Premier League stars using loophole to save millions in tax

Clubs employ pension scheme first used by bankers to make contracts even more attractive to leading players

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Top Premier League footballers face fresh public indignation today as The Independent reveals they are using a major tax loophole to protect their multi-million pound salaries from the tax authorities.

Experts in the football industry have told The Independent that around 75 per cent of Premier League clubs are now using a scheme known as EFRBS to allow players to avoid up to 50 per cent of income tax. It has come into the mainstream over the last 18 months as clubs try to find a way around the problem of losing out to clubs from across Europe on players put off by the new 50 per cent top level of income tax that will be introduced in April.

It is understood that many leading Premier League clubs, including Manchester City and Chelsea, have used EFRBS – employer-financed retirement benefit schemes – in order to make their offers to players even more attractive. Completely legal, the scheme allows players to sacrifice up to 50 per cent of their wages at source to be placed in a trust that is set aside for their retirement.

It was first used by City bankers to avoid paying tax on their bonuses but has become very popular with footballers after the Inland Revenue closed down the "image rights" loophole that was used to great effect in the late 1990s and early part of the last decade to give predominantly foreign players tax relief.

The EFRBS scheme also allows clubs to save on National Insurance payments – an extra 12.8 per cent on top of the player's salary – because the money is paid straight into an EFRBS and is therefore not liable. With wage costs going inexorably upwards for the elite players, fuelled by City's willingness to break the wage ceiling, clubs are increasingly looking around for more tax-efficient ways of paying their players.

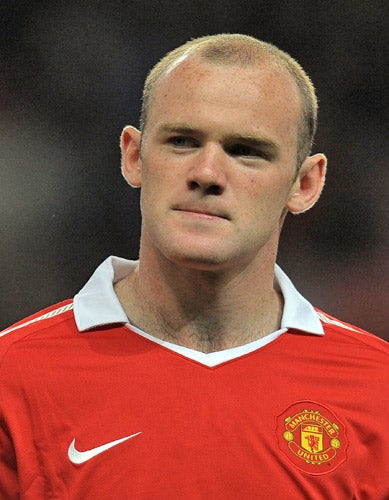

Industry experts believe that there is a very good chance that Wayne Rooney's new deal at Manchester United, understood to earn him up to £200,000 a week including bonuses, would have included an EFRBS. It would potentially mean that the Manchester United striker will have a substantial retirement fund when he finishes playing. However, the Premier League's best players, as well as high-earners in the City, are now the subject of government legislation to close the tax loophole.

Pete Hackleton, an associate director at RSM Tenon and an expert in EFRBS, said that they had become a "popular" major feature in deals for top players in the last 18 months. "We have worked with a number of Premier League and Championship clubs to set up EFRBS," he said.

"EFRBS have been around for 15 to 20 years but as image rights have become a hot topic for HMRC [Her Majesty's Revenue and Customs] and with the increase to the top rate of income tax, people have looked for an alternative."

In the case of Yaya Touré, thought to be the highest-paid footballer in English football, City are understood to have agreed with him a weekly wage that increases to £221,000 in April in order to compensate for the rise in the top rate of income tax to 50 per cent.

Even with the most lucrative broadcast deals in world sport, some of the Premier League's members are still finding it difficult to offer competitive wages to players when in competition with leagues like Spain and Russia.

There will be little public sympathy for highly paid footballers and their attempts to reduce their tax liabilities. However, there have been complaints from Premier League managers that the levels of taxation are affecting the ability of their clubs to attract players. Sam Allardyce said in August that the new top level of tax had had a direct effect on Blackburn Rovers' ability to sign players.

He said: "You are putting an extra 10 per cent on top straight away due to new tax rules. It almost becomes impossible to meet for a club like us."

At the other end of the Premier League, Arsène Wenger has also identified the new top rate of income tax as the biggest obstacle to signing new players.

"The domination of the Premier League on that front will go, that is for sure," he said in April 2009. "It will be a financial problem for all the English clubs."

The former Fulham and Blackburn footballer Udo Onwere, now a lawyer specialising in tax and trusts, said that his clients in the Premier League had prepared themselves for their EFRBS to be closed down by the Inland Revenue. "It could be at the end of the year, it could be next month," he said.

Onwere, who works at Thomas Eggar solicitors, said that there were fears among players that changes to the rules could be retrospective and claw back money already put into trusts by players.

A spokeswoman for the Inland Revenue said last night that as of this month it would be acting on the government's initiative to bring forward legislation to curb the use of EFRBS for high earners.

The Inland Revenue said in a statement it would "ensure that funded EFRBS are less attractive than other forms of remuneration".

It added: "It will also continue to monitor changes in patterns of pension saving behaviour for all other forms of EFRBS on which it will be ready to act if necessary to prevent additional fiscal risk."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments