Bitcoin's bumpy revolution may be only just beginning

Cryptocurrency was one of the defining technologies of the 2010s, but the next decade could finally see the realisation of its full potential

Bitcoin was born out of despair. Hidden among the lines of code in the first ever batch of the cryptocurrency was a headline from the frontpage of that day’s edition of The Times: “Chancellor on brink of second bailout for banks”.

It was 3 January, 2009, and the world was in the midst of the worst financial crisis since the Great Depression. Banks were collapsing, businesses were foreclosing and people were losing their homes.

It was the result of the worst excesses and greed of a capitalistic system that was teetering on the edge of comprehensive collapsed. But Satoshi Nakamoto, bitcoin’s pseudonymous creator, believed he had a solution.

It came in the form of a revolutionary “electronic cash system” that ditched centralised systems like banks and governments in favour of a peer-to-peer payments network supported by an online ledger known as a blockchain.

But for all its promise, it turned out to be a bumpy revolution. Nothing much actually happened for the first few years after bitcoin‘s birth, and it lay largely dormant until after the worst of the period’s economic turmoil had already passed.

In the early 2010s it was only a core group of cypherpunks and cryptography enthusiasts that really understood bitcoin’s potential but its semi-anonymous nature meant it soon found use among drug dealers and cyber criminals on the dark web.

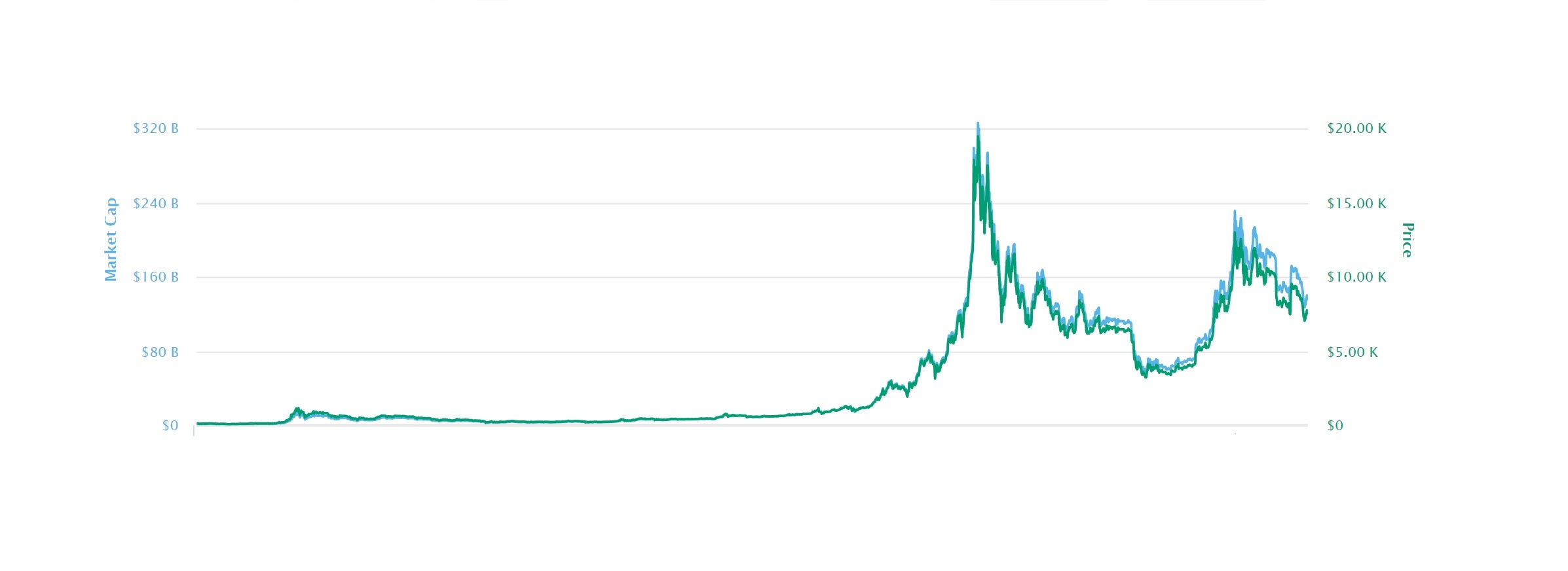

After a brief price surge in 2012 it began to gain more widespread recognition and by late 2017 it was making frontpage headlines of its own as its market capitalisation briefly exceed $300 billion – more than the entire GDP of over 140 countries.

Some warned at the time that the phenomenal price growth was the result of a bubble – and, sure enough, it eventually crashed. Throughout 2018 its value tumbled repeatedly – and sometimes spectacularly – as naysayers pronounced its death and late investors lost millions.

By the start of 2019, a bitcoin was worth less than $4,000 and excitement for the great economic experiment had subsided before any truly mass-market use cases had even been realised.

But it was far from over. As the decade draws to a close, news about new digital currency projects have begun to emerge – from vast multi-national corporations like Facebook, to some of the world’s biggest economies.

With each positive news story about cryptocurrency, the price of bitcoin has grown, yet the volatility remains. For some, this unpredictability is one of the reasons it can never achieve its potential as a mainstream form of currency.

Sceptics remain and misconceptions of bitcoin being some kind of “magic internet money” with no inherent worth continue to dominate stale narratives about cryptocurrency.

Some cryptocurrency advocates point to the fact that, on the contrary, it is traditional currencies that can be created out of thin air through processes like quantitative easing. And while established currencies are no longer backed by gold or anything tangible, bitcoin has the blockchain to mathematically regulate a finite supply.

Nigel Green, CEO of London-based financial advisory firm deVere Group, claims cryptocurrencies are redefining and reshaping the financial system and that critics are either ignoring, or simply not understanding, the promise they hold.

“I would suggest that most people saying these things do not understand the crypto sector as it is relatively young and/or have vested interests in older, traditional ones,” he tells The Independent. “However, whether they like it or not, dyed-in-the-wool financial traditionalists need to accept that cryptocurrencies are here to stay.”

Bitcoin may have assured its place in history but its future remains uncertain. There have already been thousands of spin-offs – there are currently 2,364 different cryptocurrencies listed on monitoring site CoinMarketCap – and some believe one of these will soon take its place as the dominant cryptocurrency.

Some of the more notable ones, like ethereum, ripple and bitcoin cash, offer something slightly different to bitcoin, such as quicker transaction times or greater anonymity.

Yet it is the pseudo cryptocurrencies being developed by countries and companies that could see the most mainstream success over the coming decade. They will not be decentralised and will likely be tools to track users rather than provide privacy, but they will solve two of the biggest problems: trust and stability.

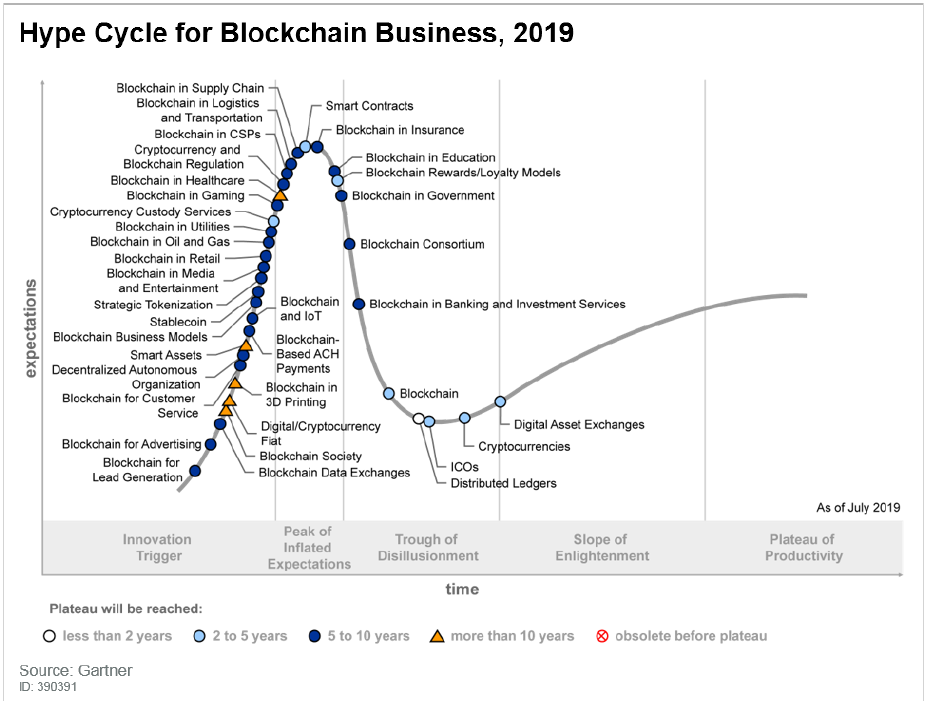

“Cryptocurrencies have arguably been the radical fintech innovation of the decade. But while the 2010s has been an exploratory phase – introducing the concepts of cryptocurrencies and blockchain to the world – the 2020s will be the decade for innovation and application,” Christel Quek, co-founder of cryptocurrency company Bolt, tells The Independent.

Beyond new currencies inspired by bitcoin, a whole new industry is forming from its underlying blockchain technology. At its core, it provides an immutable and unhackable platform for storing and transacting digital assets and records, meaning it could potentially transform everything from healthcare to the food industry.

Felix Shipkevich, a New York-based lawyer with expertise in blockchain regulations, says the technology "has the power to change the world for the better" by providing a new standard for accountability and trust.

Bitcoin has not only brought blockchain into existence, it has challenged regulatory obstacles that stand in the way of this new wave of applications being realised.

“Cryptocurrencies have given rise to regulators’ acceptance of digital cash and fintech products and services that are both novel and progressive," Shipkevich tells The Independent. "We’ve seen greater acceptance by regulators versus total rejection.

"We saw this happen in China, where crypto trading was strictly prohibited, but are now announcing the use of blockchain technology as a major government and fiscal technology initiative.”

The 2010s may have been defined by bitcoin but the next 10 years will dictate which cryptocurrency truly takes off and emerges to rival traditional currencies.

It would be foolish to write-off bitcoin - its death has been pronounced more than 350 times in the press, according to a website tracking "bitcoin obituaries" - but its flaws could see it become simply a store of value rather than a mainstream form of exchange.

Much like MySpace and Bebo were usurped by Facebook in the early days of social media, another cryptocurrency could come along to take bitcoin's crown as the most popular cryptocurrency - maybe even Facebook's Libra.

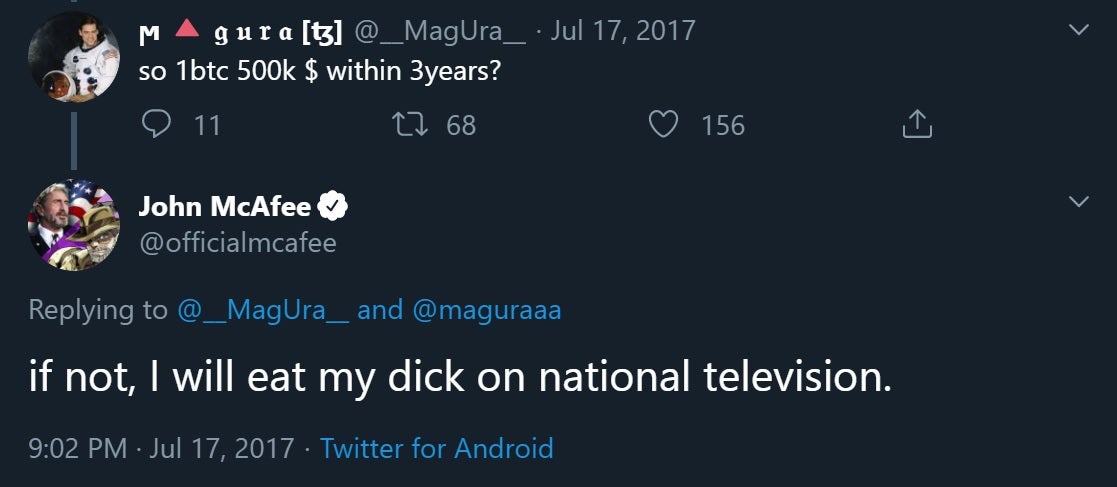

If this happens, predictions about bitcoin's price reaching $500,000 or even $1 million over the next few years will appear wildly ambitious. Then again, it has proved its doubters wrong more than once before.

At the start of the decade, bitcoin was worth just $0.03. It will likely close out the 2010’s somewhere north of $7,000.

Another Great Recession could cause enough of a seismic shift in the established order for bitcoin's price to rocket once again and for Satoshi Nakamoto’s vision to finally be realised.

Or it could continue its steady yet chaotic climb to achieve mainstream success through favourable regulation and greater commercial acceptance, which has been quietly underway over the last decade.

It may have been born out of despair but it enters the new decade full of hope.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks