Bitcoin network smashes record amid huge price surge

A record-breaking 2021 has seen the crypto market swell to over $2 trillion

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

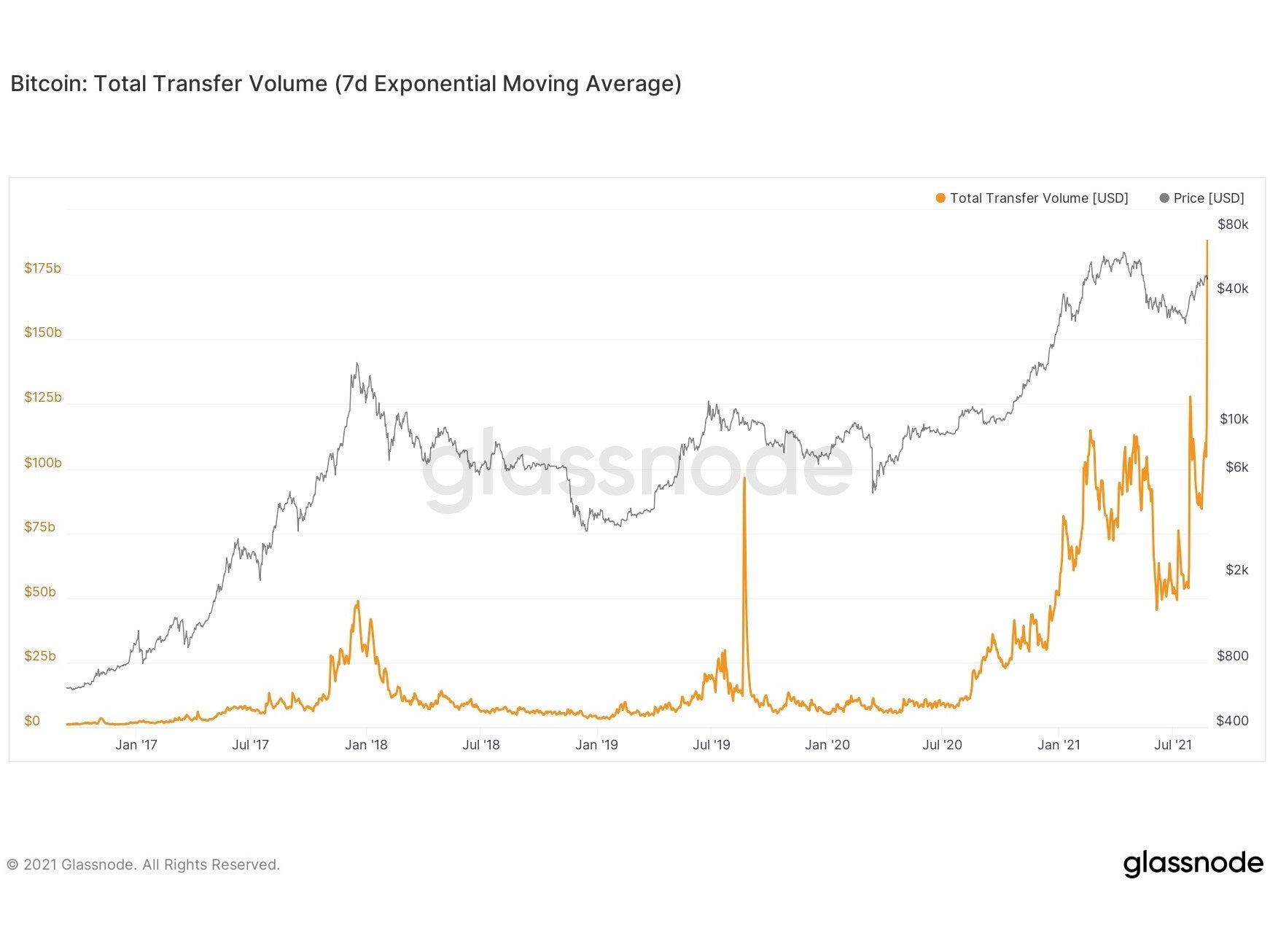

Your support makes all the difference.Bitcoin saw a record amount of cryptocurrency transferred through its network this week – more than two thirds more than it experienced during the price run that took it to an all-time high back in April.

More than $188 billion worth of bitcoin was transferred on Tuesday, according to figures from blockchain data firm Glassnode, amid a buying frenzy that took its value above $50,000 for the first time since May.

Other leading cryptocurrencies – including Ethereum (ether), Cardano (ada) and Binance Coin – have also seen remarkable price increases in recent days, pushing the overall cryptocurrency market cap from $1.9 trillion to $2.1tn in less than a week.

The gains come after a major downturn between May and July, which saw the market cool off following a record-breaking run in the first four months of 2021.

It has been boosted by positive news in the crypto space, including PayPal’s decision to open up the ability to buy, sell and hold bitcoin to millions of UK customers.

The current high price could partly explain the record transfer volume, with some analysts claiming that it could encourage long-term holders to move their funds onto exchanges and cash in on profits.

“A report from Glassnode shows that the proportion of old bitcoins being spent on the network has once again increased as long-term holders take advantage of the currently high prices to realise profits,” said Alexandra Clark, a sales trader at the UK based digital asset broker GlobalBlock.

“Whilst uncertainty remains for bitcoin in the short-term, its long-term future is clear, with professionals and academics stating that bitcoin, and digital assets more generally, will replace fiat currencies over the next five to 10 years.”

The bitcoin transaction record, first spotted by popular market analysis Twitter account Bitcoin Archive, came on the same day that software firm MicroStrategy announced another major investment in the cryptocurrency.

The Virginia-based firm, led by renowned bitcoin advocate Michael Saylor, bought a further 3,907 bitcoin for $177 million.

It takes MicroStrategy’s total holdings to 108,922 bitcoin, worth roughly $3 billion at today’s exchange rates, and makes it the largest corporate investor in the cryptocurrency. The next largest holder is Tesla, who announced a $1.5bn investment earlier this year, who currently hold roughly 42,000 bitcoins.

Bitcoin skeptic and CEO of Euro Pacific Capital Peter Schiff attributed bitcoin’s recent price rise above $50,000 to MicroStrategy’s investment.

“Now that you’re done buying (for now) the price will likely fall,” he tweeted in response to Mr Saylor’s announcement.

“One wonders how much lower the price of bitcoin would be now had you not blown so much shareholder money buying more? Imagine the crash if you tried to sell!”

MicroStrategy’s $177m purchase represents less than 0.1 per cent of bitcoin’s transfer volume on 24 August, and was likely purchased over several days.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments