Bitcoin interest to double, says banking giant ING

Cryptocurrency price correlates closely with consumer interest

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The price of bitcoin tends to mirror people's interest in the cryptocurrency, with the level of Google searches providing a near-perfect correlation to the virtual currency's value. This could be good news for investors, as new research suggests that interest in cryptocurrency is expected to more than double.

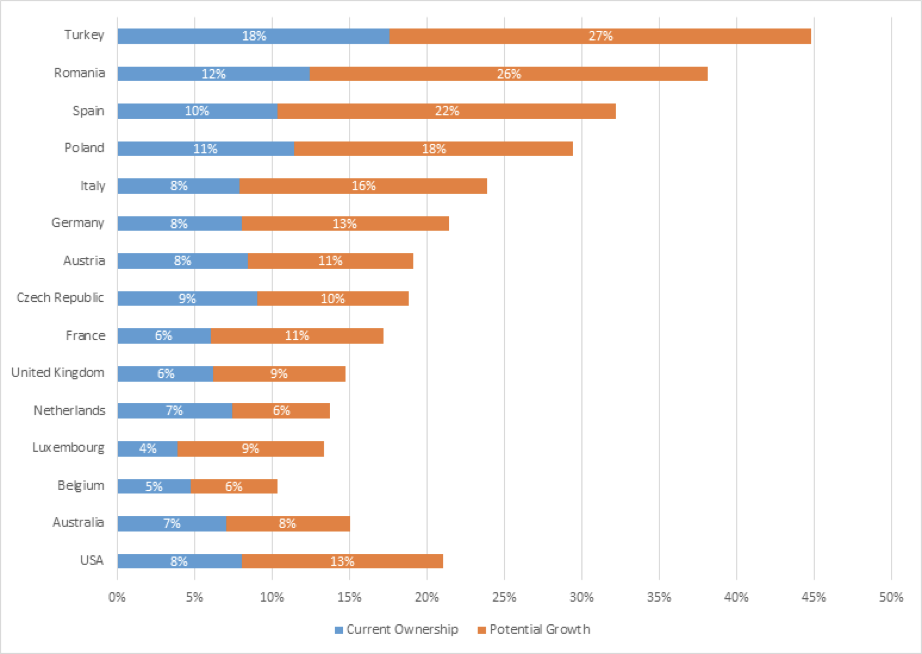

The latest consumer economic report from Dutch banking giant ING revealed that fewer than one in 10 Europeans currently own cryptocurrency, however 16 per cent of people expect to own them in the future. Surveying nearly 15,000 people across 13 countries, the Dutch bank said the survey reflects a gradual change in attitude towards cryptocurrencies like bitcoin, ethereum and ripple.

One of the most surprising findings from the survey was that 15 per cent of respondents said they would consider receiving their salary in bitcoin or other cryptocurrencies, despite their notorious volatility.

The survey's publication comes as bitcoin hovers around its lowest price of 2018, having briefly fallen below $6,000 on Sunday, 24 June. Analysts have blamed the most recent price crash on a series of hacks on cryptocurrency exchanges, as well as an increased focus on regulation in the space.

Bitcoin has since returned above $6,000 but still remains at around 30 per cent of the highs it reached late last year.

The latest research from ING will be welcomed by investors, especially those who bought into bitcoin during the massive interest in the cryptocurrency in December 2017.

Of those surveyed, more than a third said that they thought cryptocurrency represented the future of spending online, with a similar share also agreeing that it is the future of investing.

"Cryptocurrency remains an abstract investment for many, but there may be more appetite for digital currencies than some might suggest," said Jessica Exton, a behavioural scientist at ING.

"Based on our survey, ownership of cryptocurrencies could more than double in the future – although we do not know when... The volatility of cryptocurrency carries with it both positives and negatives, on the plus side it can increase awareness but may also mean people view digital money as a relatively risky asset. If cryptocurrency stabilises there may be increased interest.”

According to Teunis Brosens, an economist of global markets at ING, cryptocurrency holds the most promise in countries where the traditional financial system is less efficient.

"We find that the Dutch, with a very efficient and cheap domestic payment system, are most sceptical about the future of digital currencies," Mr Brosens said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments