The Independent's journalism is supported by our readers. When you purchase through links on our site, we may earn commission.

Why Kim Kardashian was fined for promoting cryptocurrencies but not Matt Damon

Could more celebrities be in trouble after Kim Kardashian was fined $1.26m for promoting a little known cryptocurrency? Probably not.

At the height of the cryptocurrency boom, flashy Super Bowl advertisements featuring Matt Damon and Larry David encouraged millions of investors to “steel their nerves”.

“Fortune favours the brave,” Damon said in a widely-mocked advert for Crypto.com.

As crypto prices tanked soon afterwards, those who had taken up Damon’s dare to “peer over the edge” suddenly found themselves staring into the abyss.

News broke this week that a single Instagram post promoting a little known cryptocurrency had cost Kim Kardashian more than $1m in fines and it left many wondering why she had been singled out.

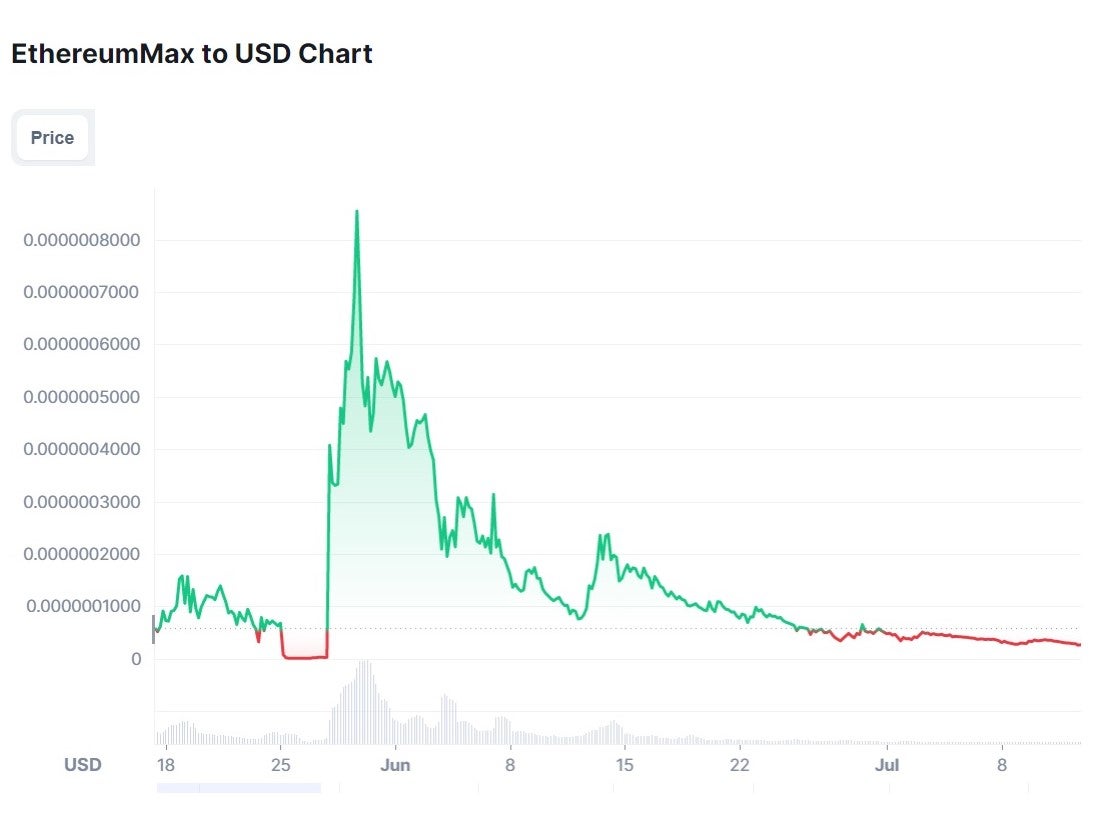

The June 2021 post to the mega-influencer’s Instagram stories, for which Kardashian was paid $250,000, invited her 330 million followers to purchase, EthereumMax.

The post caught the attention of the Securities and Exchange Commission (SEC), who ordered the reality TV personality to pay $1.26m. The agency claimed that Kardashian failed to disclose that she received payment for the brand.

Financial experts have speculated that Kardashian could be the “tip of the iceberg” of a celebrity crypto endorsement crackdown by regulators.

However, a key legal distinction in the way individual crypto tokens -- such as EthereumMax -- are regulated appears to make that unlikely.

‘Don’t be like Larry’

On the eve of the current crypto winter in early 2022, prices of tokens such as Bitcoin and Ethereum were riding high.

Companies that trade crypto like Crypto.com, FTX and Coinbase each spent an estimated $6m on commercials for the NFL showpiece Super Bowl in February.

Both Curb Your Enthusiasm star Larry David and Matt Damon’s adverts emphasised the need to get in on the crypto bonanza before it was too late.

“Don’t be like Larry, don’t miss out,” was the tagline for David’s commercial for FTX.

Tom Brady, Reese Witherspoon, Mike Tyson and LeBron James also featured in adverts hyping the virtual currency boom.

In comparison, Kim Kardashian’s Instagram post promoting the specific coin EthereumMax was relatively low-key.

Kardashian even seemed to couch her words in the post carefully, writing: “This is not financial advice, but sharing what my friends just told me about the EthereumMax token,” while including the hashtag “ad”.

This was deemed to be in violation of security laws not because it was terrible advice, which it most definitely turned out to be, but because she hadn’t disclosed the $250,000 sum she was paid for the advert.

In a statement, SEC chair Gary Gensler warned investors against following the advice of their favourite television and social media stars.

“This case is a reminder that, when celebrities or influencers endorse investment opportunities, including crypto asset securities, it doesn’t mean that those investment products are right for all investors,” Mr Gensler said.

As Axios points out, firms such as Coinbase, FTX and Crypto.com have a much looser regulatory framework to follow.

The Federal Trade Commission protects consumers from fraudulent advertising, and has the power to freeze companies’ assets and seek compensation for victims. Its truth in advertising laws state that an ad “must be truthful, not misleading, and, when appropriate, backed by scientific evidence”.

But it rarely prosecutes. Instead, it usually send cease and desist letters in the first instance, as it did to dozens of companies promoting fake coronavirus treatments during the Covid-19 pandemic.

So Kardashian’s rap over the knuckles is unlikely to lead to a glut of celebrity fines and prosecutions, however satisfying that might have been for out-of-pocket investors.

A representative for Ms Kardashian said in a statement that she was “pleased to have resolved this matter with the SEC,” and pointed out that the settlement allowed her to pursue other business pursuits.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks