Spain asks Germany to ease the strain as anxious investors tighten their grip

Jittery investors tightened the squeeze on Spain yesterday as the embattled nation's Economic Minister held talks in Berlin amid rising speculation of an international rescue.

Spain – struggling under a worsening recession, a banking crisis and the possible bankruptcy of several regional governments – is seen as the next candidate for a national bailout after requesting €100bn (£79bn) to prop up its banks a month ago.

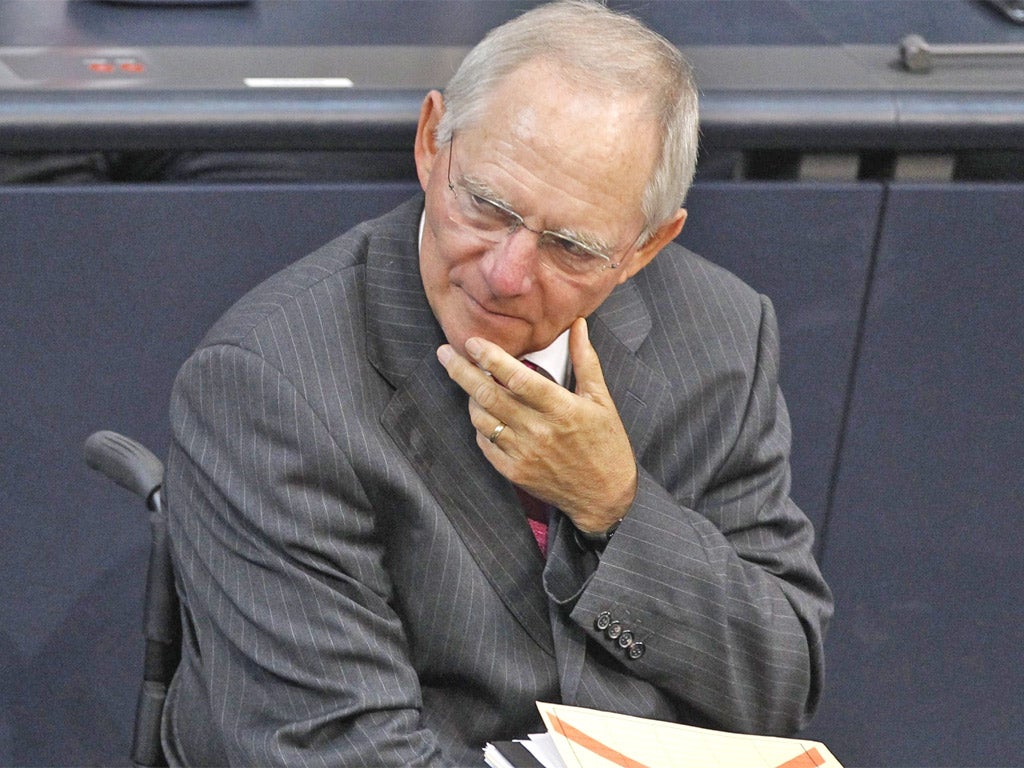

The Economy Minister, Luis de Guindos, flew to Berlin for talks with the German Finance Minister, Wolfgang Schauble, yesterday, although officials were keen to play down the significance of the meetings as the debt crisis threatens to claim its biggest victim yet.

Meanwhile, Spain's cost for borrowing for 10 years were cranked even higher yesterday to 7.52 per cent – well above the unsustainable 7 per cent level which triggered bailouts for Greece, Ireland and Portugal. Even efforts to raise short-term funds are being met with soaring interest rates after Spain paid near-record highs to raise €3bn in three-month and six-month debt yesterday. Most stock markets were calmer after Monday's sell-off but Madrid's main index sank 3.5 per cent as investors continued to dumped shares.

Officially, Mr De Guindos – who insists that Spain does not need a full-scale bailout – was due to set out the details of Spain's latest €65bn austerity programme in Berlin. But he is likely to have pressed for the European Central Bank to ease the strain on Spain by restarting the emergency bond buying operation launched at the height of last summer's turmoil. Germany, under pressure itself after ratings agency Moody's put it on notice of a potential downgrade yesterday, is opposed to this to maintain the independence of the central bank.

The talks came as a Spanish minister made a public call for the swift implementation of measures agreed at the last EU summit at the end of June. This provided for the €700bn firepower of the two European bailout funds to be used to intervene directly in debt markets, buying up the bonds of the eurozone strugglers to ease borrowing costs. Spain's Secretary of State for EU matters, Inigo Mendez de Vigo, said there was a "worrying gap between the decisions which are taken at the European Council and their implementation".

Madrid expects the Spanish economy to remain in recession well into next year, while the autonomous region of Valencia became the first to ask Madrid for aid to pay debt obligations it cannot meet. Others including Murcia are expected to follow suit in tapping up the central government's €18bn rescue fund.

Elsewhere, Spain's woes are threatening to drag Italy down after its own borrowing costs jumped sharply to 6.54 per cent, the highest for six months.

Greece remains 'hugely off track'

Greece is unlikely to be able to pay what it owes and further debt restructuring is likely to be necessary, three EU officials said yesterday.

The officials said the country would be found to be way off track by EU and IMF officials who have been assessing the country. The revelations came as inspectors from the European Commission, the ECB and the IMF returned to Athens yesterday. They will complete their debt-sustainability analysis next month but the sources said the conclusions were already becoming clear. "Greece is hugely off track," said one official. "The debt-sustainability analysis will be pretty terrible."

Reuters

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks