Bitcoin price bounces back as cryptocurrency experts predict huge jump

'Bitcoin could dethrone gold as the ultimate safe-haven asset,' one analyst predicts

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

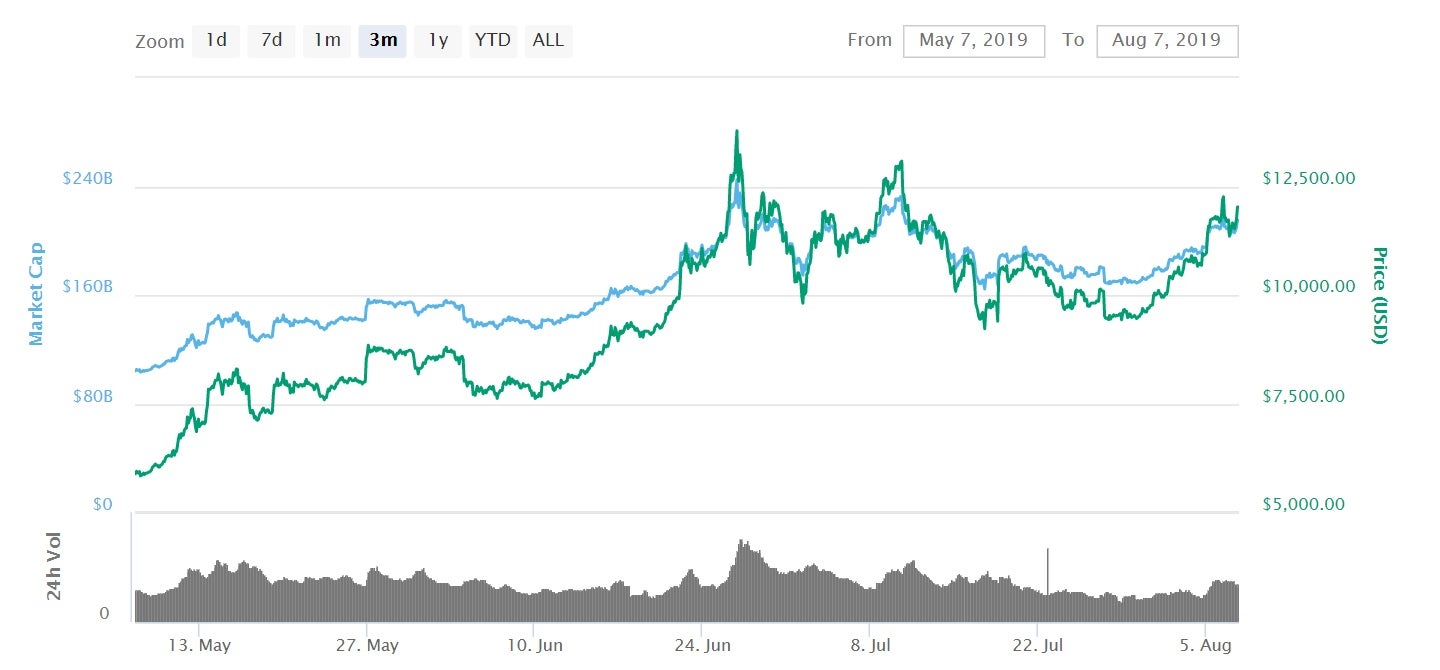

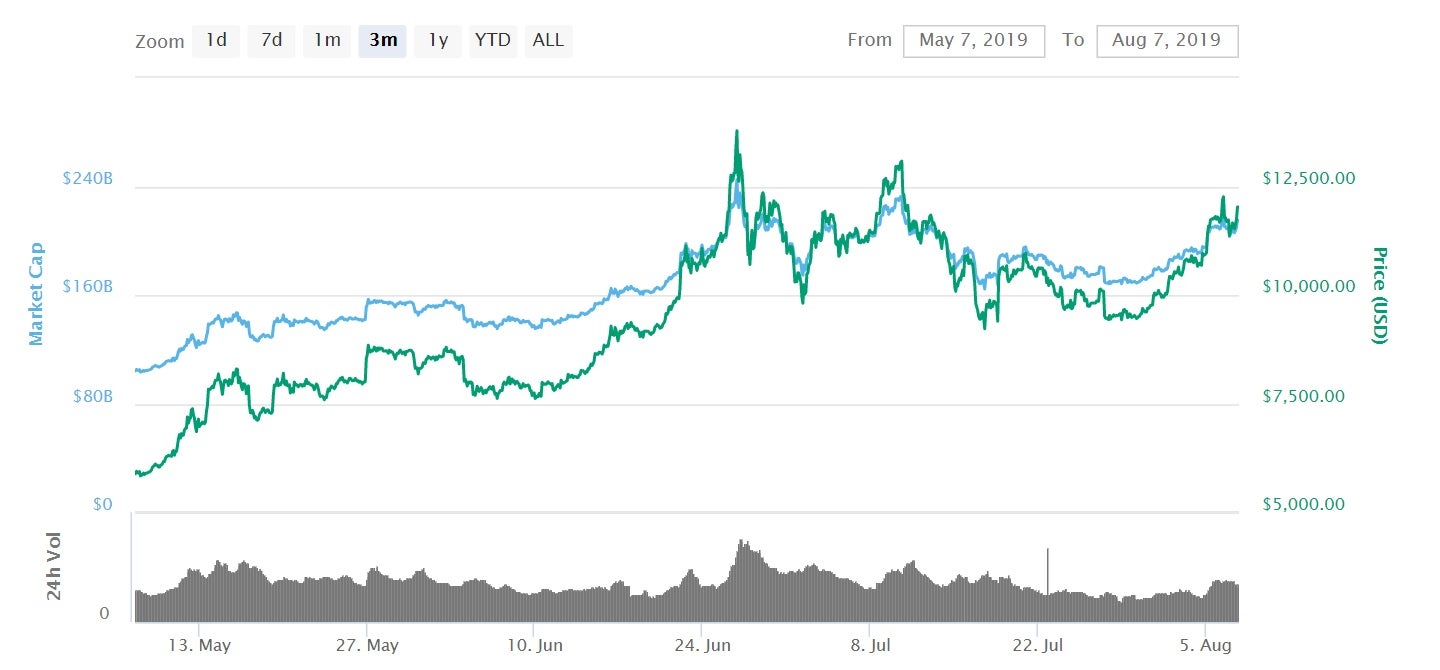

Your support makes all the difference.The price of bitcoin has broken above $12,000 (£9,870) to take its week-on-week gains above $2,000 and bring an end to a shaky time for cryptocurrency investors.

Bitcoin is notoriously volatile, but the price fluctuations since June have been among the most erratic ever experienced by the world’s most valuable cryptocurrency.

After six months of steady but near-constant gains, the price of bitcoin took a sharp dive in late June as $4,000 was wiped from its value in the space of a week. It soon bounced back and by mid-July it was back trading at around $13,000.

But even heavier losses were to come, as bitcoin once again fell towards $9,000 at the end of July. A week of positive price movement may well be proceeded by another nosedive, however some market analysts believe that this time there may be more gains to come.

One reason for this is bitcoin gaining a reputation as a safe haven asset, allowing investors can theoretically pile money into the cryptocurrency when traditional markets are looking shaky. With rising trade tensions between the US and China, as well as growing uncertainty surrounding Brexit, bitcoin could see an influx in investments over the coming weeks and months.

One cryptocurrency expert predicts that the bitcoin price “could hit $15,000 within weeks”, to take it to its highest level since January 2018, and within just $5,000 of its all-time high.

“Bitcoin is becoming a flight-to-safety asset during times of market uncertainty,” Nigel Green, chief executive of financial consultancy firm deVere Group, told The Independent.

“Bitcoin is currently realising its reputation as a form of digital gold. Up to now, gold has been known as the ultimate safe-haven asset, but bitcoin – which shares its key characteristics of being a store of value and scarcity – could potentially dethrone gold in the future as the world becomes increasingly digitised."

This analysis appears to be reaffirmed by recent data analysis by Bloomberg, which found that bitcoin’s price correlation to gold has almost doubled over the last three months.

Jeremy Allaire, CEO of one of the largest cryptocurrency payment firms Circle, also pointed to geopolitical events when justifying bitcoin’s latest price rise. In a recent interview with CNBC, Mr Allaire pointed to two of bitcoin’s key characteristics – a finite supply, and decentralised infrastructure- that make it such an attractive investment.

“You can very clearly see some macro correlation there,” he said. “Rising nationalism, rising amounts of currency conflict, trade wars, these all obviously are supportive of a non-sovereign, highly secure digital store of value.”

Other analysts suggest that bitcoin's volatility can also be attractive to investors who want to diversify their portfolio by adding a risky asset that could provide huge gains.

This is the view of Marcus Swanepoel, CEO at cryptocurrency firm Luno, who said this tactic had been successfully adopted by a number of private and institutional traders in recent months.

"It is now clear that investors put money into cryptocurrency when the main markets are falling," Mr Swanepoel told The Independent.

"The strategy of using gold or the yen as a safe-haven asset and at the same time buying digital assets to potentially produce a high return, is gaining momentum."

We’ve teamed up with cryptocurrency trading platform eToro. Click here to get the latest Bitcoin rates and start trading. Cryptocurrencies are a highly volatile unregulated investment product. No EU investor protection. 75% of retail investor accounts lose money when trading CFDs.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments