as possible, to take some of the fear away." Then he adds: "Unfortunately, that turned out to be very hard."

The past 50 years have seen a 12-fold increase in the length of printed tax legislation; it's now estimated at around 13,000 pages, and HMRC is obliged to direct a significant proportion of its efforts towards the affairs of large companies, small companies and those who are actively trying to evade tax. Meanwhile, those of us whose tax affairs are relatively simple become anxious over whether certain rules apply to us or not, and become even more worried about asking HMRC for help.

"An ordinary person in ordinary circumstances shouldn't have to pay an accountant to do their tax return," Evans says. "There are about 11 million people who qualify for self-assessment, but only a third actually complete the return without an accountant. The rest are paying out because they don't want the hassle, or for peace of mind. But technology is enabling us to do this stuff quicker and easier."

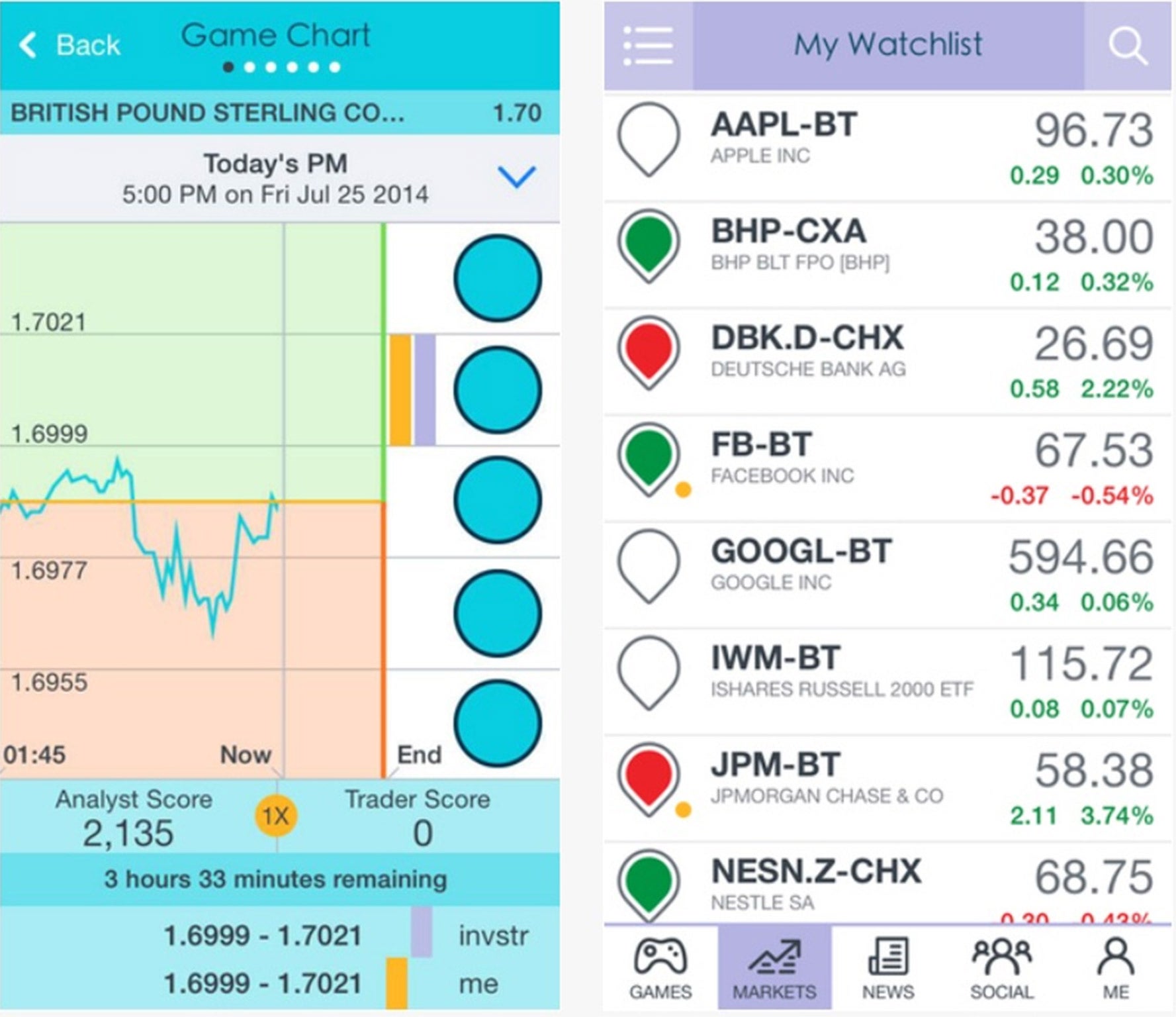

The same could be said of personal investment. Many of us regard the prominent Stocks apps that come with our smartphones to be a waste of space, and consider information pertaining to the markets to be completely impenetrable. But apps such as Plus 500 and invstr offer a more user-friendly introduction to that world: apparently, the act of buying and selling isn't some kind of black art.

"The financial system is a bubble that's removed from the ordinary citizen," says Kerim Derhalli, founder of invstr. "A while ago there was a survey conducted in the UK by the management consultants Oliver Wyman that asked who we trusted to manage our money. Fourteen per cent of people replied 'no one', 69 per cent said 'myself'. Banks and asset managers scored 5 per cent and 6 per cent respectively. People want to do things for themselves, and one of the biggest trends in finance is self-directed investing."

Both Plus 500 and invstr include games that allow those who download them to test their aptitude at predicting the ups and downs of commodities, currencies and share prices, but invstr also includes six aggregated and searchable newswires, market commentaries (for a few pnce) and easily digestible research reports, for $4.99 (£3.30), a fraction of their normal cost.

"You could say that the financial markets have been made to appear more complex than they are because information is power - which, in the money world, means increased wealth," says Derhalli. "We can complicate these things, but they're actually very simple. The emotions that drive markets are probably innate: fear, greed, lust, jealousy, concern. The key to unlocking this and to empowering people is to give them access to information in a way that's accessible."

Derhalli's hope is that invstr's crowdsourced opinions about the direction of prices will give people insight into becoming better investors. Evans wants self-employed people to sleep easier at night. "HMRC is doing the best it can," he says. "But it is slightly schizophrenic; on the one hand it wants people to get it right – because that's more efficient – but it also seems to feel the need to scare people, for example, with the adverts it displays at cashpoints. Personally, I think that just generates a climate of fear among people who are conscientious anyway."

Little wonder that we feel the need to have our accounts rubber-stamped by an accountant, but Zaptax comes with a guarantee that your return will be completed and filed accurately – as long as you've supplied correct information, natch.

While Evans stresses the assistance given by HMRC in the development of the app, he adds: "It's never going to be fun, And no one is ever going to be delighted to pay taxes. But at least we can make it less painful."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments