Rent will rise more slowly, say landlords

A quarter of renters have no plans to own their own home in the future

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Landlords expect UK rents will rise by 1.8 per cent over the next 12 months, according to a new survey.

The figures from Your Move and Reeds Rains are down from its previous Buy-to-Let Index which reported that average residential rents across the UK were rising at an annual rate of 2.4 per cent.

Four in ten of the 1,100 landlords polled expect to raise rents in the coming year, the main reasons being to cover the cost of inflation (57 per cent) and paying for maintenance work (31 per cent).

Over the last six months, just over 40 per cent of landlords reported seeing a rise in tenant demand, with new tenancies agreed across England and Wales up by 6.9 per cent compared to August 2013.

"Demand for rented accommodation is climbing, and there’s little sign of this stopping," said David Newnes, director of Your Move and Reeds Rains,. "While Help to Buy and higher LTV lending are enabling first-time buyer activity, strong house price growth this year has lifted homeownership a few steps out of reach for many, and the private rented sector remains the safety net supporting those still saving for a deposit. This is in addition to the thousands of people who rely on renting to offer them flexibility and freedom in their working lives."

Meanwhile, a second report from Access Legal, suggests that a quarter of renters have no plans to own their own home in the future.

The survey by the conveyancing firm alsoshowed that a third had never heard of Stamp Duty and half were put off buying by fears of negative equity and being in debt to a bank.

"The market and way people live is changing rapidly," said Steve Reading, Associate for Conveyancing at Access Legal. "It’s clear that people are fearful of recession and losing their investment.

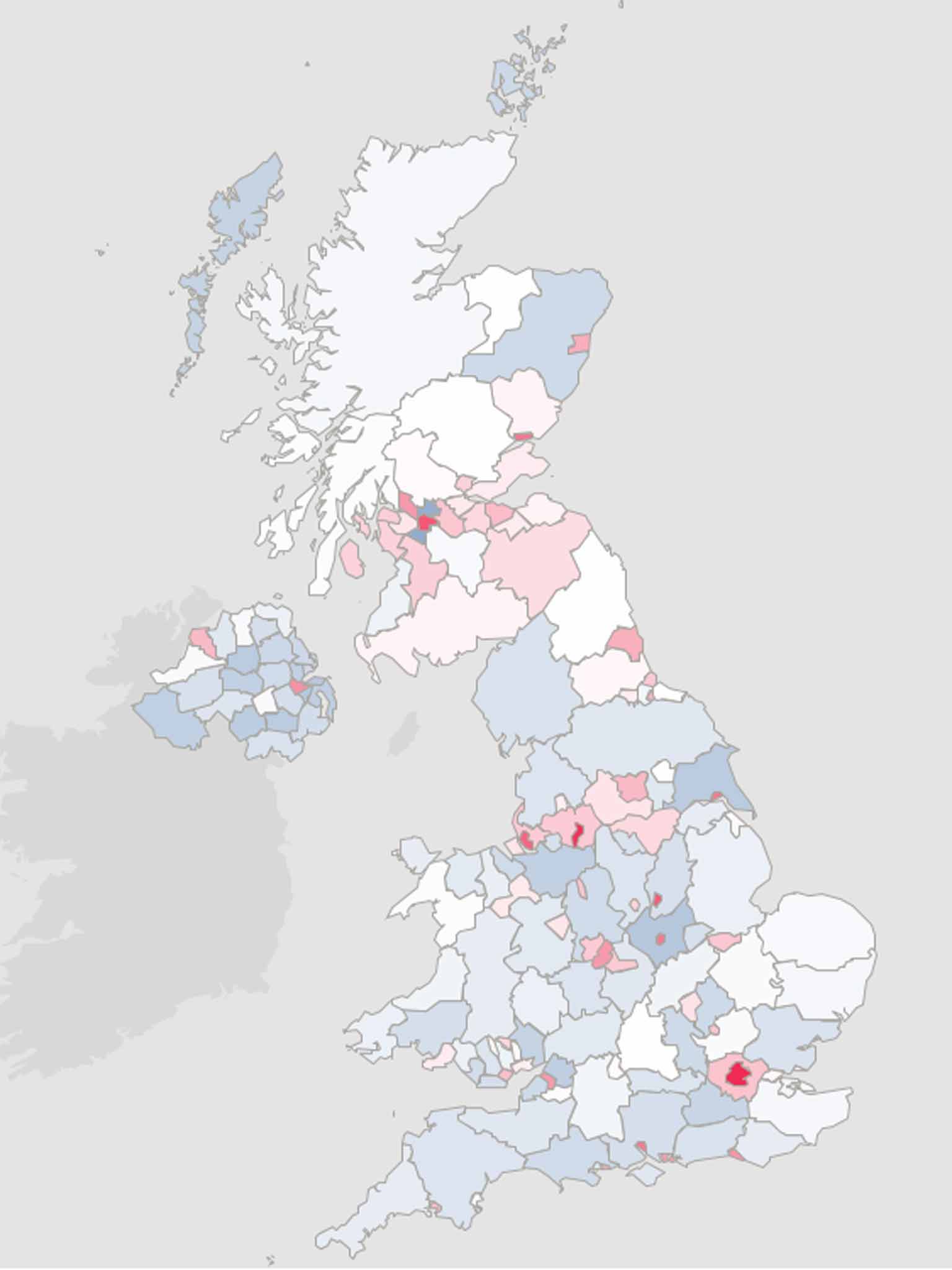

Direct Line for Business has put together an interactive map (the redder an area is the greater the proportion of rentals, see above) which identifies where the UK rental hotspots are as well as those areas with the highest number of owned properties.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments