Bitcoin price rally could be ‘supercharged’ as crypto ETF milestone finally passed

Highly-anticipated NYSE debut will open up crypto market to new swathe of traders and investors

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The first ever bitcoin futures exchange-traded fund launches in the US on Tuesday, in what is being touted as a major milestone for the crypto industry that could push it to new record highs.

The ProShares ETF will debut on the New York Stock Exchange, opening up the market to a new swathe of traders and investors who may be interested in cryptocurrencies but are unwilling to buy and sell the tokens directly through exchanges. It offers a more regulated structure for traditional investors, through platforms they are more familiar with.

Follow The Independent’s live coverage of bitcoin and the rest of the crypto market

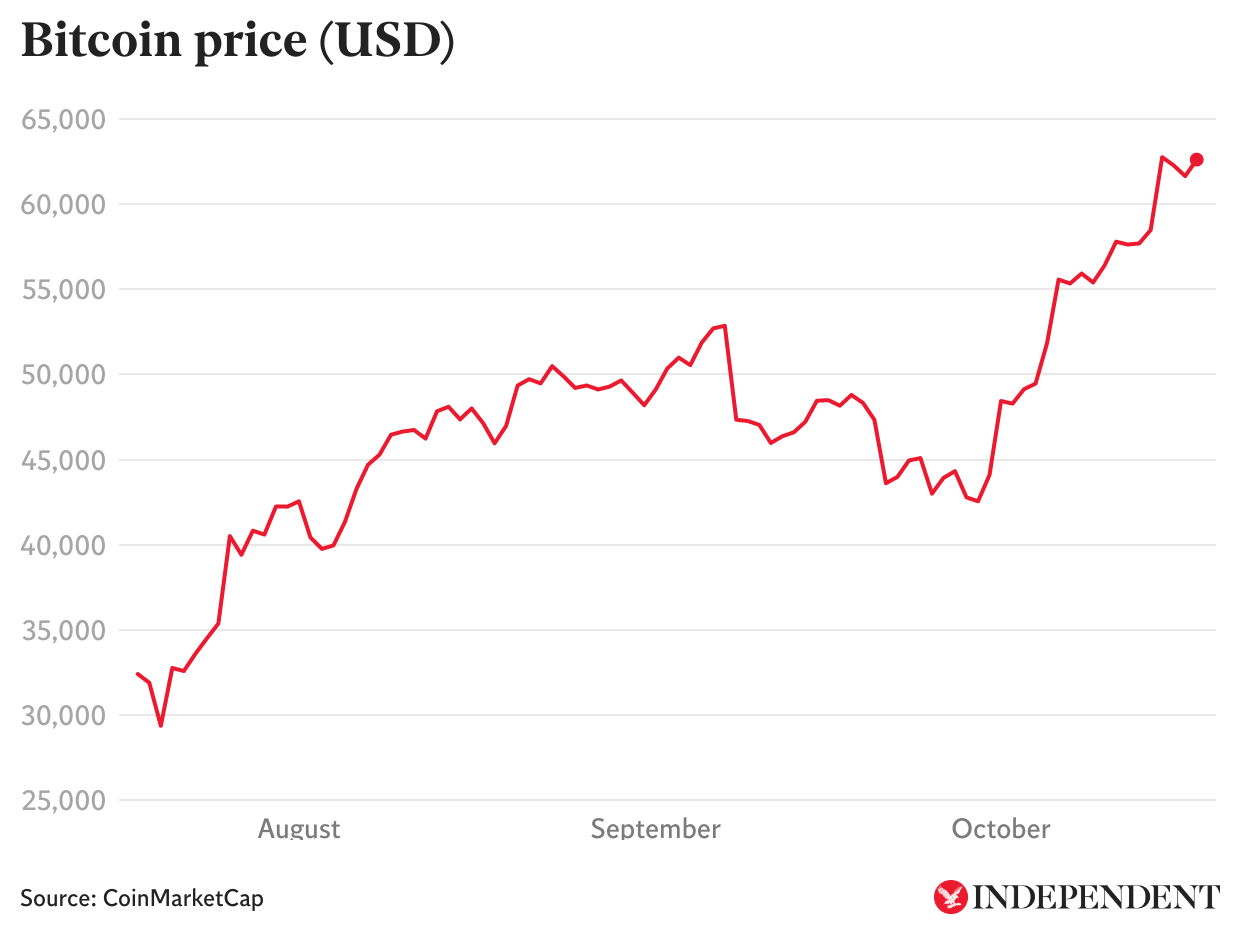

The highly-anticipated announcement was preceded by series of price surges that have pushed the cryptocurrency’s value up by nearly 50 per cent since the start of October. Bitcoin is now less than $2,000 away from the all-time high of $64,863 that it saw in mid April, with some market commentators claiming the ETF launch will “supercharge” the latest price rally.

“A bitcoin ETF will provide even more exposure to bitcoin for those who are perhaps wary of buying it directly from an exchange,” Matt Senter, chief technology officer of bitcoin rewards app Lolli, told The Independent.

“By allowing individuals to invest in bitcoin through ETFs that track its underlying value, investors can become familiar with bitcoin while fielding aspects of the ownership experience that may be daunting to crypto novices, such as navigating exchanges, wallets and private keys.”

While the move helps to dissolve barriers to entry to investors, not everyone within the crypto industry is convinced that it offers the best onramp into the space for investors.

“The BTC futures ETF is a horrible choice for investors, especially because they can buy bitcoin directly,” said Jodie Gunzberg, managing director of CoinDesk Indexes.

“Even fundamentally, the curve of bitcoin futures reflects an expectation of price in the future – that really doesn’t have a storage cost and convenience yield like commodities.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments