The price of Bitcoin is surging – and this Trump-fuelled boom could be just the start

Bitcoin’s price has hit the $100,000 mark for the first time in history, as the industry pins its hopes on the president-elect. But bitcoin’s notorious volatility is matched by Trump’s often fickle whims, writes Anthony Cuthbertson

The moment it became clear that Donald Trump was going to win the US presidential election, bitcoin’s price began to climb. Within a few hours, the cryptocurrency had hit a new all-time high, and the overall market had swelled by a quarter of a trillion dollars.

One week later, bitcoin was up by more than a third. Now, the price has hit the $100,000 mark for the first time in its history.

But the boom isn’t that simple. In its 15-year history, the crypto market has become synonymous with volatility. Price surges like the one seen in the last week are not uncommon, and can be triggered by something as minor as a tweet from Tesla CEO Elon Musk.

The latest rally, which has seen new price records for the past five consecutive days, is largely down to promises from Trump to end the “persecution” of the crypto industry in the United States and position the country as the “bitcoin superpower of the world”. During a keynote address at the Bitcoin 2024 conference in Nashville in July, the Republican pledged to form a crypto advisory council and create a bitcoin strategic reserve from the stockpile amassed through government seizures from financial criminals.

Trump’s re-election could also see the removal of Gary Gensler as the chair of the US Securities and Exchange Commission (SEC), who has been accused of pursuing a vendetta against the crypto industry, while the president-elect has said he will protect people’s cryptocurrency from “Elizabeth Warren and her goons”.

As pro-crypto figures line up to take senior roles under Trump’s administration, bitcoin’s record-breaking rally has continued to build.

Trump’s running mate JD Vance is the first bitcoin holder to run for Vice President, having disclosed that he held between $100,000 and $250,000 of the cryptocurrency in 2022 – a figure that will have at least doubled at today’s prices. He has been a strong supporter of the crypto industry and last year introduced a bill that would protect crypto firms and exchanges from being cut off by traditional banks.

“Under the Trump administration, crypto regulation is anticipated to be overhauled, including a more favourable stance from the SEC, which tightened its oversight during Joe Biden’s term,” Maria Carola, chief executive of the cryptocurrency exchange StealthEX, told The Independent.

“His support measures – such as replacing SEC head Gary Gensler, establishing a bitcoin reserve, and aiming to make the US a ‘crypto superpower’ – could fuel market growth. Currently, the market reflects a strong bull trend, with the potential for bitcoin to reach $100,000 by year-end.”

But despite all of his promises, Trump’s courting of the crypto space appears more tactical than ideological. With an estimated 50 million holders of bitcoin in the US, this demographic proved to be a significant factor in a major US election for the first time.

“Crypto has been taken seriously in this election cycle and it’s clear that a robust regulatory framework is on the way,” said Philippe Bekhazi, co-founder and CEO of XBTO.

“As we see this become a reality, digital assets will become more embedded into society, increasing both retail and institutional adoption. This macro backdrop could see Bitcoin end the year well above current levels and even head towards $100,000 in 2025.”

Bitcoin’s notorious volatility is matched by Trump’s often fickle whims. During the last major bitcoin bull run in 2021, the recently ousted president told Fox Business that he thought bitcoin was a “scam” and that its value was “based on thin air”.

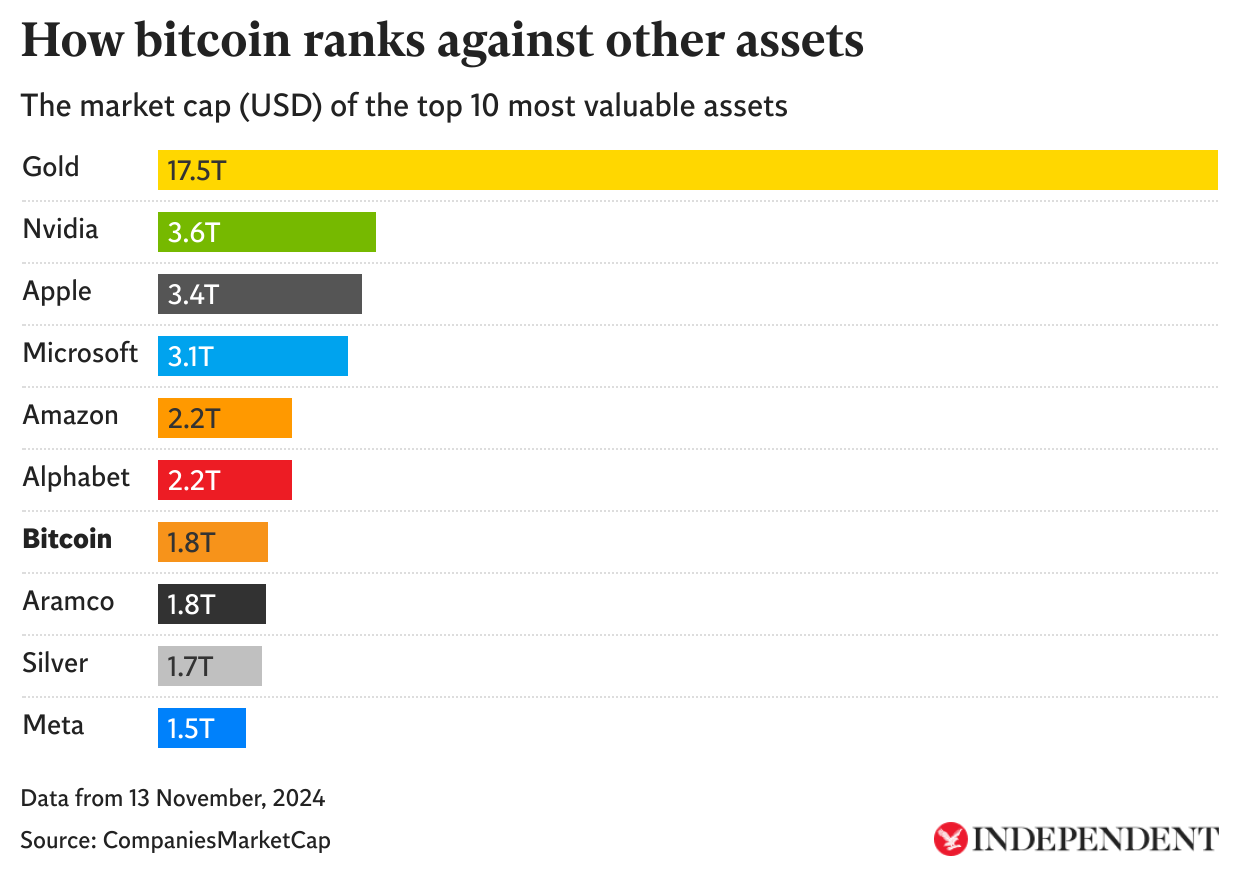

Regardless of Trump’s personal views, investors appear convinced by his promises, as well as buoyed by the maturity of the crypto market. Bitcoin has proved its resilience during periods of aggressive regulation imposed by the SEC, and the approval of bitcoin exchange-traded funds earlier this year means it is no longer viewed as a fringe asset class. With a market cap of $1.8 trillion, it now holds more value than silver.

The overall crypto market cap passed $3 trillion for the first time in the wake of the election – roughly one fifth that of gold – and its global reach means that it does not need Trump to gain legitimacy. But history suggests that he could have a significant impact on its short-term price trajectory.

And it will not make bitcoin’s price any easier to predict.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks