Today's student loan sell-off is just the tip of the iceberg

The Government is "considering" more sales - which would be a disaster

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Today the government has sold off student loans worth £900m to a private debt collector for the bargain basement price of £160m, in a deal which includes all the student loans taken out before 1998.

But this outrageous decision is likely to be just round one of the "Great Student Loan Giveaway".

In today’s story, the government sows some seeds of doubt by saying it is “looking at options” on a future sale of the Income Contingent Repayment (ICR) loan book. This refers to all the student loans taken out since 1998.

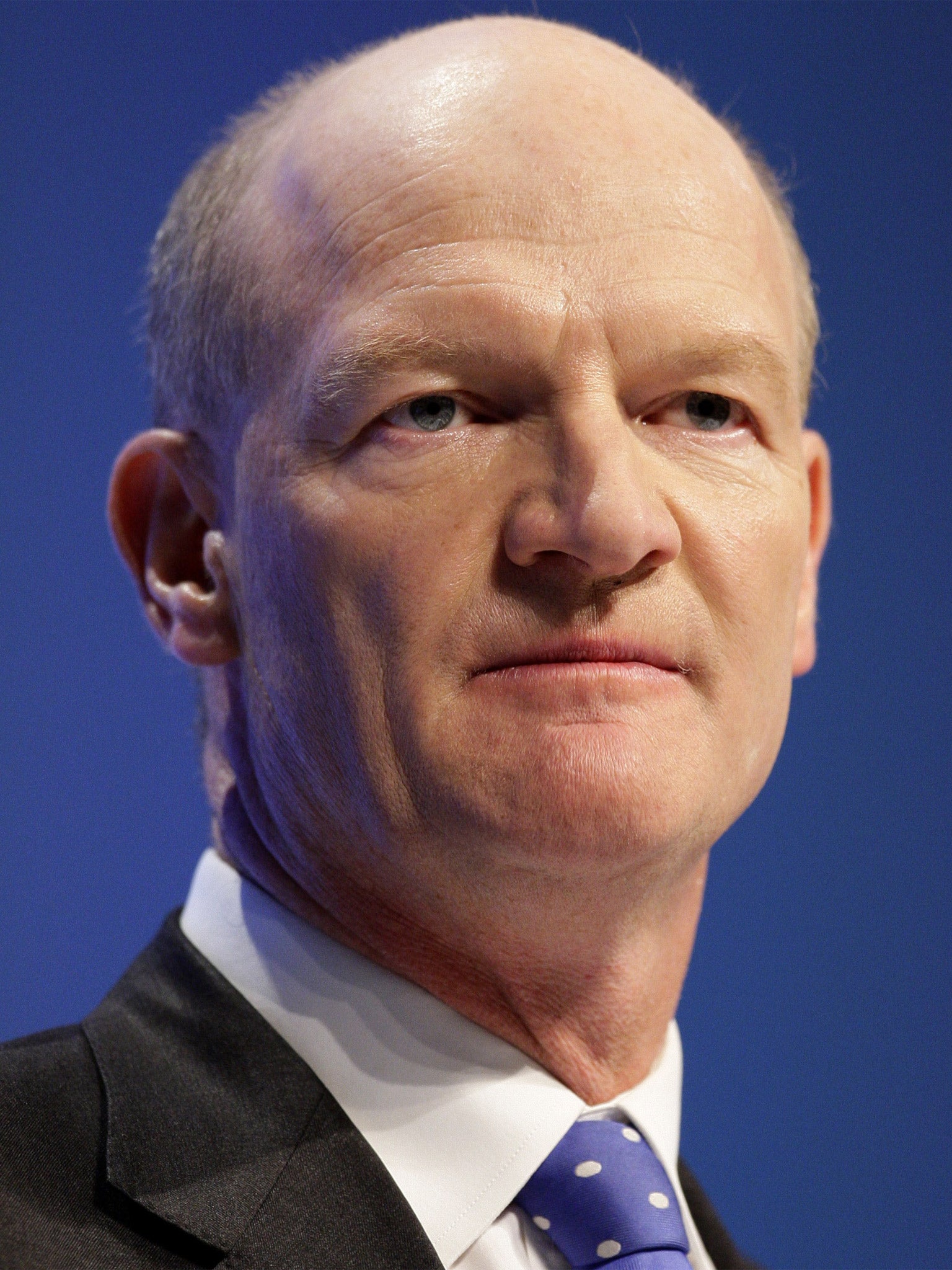

In reality, it is likely that the government is doing much more than “considering” the privatisation of all student loans, if Danny Alexander, the Chief Secretary to the Treasury’s, statement to Parliament in June of this year is anything to go by.

He said: “We will take action to sell off £15 billion worth of public assets by 2020. £10billion of that money will come from corporate and financial assets like the student loan book.”

So the fight to stop the student debt sell off is going to be stepped up.

Anger over the government’s plans to privatise the student loan book is already growing on campuses. Last week the Student Assembly Against Austerity organised a day of action which saw a wave of protest on more than 25 campuses.

Student anger over the proposals is fed by concerns that handing over our student debt to private companies will lead to an increase in the financial burdens placed on students and graduates, as the new owners of the debts hike up interest rates in a bid to make more profit.

These concerns are well placed. As a secret report for the government has revealed, in order to make sure the student loan book is profitable for private companies the cap on interest for repayments would need to be increased or removed all together. To put it bluntly, this proposal would cause student debt to soar and represents a retrospective hike in tuition fees.

As the Tory Minister for universities, David Willetts, made clear to a parliament select committee last June, it is very easy for the rate of interest to be hiked up: “In the letter that every student gets there are some words to the effect that governments reserve the right to change the terms of the loans.”

In light of this, David Willetts’ reassurances that the terms and conditions on our student loans will not be changed following the privatisation of the student loan book ring hollow.

We are determined to build a mass movement on campuses across the UK to stop the government in its tracks. The Student Assembly Against Austerity is co-ordinating a major national week of action in February next year to make the government think twice and rule out any further privatisation of the student loan book.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments