Graduate placements: Earn and learn

Make a splash with a graduate placement, says Becky Slack

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

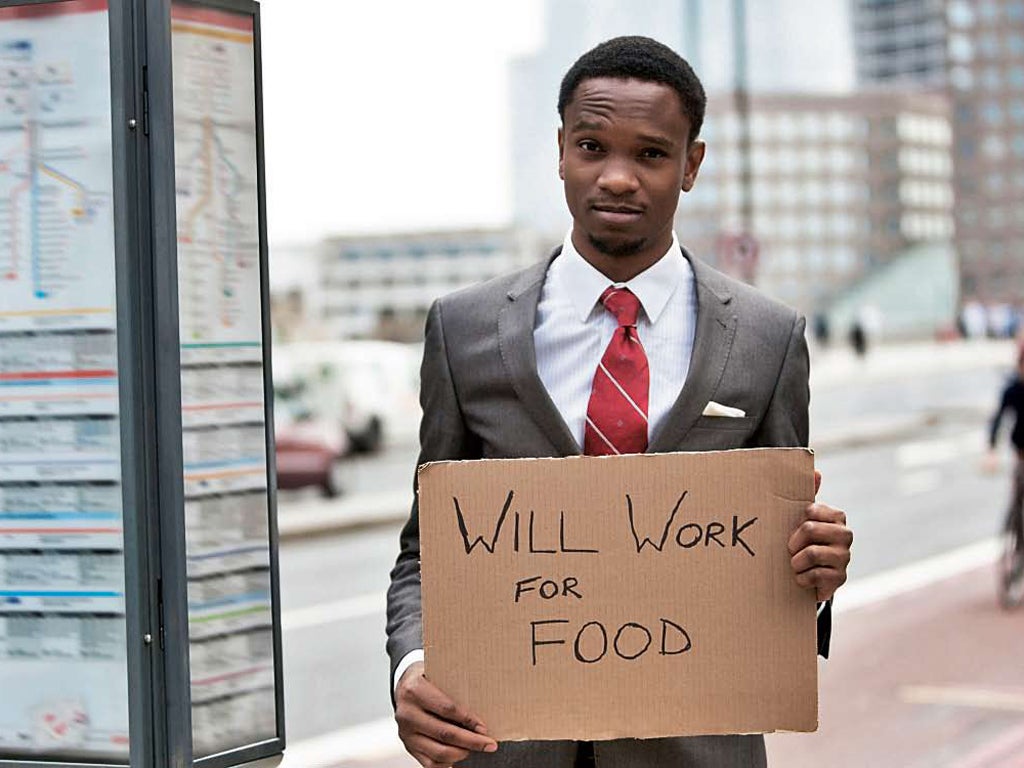

Your support makes all the difference.University leavers are failing to get work, warn the headlines. “Man applies for 2,000 jobs but doesn’t get one interview,” bemoans one paper.

“Desperate graduate spends his last £500 on a billboard begging for a job,” screams another. With so much doom and gloom cast over employment figures, graduates would be forgiven for considering alternatives to finding a job. But is the situation really that bad? For those keen to get their foot on the first rung of the career ladder, what are the options available?

Although the Association of Graduate Recruiters reported last June that around 83 applications were being received for every vacancy, the graduate labour market isn’t performing as badly as many might have thought, suggests a recent report by the Higher Education Statistics Agency. Using data gathered within the first six months of a student leaving university, the report reveals that 62 per cent of graduates had found work while just nine per cent were unemployed – figures similar to last year.

In addition, The Graduate Market in 2012, an earlier report from graduate recruitment research specialist High Fliers, points out that the UK’s leading employers were planning on increasing their graduate intake in 2012. “Public sector employers are planning to expand their graduate intake by 21.9 per cent in 2012, an increase of almost 500 additional roles year-onyear”, it says. “There will also be a substantial rise in the number of graduate jobs available at engineering and industrial companies (up 22.4 per cent compared with 2011), IT and telecommunications firms (up 31.6 per cent), high street banks (up 16 per cent) and retailers (up 11.5 per cent).”

Even graduate salaries have been relatively buoyant, despite the economic downturn, rising 7.4 per cent in 2010 and 5.9 per cent in 2009.

The median salary is £29,000 per year, but more generous remuneration can be found at investment banks, whose new recruits earn an average of £45,000, law firms which offer around £38,000 and oil and energy companies where graduate pay is around £32,500. Retailers, public sector employers and charities offer the lowest at £24,000, £23,000 and £15,000 respectively. Graduates who take on a sales role may start on a low basic salary but can take home twice as much if they’re prepared to roll up their sleeves and get stuck in, says Gordon Bennell, managing director at recruitment agency Graduate Fasttrack.

“Salaries vary, but average about £20,000 in London, £18,000 elsewhere, but some companies do offer more. Once commission has been factored in, the average take-home salary is £35,000.”

“Graduate sales roles can provide lots of transferable skills. In most jobs there is an element of sales, of having to convince someone to do something,” he adds. “And if you want to be an entrepreneur it’s a great place to start. Many of our graduates are now running their own businesses or are involved in start-ups.

Testing the water

For those graduates looking to learn more skills before launching themselves into a specific career, a trainee scheme can be an attractive option.

Available across most sectors and industries, these usually offer a structured programme allowing participants to experience on-the-job training across different aspects of a business or department. “It’s a full-time job, so you get a salary and most also involve some kind of professional training that the employer pays for,” explains Jane Artess, research director at the Higher Education Careers Services Unit, the parent charity of the website Graduate Prospects. “The outcome may well be a job in that organisation, but it’s also a good learning experience giving you skills you should be able to transfer elsewhere.”

One such scheme is offered by the NHS. Aimed at graduates who have the “hunger and the desire to work their way through the healthcare system”, it provides them with two and half years’ experience designed to help propel them up the career ladder. Rob Farace, a senior programme leader at the NHS Leadership Academy, which implements the scheme, describes it as “a foundation that is absolutely essential to what individuals will go on to do.”

“As well as sitting in on board meetings and being given access to senior professionals, they will ride in the back of ambulances, visit mortuaries, work with the cleaners. It’s vital to understand the complexities of the grassroots if they are to be effective managers and leaders,” he says. “The blend of learning coupled with experience means these guys tend to fly.”

Typecasting

Graduates looking for careers in the voluntary sector would do well to consider a leadership trainee scheme offered by Charityworks, a consortium of non-profit organisations. “We are very explicit about the type of person we are looking for,” explains Rachel Whale, programme director at Charityworks. “They need fantastic interpersonal skills, and decision-making and leadership abilities. They need to be valuesdriven and they need to be resilient, as working in this sector is not an easy option. Non-profits are facing increased demand for services at a time when funding is being cut so our graduates will have to come up with new ways of tackling really complex social problems.”

Starting salaries are low at just £15,000, but participants who make the most of the programme, which features mentoring, networking and on-the-job training, can go on to earn double that in their first management role.

On average, charity chief executive salaries are £60,000, but can top £125,000. “They might not earn as much as the rest of their peers, but the sense of motivation is massive. Not only do they gain the strategic and management experience, and therefore skills that are transferable whatever the sector, but they can also see a social impact to what they are doing,” says Whale.

For graduates who are motivated more by the thought of cold hard cash than by doing good, trainee schemes in the financial and professional services industries can be the way to go – either those run directly within the organisations themselves or via schemes such as that run by JDX Consulting, which puts graduates through an intensive training boot camp before seconding them to investment banks.

Recruiting on the same scale any more and it can be difficult for graduates to get a job. They also tend to use a recruitment process which includes psychometric testing, whereas we approach things differently,” explains Jonathan Davies, chief executive of JDX Consulting. “We give opportunities to people who want to work hard and who have a passion for teamwork. We look for those who have done team sporting activities at university or have foreign languages.”

The use of psychometric testing to select graduates, as mentioned by Davies, is not unusual. Nor is the use of assessment centres. These generally incorporate a whole day where candidates are taken through a series of activities, such as a group exercise, roleplays and individual interviews. They are very competitive and candidates have to work very hard, but those who are successful can find many doors open to them as a result.

Two years on, AXA’s trainee scheme has led Jo Franco, a philosophy graduate from Durham University, to a series of increasingly senior roles within the insurance provider before she eventually moved to management consultants Ernst & Young, where she now works on global HR transformational projects. “I wouldn’t be where I am now if I hadn’t done a graduate trainee scheme,” she says, explaining that as well as different departmental placements, she also benefited from a professional qualification and leadership training. At the time, the AXA scheme was general, enabling Franco to work across multiple disciplines and gain lots of different experience. These days it offers a range of different traineeships, some more specific than others, from actuarial to IT to Future Leaders. All are small though – no more than 30 graduates in total are recruited, which the company believes allows it to give them their undivided attention.

The tiny pool of graduates that AXA takes on each year is an indication of the level of competition for each place on its scheme, and it’s not the only one so highly sought after. JDX Consulting reports 3,500 applications for every five trainee places, while the 2012 NHS graduate scheme saw 12,500 people vying for 150 spots. The same trends are reflected in the jobs market, with employers receiving around 19 per cent more graduate job applications during the 2011-12 recruitment round compared with the previous year.

In part, this is down to overall graduate recruitment being 6 per cent below prerecession levels, despite this year’s increases in vacancies. Some 50,000 extra students also graduated in 2012 compared to 2007, adding additional pressures. So what can graduates do to make themselves stand out in such a competitive market place?

“The way to impress is to use your experience, learning, knowledge and skills to explain how you are suitable for that job,” says Artess. “A generic CV won’t work. If it doesn’t address what the employer is looking for you won’t get far. Therefore it’s an onerous task as you have to do that for every job.” Nor is it simply about having the right degree. “In some jobs, the degree is closely related. You can’t be a doctor without a medical degree, for example.

However, roughly 60 per cent of graduate jobs are allocated on the basis that the subject of the degree doesn’t matter,” she adds.

Paul Redmond, director of employability at University of Liverpool and chair of the Association of Graduate Careers Advisory Services (AGCAS), agrees. “A degree is essential, but it’s not enough,” he says, emphasising how employability is about the right combination of qualifications, skills, contacts and, importantly, experience. “Work experience is the gold currency,” he says.

Setting the foundations

This view is backed up by The Graduate Market in 2012 report by High Fliers, which found that more than half of recruiters are unlikely to give jobs to graduates who have had no previous work experience, while around a third of their entrylevel positions would be filled by graduates who had already worked for the organisations – either through industrial placements, vacation work or sponsorships. This is when an internship can prove particularly useful. Work experience programmes can last for weeks and sometimes months and internships are becoming prevalent across most sectors. Some sectors such as the creative, arts and media industries, already view work experience as a rite of passage.

Under British law, interns who do work of value to their employer are likely to have the right to be paid the national minimum wage, yet many firms only offer expenses or some other benefits in kind.

This means an internship can be a pricey exercise for many, but particularly in London, where it can cost as much as £6,000 to survive for six months (the duration of many modern internships), according to the London School of Economics.

There are plenty of these opportunities available, so much so that a plethora of companies, such as Instant Impact and Intern Avenue, have been set up specifically to place people on programmes. The UK’s leading graduate employers alone offered more than 11,000 paid work experience programmes during the 2011-12 academic year, not to mention the countless small and medium-sized enterprises keen to benefit from the cheap labour. If opting for this route, it’s always important to ensure you’re not taken advantage of, says Ben Lyons, co-director at the campaign group Intern Aware. “If you do go for an unpaid internship, recognise that you are working for free and you shouldn’t be expected to do things that aren’t useful.”

Choosing the right career path to take can be a difficult challenge and the key is not to rush into things or make snap decisions. Applications are more likely to be successful when they’ve been properly thought through. Importantly, advises Ernst & Young’s Franco, graduates should remember that their career is “a marathon, not a sprint. “They should make the most of the opportunity to ask all the stupid questions while they can,” she says. “This isn’t about getting as high up as possible as quickly as possible. It’s about getting the right foundation, so you can get as high as possible and be good at it.”

Top 10 graduate employers, 2011

- Boots, 550 posts

- PricewaterhouseCoopers, 485 posts

- Deloitte, 445 posts

- National Health Service, 420 posts

- Royal Bank of Scotland, 340 posts

- Ernst & Young, 330 posts

- KPMG, 310 posts

- Barclays, 265 posts

- Tesco, 260 posts

- Lloyds Banking Group, 220 posts

Compiled by the Complete University Guide using data from the Higher Education Statistics Agency’s Destinations of Leavers Survey, 2010-11

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments