Just 62 people now own the same wealth as half the world's population, research finds

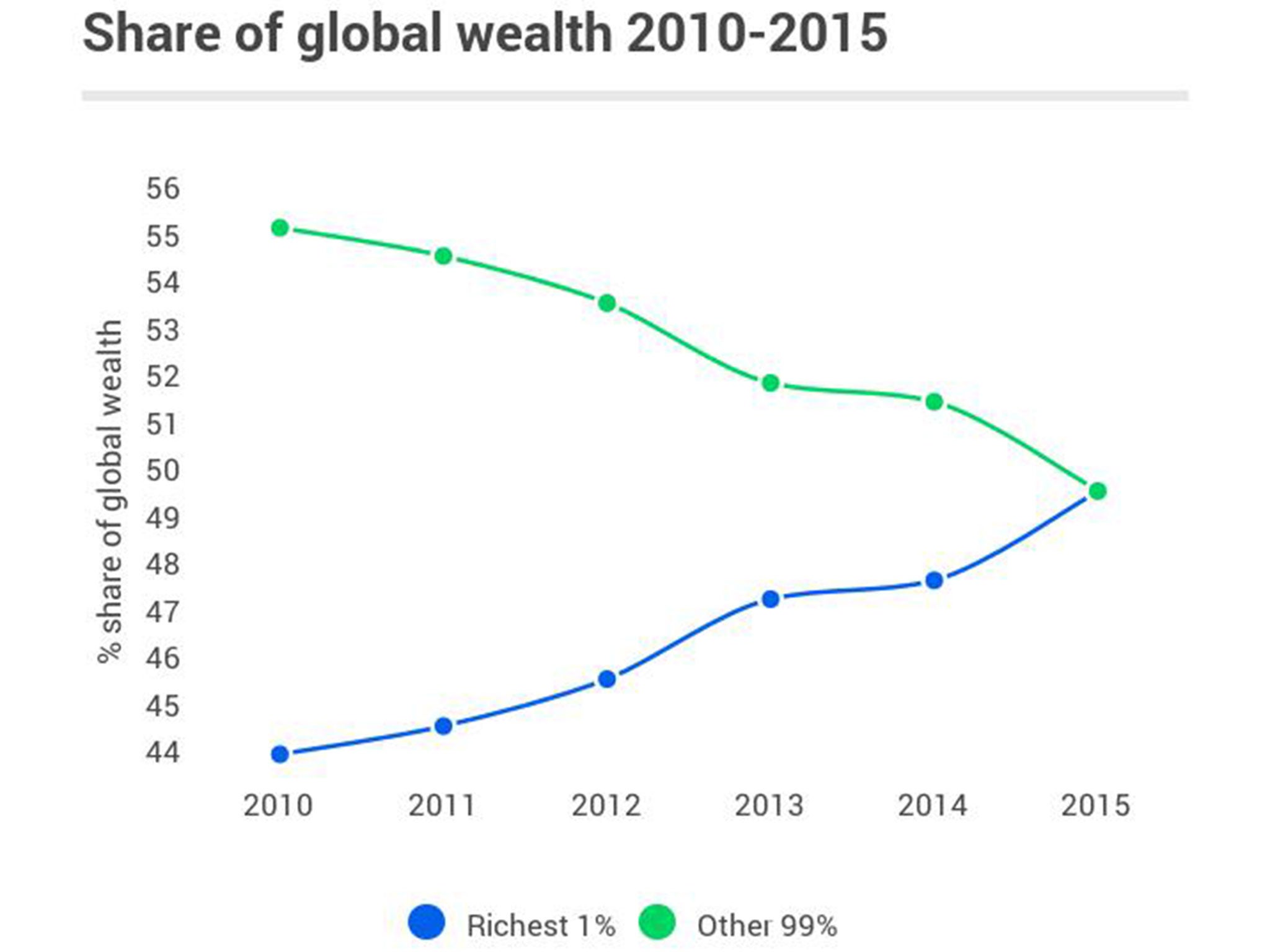

The world's richest are getting richer while the wealth of the poorest is being spread more thinly

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Wealth inequality has grown to the stage where 62 of the world’s richest people own as much as the poorest half of humanity combined, according to a new report.

The research, conducted by the charity Oxfam, found that the wealth of the poorest half of the world’s population – 3.6 billion people – has fallen by 41 per cent, or a trillion US dollars, since 2010.

While this group has become poorer, the wealth of the richest 62 people on the planet has increased by more than half a trillion dollars to $1.76 trillion.

The report, “An Economy for the 1%”, says the gap between the global richest and the global poorest has widened in just the last 12 months.

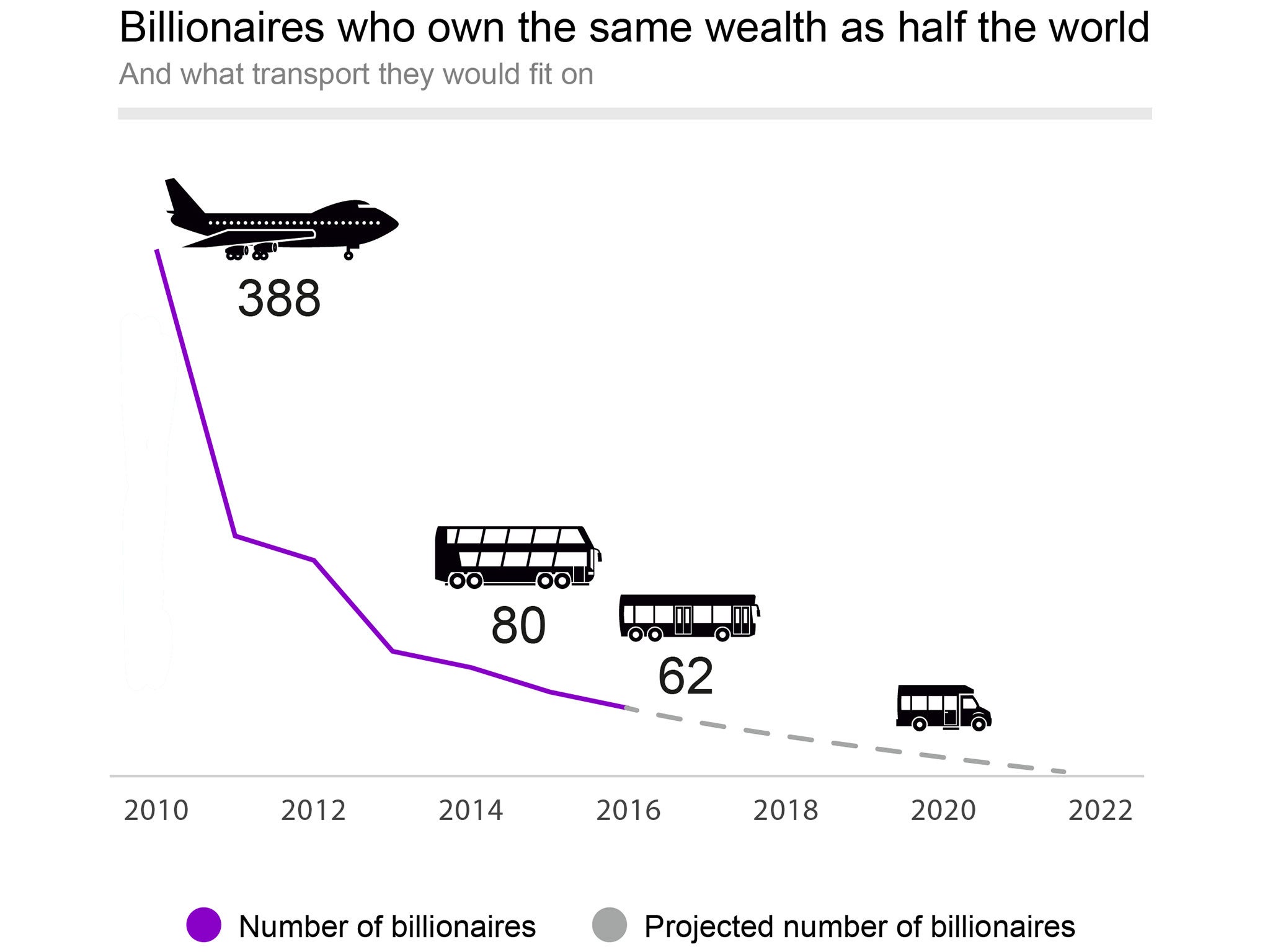

In 2011 388 people had the same wealth as the poorest half of humanity. In 2011 this fell to 177. The number has continued to fall each year to 80 in 2014 and 62 in 2015.

The research was released days ahead of the annual gathering of the world’s elite in Davos for the World Economic Forum 2016.

Oxfam GB chief executive Mark Goldring said a crackdown on global tax havens was a necessary step towards ending the rampant global inequality.

“It is simply unacceptable that the poorest half of the world population owns no more than a small group of the global super-rich – so few, you could fit them all on a single coach,” he said.

“World leaders’ concern about the escalating inequality crisis has so far not translated into concrete action to ensure that those at the bottom get their fair share of economic growth. In a world where one in nine people go to bed hungry every night we cannot afford to carry on giving the richest an ever bigger slice of the cake.

“We need to end the era of tax havens which has allowed rich individuals and multinational companies to avoid their responsibilities to society by hiding ever increasing amounts of money offshore.

“Tackling the veil of secrecy surrounding the UK’s network of tax havens would be a big step towards ending extreme inequality. Three years after he made his promise to make tax dodgers ‘wake up and smell the coffee’, it is time for David Cameron to deliver.”

In November the Public Accounts Committee of MPs warned that HMRC had made "little or no progress" on measures to reveal the scale of aggressive tax avoidance happening in Britain.

In addition, last year the Office for Budget Responsibility announced that George Osborne’s tax avoidance crackdown had missed its target by hundreds of millions of pounds.

But the report’s authors say the situation could be even worse in the world’s poorest countries. The researchers estimate that as much as 30 per cent of African financial wealth is held offshore, costing the governments of countries in the region $14 billion US dollars each year.

That money, if collected, might otherwise be destined for the world’s poorest.

Last year an investigation by the Independent revealed that the UK was paying millions of pounds to EU-listed tax havens in the form of international aid.

A significant number of tax havens are also British Crown dependencies and have Queen Elizabeth II as their head of state.

The Government says it has made cracking down on tax avoidance a priority. In September HMRC said it had collected £1bn from users of tax avoidance schemes as a result of new rules.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments