9 ways you can pay student bills

Ask not for whom the bills toll (it's you, unfortunately)

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.In between all the carousing and carryings-on of university life, it can be hard to remember that you’re an adult now, with certain adult responsibilities. Most of those responsibilities are a drag; your mum won’t do your laundry, you have to make your own sandwiches and, suddenly, you have to pay your own bills.

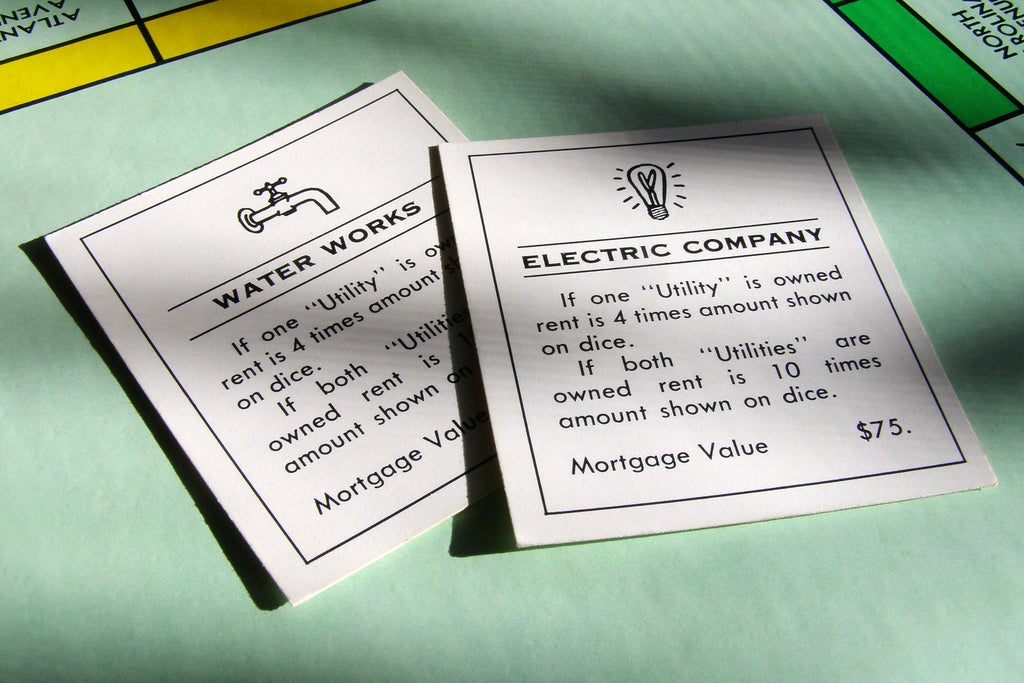

If, like most of us, your parents have happily handled all the nitty-gritty bits of real life you’ve been too engrossed in your schoolwork (ha) to deal with, you’ve probably come to earth with a bit of a bump. Because, wow, you have to pay for everything – even flushing the toilet costs money, after a fashion. There’s gas, electricity, water, Internet, TV licence and phone lines, to name but the most common. And because it’s real money that you owe to real companies, paying your bills isn’t something you can really avoid for too long.

So how do you do it then? And not only that, how do you persuade a house full of reluctant students to part with their own beer money on anything resembling a regular basis?

It’s funny you should ask; here are nine of the most common ways to get it done.

Shared bank account

Take out a brand new joint bank account in everyone’s name, with the idea being that everyone pays in an equal share each month. Direct debits for household bills then come out automatically, and no one sends the bailiffs in.

Trouble is, this system breaks down the minute someone flakes. If even one person stops paying in, or moves out, or even cleans it out, the whole system is in tatters. How much do you trust your flatmates? On top of that, your bills aren’t usually static, so you can’t just pay in a set amount every time and let it take care of yourself. For instance, what if you burn your way through winter, and don’t have enough in the account to settle up?

Each flatmate pays a different bill

Under this system, everyone takes responsibility for paying one bill. Fine in theory, but in practice you’re going to be using much more gas and electricity than you are water or Internet, and that just won’t be fair on someone. This scheme also breaks down in the face of fraud; when you find yourself plunged into darkness because your mate’s spent all the ‘leccy money on daft tobacco, you’ll understand what we mean.

One person becomes the ‘billkeeper’, and collects from the others

This is a very common way to keep on top of the bills, but it requires living with at least one quite bolshie person or it simply won’t work. The billkeeper needs to be mathematical enough to divide payments equally between all housemates, ruthless enough to chase them up for cheques – which isn’t easy when someone isn’t keen on parting with £300+ per term – and organised enough to get them all in the post on time.

Packaged bills

An interesting concept, whereby companies like Glide package up all the household bills and itemise them per person, allowing people to pay one monthly payment plan. This way, if one particular flake falls behind on their payments, the rest of the house isn’t liable for their mistakes.

Rent inclusive

Of course, you could find a flat that charges your bills automatically alongside the rent, and save yourself the bother of worrying. But not every landlord does that, and many of them might be tempted to use the idea as a way of shaking you all down for a few stealthy extra pennies each month.

Rent and bills through the landlord, who has to chase

Another pretty reasonable, relatively hassle-free solution to the problem, provided you pay up in full and on time every month. The minute you start to slip, you can kiss cordial relations with the landlord goodbye – and once you’ve passed the point of no return, they might start being tempted (more tempted) to find reasons to dip into your damage deposit at the end of the year.

Pre-payment meters

This is exactly like having a pay-as-you phone. You can buy top-up cards or keys at newsagents and post offices, and pop them into a special meter at home. This allows your household to monitor expenditure very efficiently, but you run the risk of running out at inopportune moments. If the electricity runs out in a rainstorm and the nearest newsagent is closed, you are going to have a bad time. What’s more, knowing exactly how much each top-up is costing you is a quick way to getting over-stingy with utilities; it’s when you start saying no to a cup of tea because you don’t want to waste power on boiling the water that you know you’re in too deep.

PayPoint

In this system, residents take their bills to their nearest PayPoint, found in most newsagents, so they can pay their bill in cash. Something of a brute-force way of paying up, but it gets the job done. Look for the logo, which is usually stuck to the window of participating shops.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments