The countries where the rich are getting richer

Billionaires saw their wealth grow 5.4 per cent last year, but not in every country, report reveals

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.It's a universal truth that the rich are getting richer – but,according to a new report, it's not the case the world over.

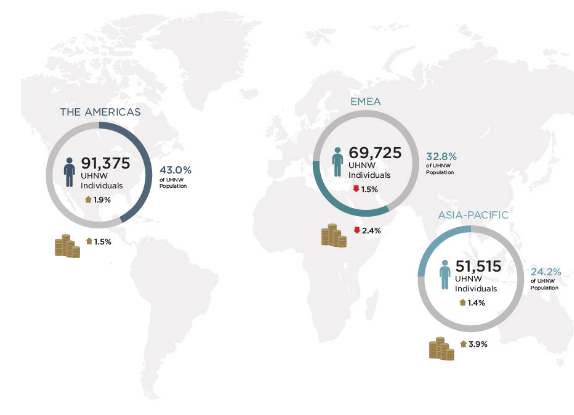

The number of ultra wealthy people in the world rose by 0.6 per cent in 2015, with their total wealth up by 0.8 per cent to $30 trillion (£23 trillion) in net assets - a record high - according to a new report by Wealth-X.

These individuals - referred to as ultra high net worth (UHNW) individuals - account for just 0.004% of the world’s adult population, but control 12 per cent of global wealth.

In 2015, billionaires saw their wealth grow 5.4 per cent - more than double the rate of global economic growth - while collectively other tiers saw their wealth shrink by 0.6 per cent.

But while the wealthiest individuals experienced the most success across all geographic regions, not every country is experiencing the same rise.

In Europe, the Middle East and Africa, UHNW wealth fell 2.4 per cent as equity markets, local currencies and gross domestic product collectively experienced negative net returns.

By contrast, Asia-Pacific experienced a 3.9 per cent rise as the ultra wealthy in certain markets continued to benefit from dynamic business expansion and economic growth.

Australia experienced the biggest decline in ultra wealthy individuals of any developed economy, with the number slipping by almost 31 per cent last year - largely attributed to the fact that China, one if its main trading partners, is experiencing an economic slowdown.

Russia also saw its wealthy population drop, slipping by nearly 13 per cent to 1,075 individuals who have $30 million or more in assets.

Meanwhile in the Americas, it was Latin America, rather than North America, that helped the region achieve a modest 1.5 per cent growth in ultra wealth value.

The report also revealed the rise is not equal across the sexes, with men experiencing an increase in wealth while the share of ultra wealthy female individuals has dropped.

While the female UHNW population remained steady at 13 per cent, their share of total UHNW wealth fell from 14 per cent to 11 per cent, while by contrast UHNW male wealth increased 2.4 per cent.

The findings also indicated how the wealth of the wealthiest is accumulated. In two out of three cases, wealth was found it be purely self-made rather than inherited, in a transfer of wealth that has seen a growing class of second-generation ultra wealthy emerge.

Yet wealth continues to rise generation by generation. The under-30 demographic accounts for just one per cent of the world’s ultra wealthy population and 0.3 per cent of global UHNW wealth, while UHNW individuals aged 80 or over are seven times wealthier and worth nearly double that of the average UHNW individual globally.

This rise in riches among the world's richest is set to continue. According to the report, by 2020 UHNW wealth is expected to grow to $46.2 trillion (£35.7 trillion) at a compound annual growth rate of nine per cent.

Collated with dossiers curated by Wealth-X, the World Ultra Wealth Report contains detailed analysis of the wealthiest individuals in the world with a focus on geography, lifestyle, social networks, philanthropic behaviors, motivations and legacy.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments