Panama Papers: Journalists publish leaked data online despite legal threats

The International Consortium of Investigative Journalists (ICIJ) makes data on 200,000 entities available on its website

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Journalists have published the names of thousands of offshore companies included in the Panama Papers.

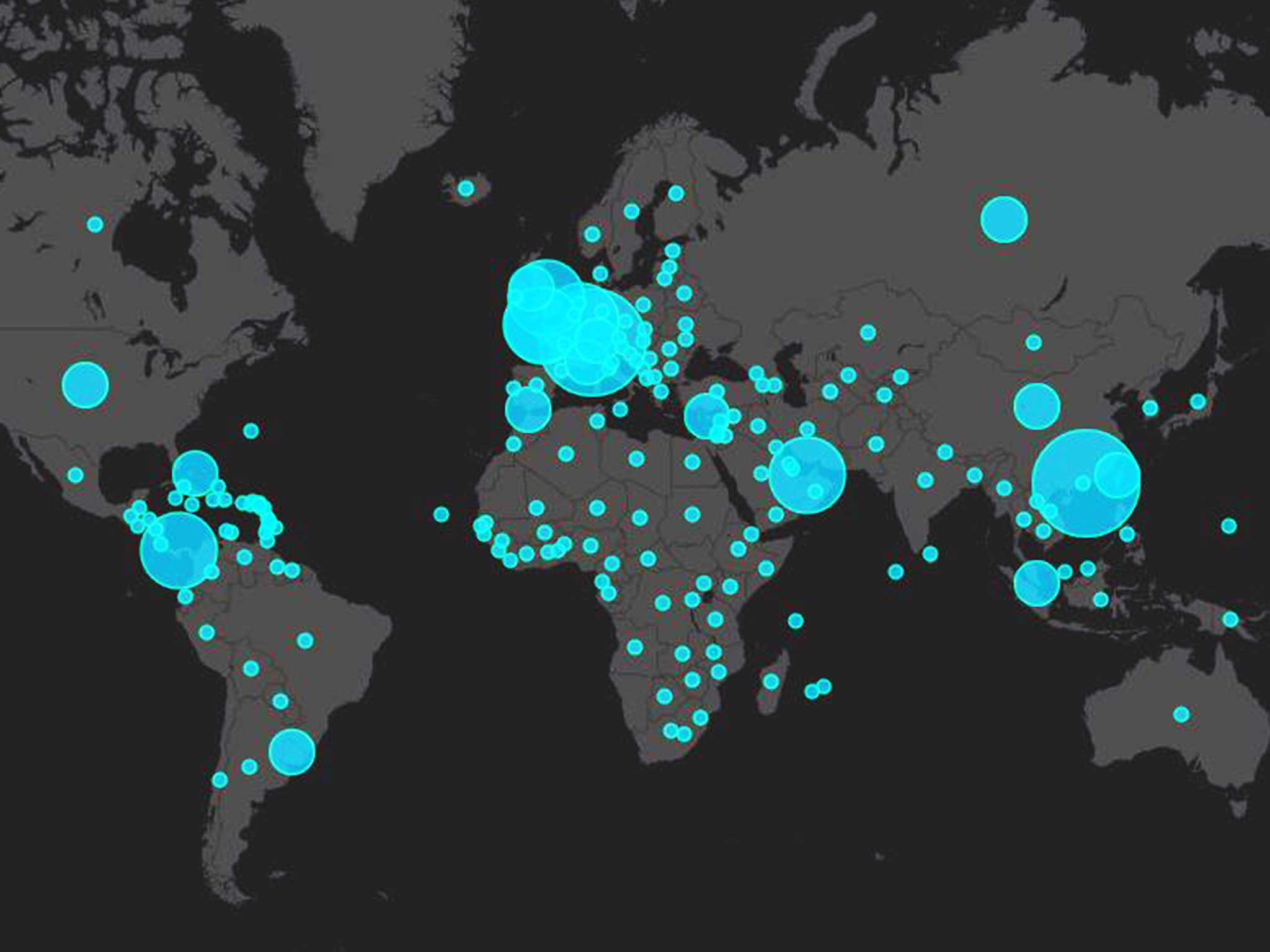

The International Consortium of Investigative Journalists (ICIJ) made data on 200,000 entities available on its website on Monday evening.

They contain basic corporate information about companies, trusts and foundations set up in 21 jurisdictions including Hong Kong and the US state of Nevada. The data was obtained from Panamanian law firm Mossack Fonseca, which said it was hacked.

Users can search the data and see the networks involving the offshore companies, including, where available, Mossack Fonseca's internal records of the true owners.

Information and documents on bank accounts, phone numbers and emails have been removed from the database.

The ICIJ said it was putting the information online "in the public interest" as "a careful release of basic corporate information" as it builds on an earlier database of offshore entities.

Setting up an offshore company is not by itself illegal or evidence of illegal conduct, and Mossack Fonseca said it observed rules requiring it to identify its clients.

The ICIJ prefaced the data dump by noting that the appearance of particular persons and companies on the list does not imply wrongdoing.

But anti-poverty campaigners say shell companies can be used by the wealthy and powerful to shield money from taxation, or to launder the gains from bribery, embezzlement and other forms of corruption.

The Group of the 20 most powerful economies has agreed that individual governments should make sure authorities can tell who really owns companies, but implementation in national law has lagged.

The data cache, first leaked to Germany's Sueddeutsche Zeitung newspaper, showed offshore holdings of 12 current and former world leaders.

Reports based on the documents quickly led to the resignation of Iceland's Prime Minister David Gunnlaugson after it was revealed he and his wife had set up a company in the British Virgin Islands that had holdings in Iceland's failed banks.

Prime Minister David Cameron, who had campaigned for financial transparency, faced questions about shares he once held in an offshore trust set up by his father. The ICIJ reported that associates of Russian President Vladimir Putin moved some 2 billion US dollars through such companies. Mr Putin's spokesman dismissed the report.

Hundreds of economists have urged world leaders to end the era of tax havens, arguing they only benefit rich individuals and multinational corporations and serve to increase inequality.

The 300 economists, in a letter coordinated by activist group Oxfam, say poorer countries are hit hardest by tax dodging.

"As the Panama Papers and other recent exposes have revealed, the secrecy provided by tax havens fuels corruption and undermines countries' ability to collect their fair share of taxes," the letter said. "While all countries are hit by tax dodging, poor countries are proportionately the biggest losers, missing out on at least 170 billion dollars of taxes annually as a result."

The letter comes days before an anti-corruption summit in London, featuring politicians from 40 countries as well as representatives from the World Bank and the International Monetary Fund. Many of the companies that featured in the Panama Papers were incorporated in British Overseas Territories and the British Virgin Islands.

AP

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments